What Bank has 022000046 routing number?

What is the routing number 002000046

The routing number for M&T Bank for domestic wire transfer is 22000046.

Cached

Are all M&T routing numbers the same

M&T Bank has three different routing numbers – the number you use depends on which state you're in.

Where is the account number on a M&T check

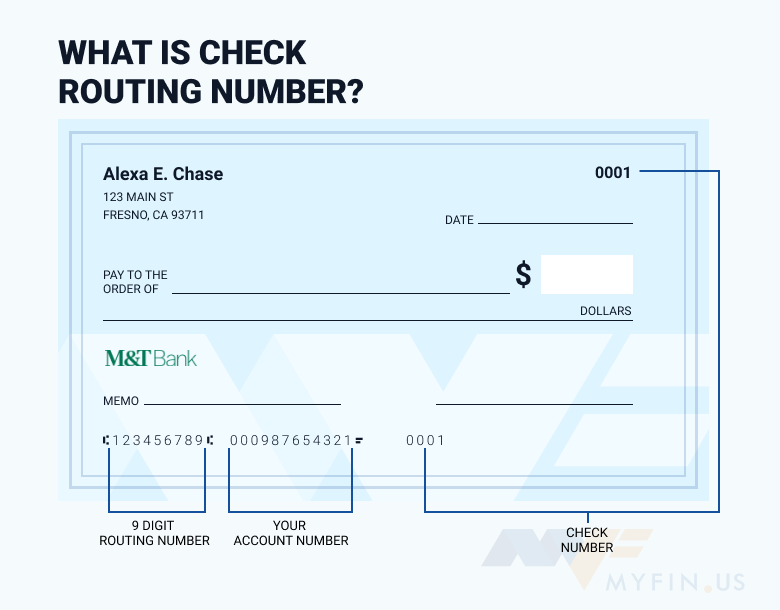

If you need to find your M&T Bank routing number on a check, look at the 9-digit number in the bottom left-hand corner. That is your routing number, but it's just the nine digits. The other digits in the middle are your account number and the numbers on the right side are your check number.

Cached

What is the wire transfer number for M&T bank

1-800-724-2240

Learn more about how to send a bank wire through M&T or to enroll in any of our wire transfer services. Simply call 1-800-724-2240 to speak to one of our experienced Commercial Service Team Representatives, Monday – Friday, 8am-6pm ET, or contact your dedicated M&T Relationship Manager.

What routing number is 256078446

PenFed's routing number is 256078446, which you can find at the top of PenFed.org and in the View Account Details section for any of your accounts.

Whose routing number is 256078446

PenFed's ABA routing number is 2560-7844-6.

Does it matter which routing number I use for my bank

Each routing number is unique to one financial institution and helps avoid confusion. Routing numbers ensure that checks intended for Citibank don't go to CIT Bank, for example.

Is People’s United bank the same as M&T bank

M&T is an American bank holding company headquartered in Buffalo, New York. M&T's acquisition of People's United Bank was finalized back in April, according to Mike Keegan of M&T. The distribution in service will start on Friday and extend through the Labor Day holiday weekend, while the two banks merge.

What checks qualify for M&T flash funds

Am I eligible for M&T Flash Funds™ Personal and Business Banking Customers completing a mobile deposit for checks above $10 may be eligible for M&T Flash Funds™.

What bank to bank info for wire transfer

When sending a domestic bank wire, you will need to provide the recipient's name, address, bank account number, and ABA number (routing number).

How do I identify a wire transfer

A SWIFT code or Bank Identification Code (BIC) identifies the bank that will receive your wire transfer. If you don't know this, contact your recipient's bank. Your recipient's International Bank Account Number (IBAN). An IBAN identifies specific bank accounts at international banks.

Is 021000322 a routing number

Bank of America New York routing numbers

The routing number for Bank of America in New York, United States is 021000322 for checking and savings accounts.

What is St Thomas Banco Popular routing

The routing number for accounts in Banco Popular-Virgin Islands is 021606674 and for accounts in Banco Popular-Tortola it is 021502011.

Which Bank owns this routing number 322271627

JPMorgan Chase, NA

Bank Name: JPMorgan Chase, NA. Routing number: 322271627.

Why does Bank of America have 2 routing numbers

Bank of America has branches throughout the United States and uses different routing numbers for different states and regions. Bank of America savings accounts use the same routing numbers as checking accounts.

How can I verify a routing number

You can find the ABA Routing Number at the bottom of your checks. The ABA Routing Number is the left-most number, followed by your account number, and then by the number of the check.

What bank merged with Peoples United Bank

M&T Bank

On April 2, 2023, the bank merged with M&T Bank and was fully integrated into M&T by the third quarter of 2023.

What bank is taking over People’s United

M&T

M&T is an American bank holding company headquartered in Buffalo, New York. M&T's acquisition of People's United Bank was finalized back in April, according to Mike Keegan of M&T. The distribution in service will start on Friday and extend through the Labor Day holiday weekend, while the two banks merge.

What checks are not eligible for mobile deposit

The following are not eligible for Mobile Deposit: international checks, U.S. savings bonds, U.S. postal money orders, remotely created checks (whether in paper form or electronically created), convenience checks (checks drawn against a line of credit), non-American Express traveler's checks, cash, checks that are …

Can a bank put a hold on a Treasury check

Yes. Your bank may hold the funds according to its funds availability policy.