What bank does Continental Finance use?

What credit cards are under Celtic Bank

Celtic Bank Credit Cards– Select a Bank –BMO.Fleetcor.Genesis.PREMIER Bankcard®

Is Continental Finance a real company

Continental Finance is one of America's leading marketers and servicers of credit cards.

Where is Continental Finance from

Continental Finance is located in Greenwich, Connecticut, United States .

What credit cards are issued by Bank of Missouri

They also issue credit cards through Continental Finance, SoFi and Fortiva to help individuals rebuild their credit history and via Aspire so cardholders can earn cash back.Credit Card.First Access Solid Black Visa® Credit Card.Fit Mastercard® Credit Card.Milestone Mastercard® – $700 Credit Limit.Total Visa® Card.

Cached

What credit card is through Continental Finance

At a glance

| Card name | Annual fee |

|---|---|

| Fit Mastercard | $99. |

| Reflex® Platinum Mastercard® | $75-$125 in the first 12 months, then $99-$125 annually. |

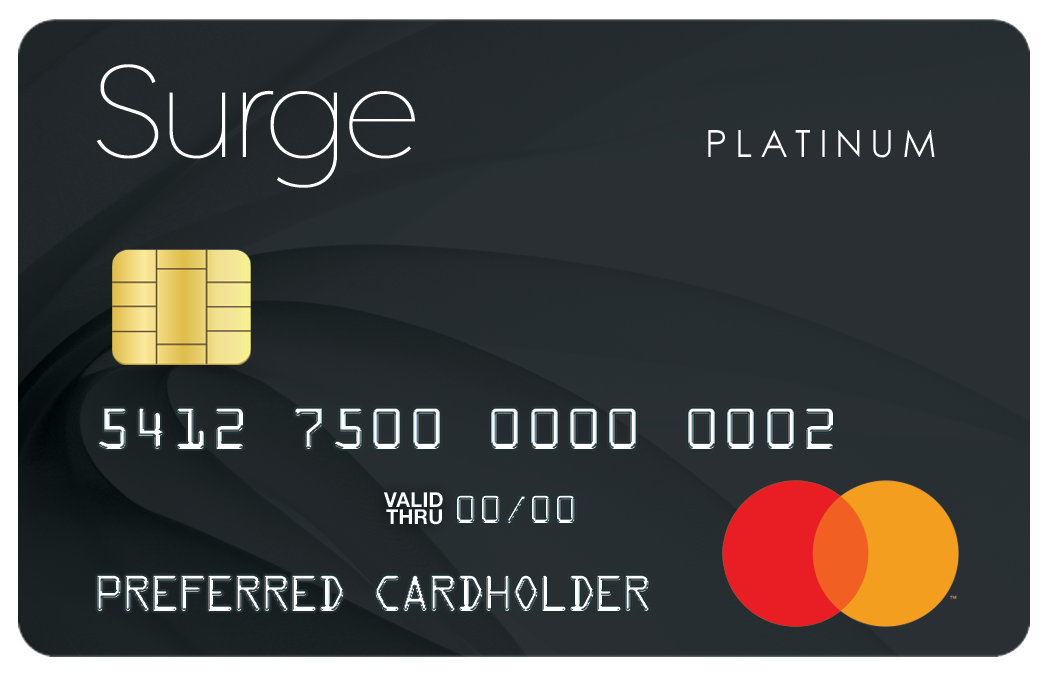

| Surge Mastercard | $75-$125 in the first 12 months, then $99-$125 annually. |

| Verve Mastercard | $75-$125 in the first 12 months, then $99-$125 annually. |

What credit card is associated with Continental Finance

The Verve credit card can be used as an effective tool to build credit. Continental Finance accepts people who apply for a Verve credit card with less than perfect credit. Continental Finance will report your payments to the three major credit bureaus – TransUnion, Experian, Equifax.

How do I know if a loan company is scamming me

5 ways to spot personal loan scamsThe lender asks for fees upfront.The lender guarantees you're approved before you apply.The lender promises to clear your debt.The lender isn't registered in your state.The lender calls you with an offer.

Does Continental Finance give credit increases

The card's issuer, Continental Finance, does not disclose a particular timeline for getting another credit limit increase after the initial one. A good rule of thumb is to wait at least 6 months between each time you request a credit limit increase.

Who is the parent company of Continental Finance

There are different ways you can repay a Continental loan: In person at a local branch, over the phone, by mail, through the online portal or through the mobile app of Continental's parent company, Security Finance.

What credit card is Continental Finance

Continental Finance is a credit card company that services credit cards for consumers with limited, fair or bad credit (FICO scores of 300-689). Its portfolio includes the following cards: Cerulean Mastercard, issued by The Bank of Missouri. Fit Mastercard, issued by The Bank of Missouri.

How do I find out what bank issued my credit card

To recap, when looking at the full bank card number, the first digit identifies the card issuer's industry, while the first six digits collectively identify the specific institution which issued the card.

What credit system does synchrony bank use

Find out your score and how to improve it when you enroll in Synchrony's® free credit score program with VantageScore®. VantageScore® is a top credit scoring model used by many lenders when they consider whether or not to approve applications and decide what rates and terms to offer.

What credit system does Chase bank use

Experian™

Which credit bureau does Chase use Chase Credit Journey® gives everyone (even those who aren't Chase customers) access to their credit score through Experian™.

What credit card uses Cross River bank

The Solution: Divvy Card issued by Cross River

The Divvy Card was brought to market through Cross River's complete credit card BIN sponsorship. Divvy was able to choose between using one of Cross River's processor options or their own choice of processor.

How do I know if my loan is real

How to check if a loan company is legitimatePerform a search on the BBB database.Check the online reviews or for any complaints.Contact your state attorney general.Their physical address or contact information should match.The lender's website is not secure.There are no credit checks.

How do you check if a company is legit

Check out the company's address, phone number, and website to make sure they look legitimate. Be aware, though, that it's pretty easy for a company to get a fake address, phone number, and website. If you can, visit the company's physical address and talk to the people who work there.

What credit score do you need for Continental Finance

Continental Finance is a credit card company that services credit cards for consumers with limited, fair or bad credit (FICO scores of 300-689).

Can I get a credit card with a 526 credit score

The best type of credit card for a 526 credit score is a secured credit card. Secured cards give people with bad credit high approval odds and have low fees because cardholders are required to place a refundable security deposit.

Who did Continental Bank merge with

In 1994, Continental Bank was acquired by BankAmerica in order to broaden the latter's midwestern presence. Successor Bank of America has a retail branch and hundreds of back-office employees at Continental's former headquarters on South LaSalle Street in Chicago.

Does Continental Bank still exist

The same community bankers you've come to know and trust will now be serving you as part of the First American Bank family. And while the name and logo may be different, First American's focus on local businesses and the communities we serve will be familiar to all Continental Bank customers.