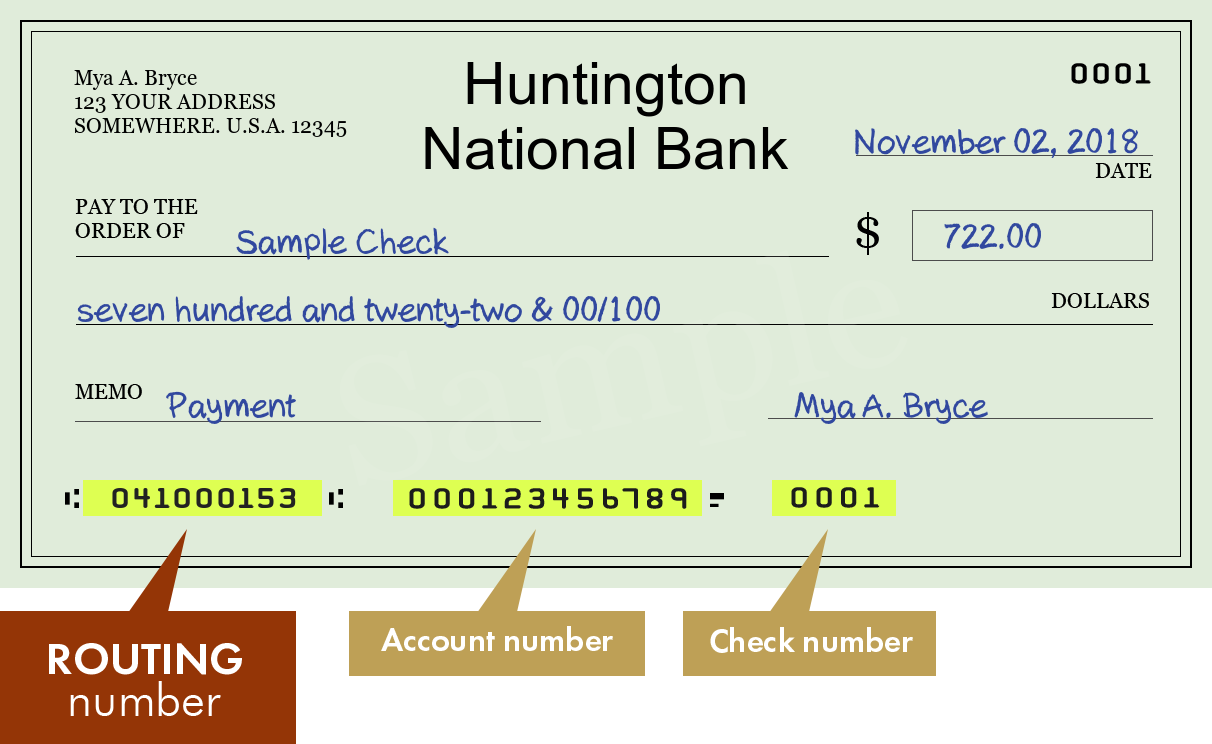

What bank routing number is 041000153?

What routing number is 041215032 on a check

Huntington Bank

Huntington Bank routing numbers

| Account number | Huntington Bank routing number |

|---|---|

| 63 | 041215032 |

| 65 | 042015422 |

| 66 | 041000153 |

| 67 | 044108641 |

Cached

Can you identify a bank by its routing number

If you wish to look up a bank by its routing number, you can search for it on the ABA's website. Additionally, you can also search for routing numbers through their website by inputting the bank's name and address. It's possible to receive checks without a bank name.

What is the routing number for Huntington wire transfers

When initiating a domestic wire transfer to Huntington, use the routing number 044000024.

Does Huntington have different routing numbers

Huntington Bank has one routing number for incoming domestic wire transfers: 044000024. For incoming international wire transfers, Huntington Bank's SWIFT code is HUNTUS33.

Cached

What routing number is 041000124 on a check

PNC Bank

The routing number for PNC Bank in Ohio, United States is 042000398/ 041000124 for checking and savings account.

Are ACH and check routing numbers the same

And while they do have similarities — and an ACH routing number is an ABA routing number — there are differences between ACH and ABA routing numbers: ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers.

How do you find what bank an account number belongs to

Account numbers alone can't be used to identify account details — such as who the bank account belongs to. If you want to figure out what bank or credit union holds an account, you'll need the routing number, too. An ABA routing number identifies the specific bank that maintains an account.

Can you Google a routing number

Often, banks have routing number information published online. Google your bank's name plus the words "routing number." If you can't find it by looking directly at your bank's website, try Google. You might be surprised at how often you can find something with Google that you can't find easily at a company site.

Do banks have different routing numbers for wire transfers

Banks also can have separate routing numbers for different types of transactions — one for processing paper checks and another for wire transfers, for example.

Does Huntington bank receive wire transfers

Transactions are completed in minutes providing immediate availability and use of funds. Incoming domestic wire transfers received before 6:40 p.m. ET receive same day credit. Online outgoing domestic wire transfer requests and phone-in wires received before 6:15 p.m. ET will be processed same day.

Why does my bank have 2 different routing numbers

Banks also can have separate routing numbers for different types of transactions — one for processing paper checks and another for wire transfers, for example.

Why do I have 2 different routing numbers

In most cases, banks and credit unions only have one routing number. But some large national and multinational banks may have multiple routing numbers based on where you live or hold the account.

Is 044000037 a Chase routing number

The routing number for Chase in Ohio is 044000037 for checking and savings account. The ACH routing number for Chase is also 044000037. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code.

Are all routing numbers the same for PNC

Are all PNC routing numbers the same The PNC routing number you need will depend on the transaction. You might need one number to receive ACH transfers, and another to set up automated bill payments. A bank might have a few different routing numbers, but they're never shared with other banks.

What does an ACH routing number look like

ACH routing numbers are always nine digits long, and the first two digits often range from 61 to 72. This number may be the same routing number as the one on your checks, but they can be different, so you should verify with the bank or through your online banking portal before using it.

What is the difference between a wire routing and an ACH routing

What Is the Difference Between ACH and Wire Transfers An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the direct movement of money from one bank account to another, typically for a fee.

How can I verify a routing number

You can find the ABA Routing Number at the bottom of your checks. The ABA Routing Number is the left-most number, followed by your account number, and then by the number of the check.

How can I verify a bank account number

How do you verify a bank accountMicro deposits: a customer gives their account details to a merchant.Sending bank statements: a customer provides a merchant with documents from their bank.Credit checks: a merchant checks their customer's account details against the information held on file at a credit bureau.

Which routing number to use for wire transfer

Instead, a wire transfer uses the recipient's bank account number and ABA routing number. This is a unique 9-digit number that identifies each banking institution. If you don't know your bank's routing number, you can find it using a quick internet search.

What happens if you have the wrong routing number for a wire transfer

What Happens If A Wire Transfer Goes To The Wrong Account Transactions are usually rejected if you have entered the wrong routing number or bank account number. If the transfer goes through, it's possible to initiate wire transfer reversal by the bank to reject the transaction.