What can I do with my 770 credit score?

What can you do with a 770 credit score

With your 770 credit score, you are pretty far from having bad credit. You can generally qualify for whatever type of loan you need and can get favorable interest rates and terms. However, you're not in the elite realm of “exceptional” credit, which is generally considered FICO Scores of 800 or higher.

Cached

Is a 770 credit score considered good

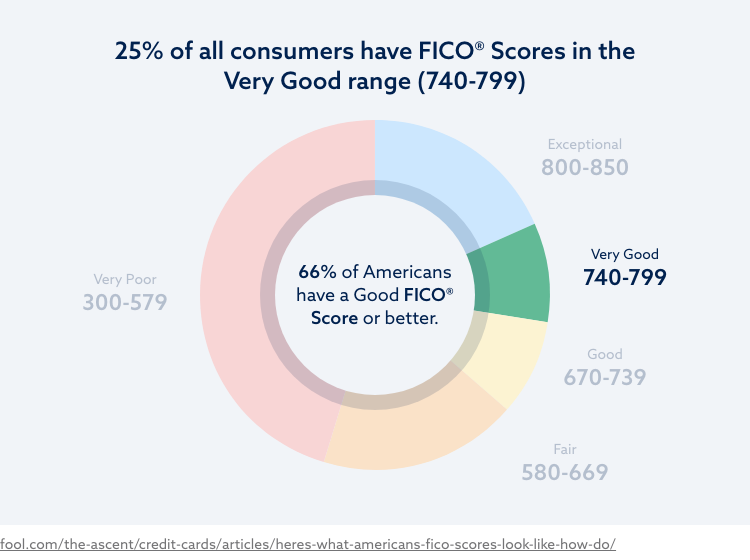

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Cached

What interest rate can I get on a house with a 770 credit score

Average mortgage interest rate by credit score

| FICO Score | National average mortgage APR |

|---|---|

| 660 to 679 | 6.806% |

| 680 to 699 | 6.592% |

| 700 to 759 | 6.415% |

| 760 to 850 | 6.193% |

Can I get a personal loan with 770 credit score

Since a credit score of 770 is in the excellent credit range, people with this score should have great odds of qualifying for nearly any personal loan on the market, including those with a low APR and no origination fee.

How many people have 770 credit score

A 770 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO® Scores in the Very Good range.

How to get 800 credit score from 770

4 key factors of an excellent credit scoreOn-time payments. The best way to get your credit score over 800 comes down to paying your bills on time every month, even if it is making the minimum payment due.Amounts owed.Credit history.Types of accounts and credit activity.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

How many people have a 770 credit score

A 770 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO® Scores in the Very Good range.

What credit score is needed for a $35000 personal loan

620

In order to qualify for a $35,000 loan, borrowers are generally required to have a credit score of at least 620. A good to excellent credit score not only gives you more options in terms of lenders, but it also improves your chances of approval and gives you access to the most flexible terms and lowest interest rates.

Can I get a $50000 personal loan with a 700 credit score

You will likely need a minimum credit score of 660 for a $50,000 personal loan. Most lenders that offer personal loans of $50,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

How rare is 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Is 800 credit score rare

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Can I afford a 300K house on a $70 K salary

Home buying with a $70K salary

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*.

How much do you have to make a year to afford a $400000 house

$105,864 each year

Assuming a 30-year fixed conventional mortgage and a 20 percent down payment of $80,000, with a high 6.88 percent interest rate, borrowers must earn a minimum of $105,864 each year to afford a home priced at $400,000. Based on these numbers, your monthly mortgage payment would be around $2,470.

What credit score do I need for a $70000 loan

670

If you have bad credit, your options for getting a $70,000 personal loan are more limited. Most lenders require a credit score of at least 670, and criteria may be strict for this large loan amount. That doesn't mean you're out of options.

Can I get a $50,000 personal loan with 700 credit score

You will likely need a minimum credit score of 660 for a $50,000 personal loan. Most lenders that offer personal loans of $50,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.

Can I get a 20k loan with 750 credit score

You should have a 640 or higher credit score in order to qualify for a $20,000 personal loan. If you have bad or fair credit you may not qualify for the lowest rates. However, in order to rebuild your credit you may have to pay higher interest rates and make on-time payments.

Can I get a 100k loan with 700 credit score

Check Your Credit Score

To qualify for a $100,000 personal loan, you should have a score of at least 720, though a score of 750 or above is ideal. Before you apply for a large personal loan, check your credit score so you know what kind of loan terms you're likely to qualify for.

How much is a 850 credit score worth in money

The average mortgage loan amount for consumers with Exceptional credit scores is $208,617. People with FICO® Scores of 850 have an average auto-loan debt of $17,030.