What can I get with a 690 credit score?

Is 690 a good credit score to buy a house

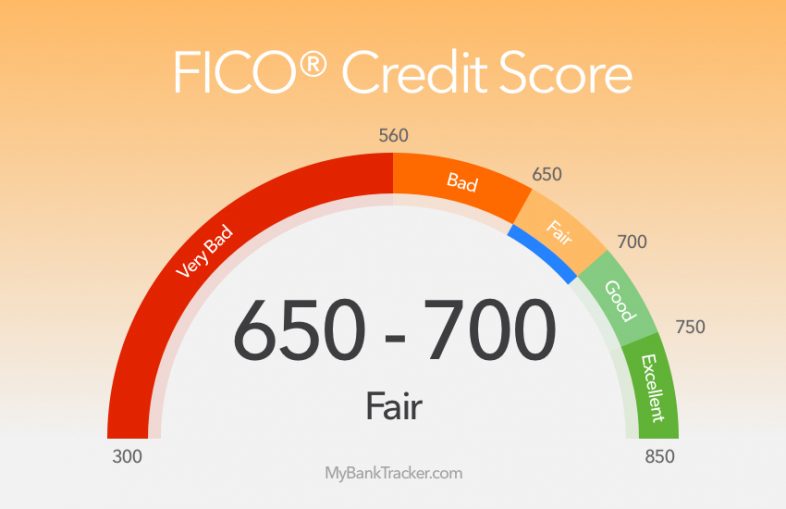

A 690 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms.

Cached

How do I get my credit score up from 690 to 700

Here's what you need to do.Make every payment on time.Keep your credit utilization low.Don't close old accounts.Pay off credit card balances.Ask your card issuer to increase your limit.Use the authorized user strategy.Put your bill payments to work.Use a rent reporting company.

Can I get a car with a 690 credit score

Good news! 690 is a good credit score for a car loan. You shouldn't have a problem getting approved with that rating. In most cases, you can get approved for a car loan if your credit score is 660 or above.

Cached

How to get credit score from 690 to 800

4 key factors of an excellent credit scoreOn-time payments. The best way to get your credit score over 800 comes down to paying your bills on time every month, even if it is making the minimum payment due.Amounts owed.Credit history.Types of accounts and credit activity.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

How to go from 690 to 750 credit score

How to Bring Your Credit Score Above 700Pay on Time, Every Time.Reduce Your Credit Card Balances.Avoid Taking Out New Debt Frequently.Be Mindful of the Types of Credit You Use.Dispute Inaccurate Credit Report Information.Don't Close Old Credit Cards.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

What credit score do I need for a 70k car loan

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

How to get a 900 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

What credit score is needed to buy a $250 000 house

While credit score requirements vary based on loan type, mortgage lenders generally require a 620 credit score to buy a house with a conventional mortgage.

How much does a couple need to make to buy a $200 K house

What income is required for a 200k mortgage To be approved for a $200,000 mortgage with a minimum down payment of 3.5 percent, you will need an approximate income of $62,000 annually.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Can my credit score go up 200 points in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

What credit score do I need to buy a $30 000 car

There's no set minimum credit score required to get an auto loan. It's possible to get approved for an auto loan with just about any credit score, but the better your credit history, the bigger your chances of getting approved with favorable terms.

What credit score is needed to buy a 40000 car

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

How long does it take to build credit from 500 to 750

Average Recovery Time

For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use. Once you've made it to the good credit zone (670-739), don't expect your credit to continue rising as steadily.

How long does it take to go from 600 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

What credit score is needed for a $350 000 house

Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

What credit score is needed to buy a $150000 house

620 or higher

Conventional Loan Requirements

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

How much do you need to make to buy a 300K house

To purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, type of home loan, loan term, and mortgage rate.