What Bank does routing number 021000021 belong to?

Can routing number 021000021 be used for ACH

For wire transfers, please use routing number 021000021. **The above routing number can only be used for direct deposits and ACH transactions. For wire transfers, please use routing number 021000021.

What bank address to use for wire transfer Chase

Incoming funds cannot be credited to a Chase Liquid Prepaid Card. Incoming funds may take 1 full business day before the funds are received from the sender. Sender's bank may request Chase's address for incoming wires. Address is 270 Park Ave., New York, NY 10017.

What is the wire routing number for JP Morgan Chase Bank

Domestic wires

If you plan to receive money by wire, you will need to provide your bank account information to the person sending. The Chase routing number for wires is 021000021.

Cached

What bank swift code is 021000021

RBC Royal Bank Routing/ABA number (if funds coming from U.S.): 021000021. RBC Royal Bank SWIFT BIC (if funds coming from international location): ROYCCAT2.

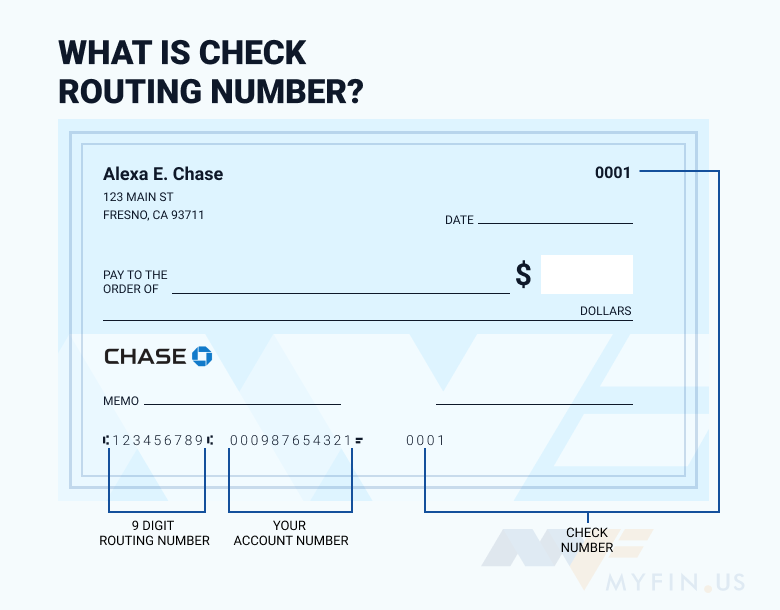

Is 021000021 a wire or ACH number

The routing number for Chase in New York is 021000021 for checking and savings account. The ACH routing number for Chase is also 021000021. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code.

Can I use ACH routing number for wire transfer

Not necessarily. Both transactions require a 9-digit number, but you will have to verify with the financial institution where you are sending the funds, if the ABA number for ACH or wires are the same, or which routing number should be used for a wire transfer and for the ACH.

What bank to bank info for wire transfer

When sending a domestic bank wire, you will need to provide the recipient's name, address, bank account number, and ABA number (routing number).

What information is needed for wire transfer to Chase bank

Bank and wire transfer services may require:

The sender's full name and contact information. The sender's bank account and transit number. The recipient's full name and contact information. The recipient's bank account information and transit number.

Does Chase have 2 routing numbers

Many banks have only one routing number, but because Chase is so big, it has multiple routing numbers across the U.S. If you're a Chase customer, your routing number depends on where you opened your account.

How do I receive a wire transfer to my Chase account

Enroll in Wire TransfersSign in to the Chase Mobile® app, tap "Pay & Transfer"Tap "Wires & global transfers" , "Get started" and "Next"Choose the phone number for an activation code.Tap "Next" and enter the code.Read the terms and conditions, "check the box" to accept and tap "Next"

What is the SWIFT code for wire transfer to Chase Bank

Chase SWIFT/BIC Codes. The SWIFT/BIC code for Chase is CHASUS33XXX.

What is the SWIFT of JP Morgan Chase Bank

CHASUS33XXX

The SWIFT/BIC code for JPMORGAN CHASE BANK, N.A. is CHASUS33XXX.

How to do an ACH or wire transfer on Chase

Once you log in, click Pay & Transfer at the top of the page and then click Payment Center. From the menu, select ACH Payment Services and enroll. Once you're enrolled, click Add Payee to begin adding the names or people and businesses you want to pay.

Do all banks allow ACH transfers

All banks in the United States can use ACH, as all that's needed to receive an ACH transfer is a valid bank account and routing number. Additionally, payment processors like Square, PayPal, and Stripe also use ACH.

Is wire transfer the same as direct deposit ACH

What Is the Difference Between ACH and Wire Transfers An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the direct movement of money from one bank account to another, typically for a fee.

Do all banks have different routing numbers for wire transfers

Banks also can have separate routing numbers for different types of transactions — one for processing paper checks and another for wire transfers, for example.

Can any bank do a wire transfer

Both banks and nonbank money transfer providers can help you send wire transfers. With bank wire transfers, both the sender's and receiver's financial institutions are involved. Transfers within the U.S. may be processed the same day, but expect international ones to take at least a few days.

How do I receive a wire transfer into my Chase account

Enroll in Wire TransfersSign in to the Chase Mobile® app, tap "Pay & Transfer"Tap "Wires & global transfers" , "Get started" and "Next"Choose the phone number for an activation code.Tap "Next" and enter the code.Read the terms and conditions, "check the box" to accept and tap "Next"

Can my Chase account accept wire transfers

Some of these accounts charge transfer fees, ranging from $5 to $50 per transaction. But holders of higher-tier Chase Premier Plus Checking, Chase Sapphire Checking, Chase Private Client Checking and Chase Private Client Savings accounts can carry out wire transfers without paying fees.

Why does my bank have 2 different routing numbers

Banks also can have separate routing numbers for different types of transactions — one for processing paper checks and another for wire transfers, for example.