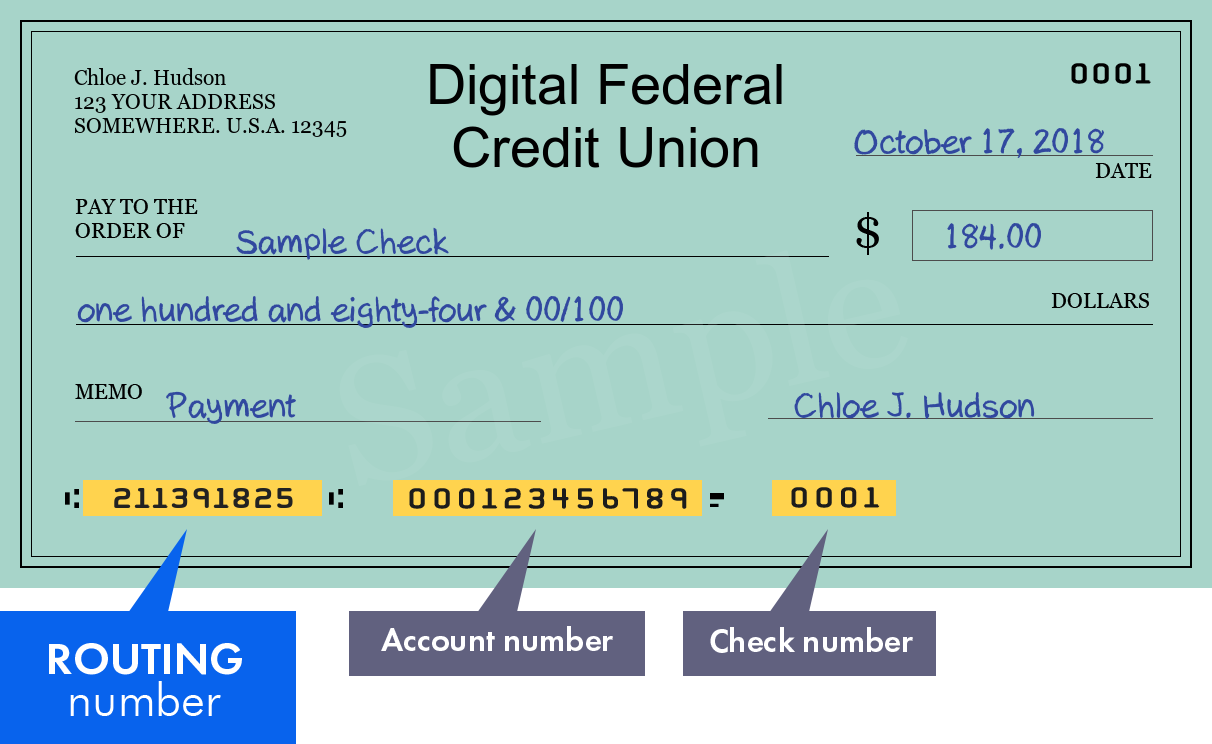

What Bank uses the routing number 211391825?

What is the bank name for DCU

Digital Federal Credit Union, better known as DCU, is a not-for-profit financial cooperative owned by and operated for our members.

Why does boa have two routing numbers

Your ABA routing number (for domestic money transfers) is the one which is labeled “paper and electronic transfers.” The other routing number is for wire transfers.

Is a bank routing number specific a bank location

Each routing number is unique to one financial institution and helps avoid confusion. Routing numbers ensure that checks intended for Citibank don't go to CIT Bank, for example.

What is DCU share number

DCU Routing Number: 211391825.

What is the new name for Enterprise bank

On 27 January 2015, AMCON officially transferred ownership of Enterprise Bank Ltd to Heritage Bank Plc.

Is DCU Digital Banking legit

Is DCU a real bank Digital Federal Credit Union is a real bank with over 900,000 members, 23 branches and a network of 5,900 Shared CO-OP branches nationwide.

What routing number does Wells Fargo use

Wells Fargo ACH transfer routing number

The ACH routing number for Wells Fargo is 121000248.

Which routing number do I use for ACH Bank of America

The ACH routing number for Bank of America is 026009593. Short for Automatic Clearing House, ACH numbers are unique to each bank in the US.

How can I verify a routing number

You can find the ABA Routing Number at the bottom of your checks. The ABA Routing Number is the left-most number, followed by your account number, and then by the number of the check.

What does the routing number tell the bank or us

A routing number is a nine-digit code used by financial institutions to identify other financial institutions. It's also known as an RTN (routing transit number) and an ABA (American Bankers Association) routing number. Combined with your account number, it allows institutions to locate your individual account.

What does share mean on a bank account

Credit unions refer to checking accounts as share draft accounts. While it might not affect how you use the account, share draft accounts are a form of ownership. This means you are a partial owner of the credit union, while checking account owners are customers of banks.

What is a share account at the bank

A share account represents an individual's ownership in the credit union. Share accounts can be savings accounts or checking accounts. You may also hear credit union checking accounts referred to as share draft accounts.

Which bank is enterprise bank

Enterprise Bank Limited (EBL), also known as Enterprise Bank, was a commercial bank in Nigeria. It was licensed as a commercial bank by the Central Bank of Nigeria, the country's banking regulator.

What type of bank is enterprise bank

Our Story. Enterprise Bank was founded with an entrepreneurial vision to help create successful businesses, opportunities, wealth and vibrant, prosperous communities. We have stayed true to this vision and will always be a community bank, leading with a deep sense of mission and purpose.

What is DCU routing information

You'll need DCU's routing and transit number (211391825) and your account number.

Is DCU a US bank

DCU is regulated under the authority of the National Credit Union Administration (NCUA) of the US federal government. DCU has nineteen full-service branches in Massachusetts and four full-service branches in New Hampshire, although it has members in all 50 U.S. states.

How do you verify a routing number

At the bottom of a check, you will see three groups of numbers. The first group is your routing number, the second is your account number and the third is your check number.

What bank does this routing number belong to 121000248

Share this page

| City | Name | FED & CHIPS ABA |

|---|---|---|

| Philadelphia | Wells Fargo Bank, N.A. International Processing Center | FW ABA: 026005092 CHIPS ABA: 0509 |

| San Francisco | Wells Fargo Bank, N.A. Foreign Exchange | FW ABA: 121000248 |

| Winston-Salem | Wells Fargo Bank, N.A. Standby Letters of Credit | FW ABA: 026005092 CHIPS ABA: 0509 |

Are there different routing numbers for ACH and wire

Not necessarily. Both transactions require a 9-digit number, but you will have to verify with the financial institution where you are sending the funds, if the ABA number for ACH or wires are the same, or which routing number should be used for a wire transfer and for the ACH.

How do you find what bank an account number belongs to

Account numbers alone can't be used to identify account details — such as who the bank account belongs to. If you want to figure out what bank or credit union holds an account, you'll need the routing number, too. An ABA routing number identifies the specific bank that maintains an account.