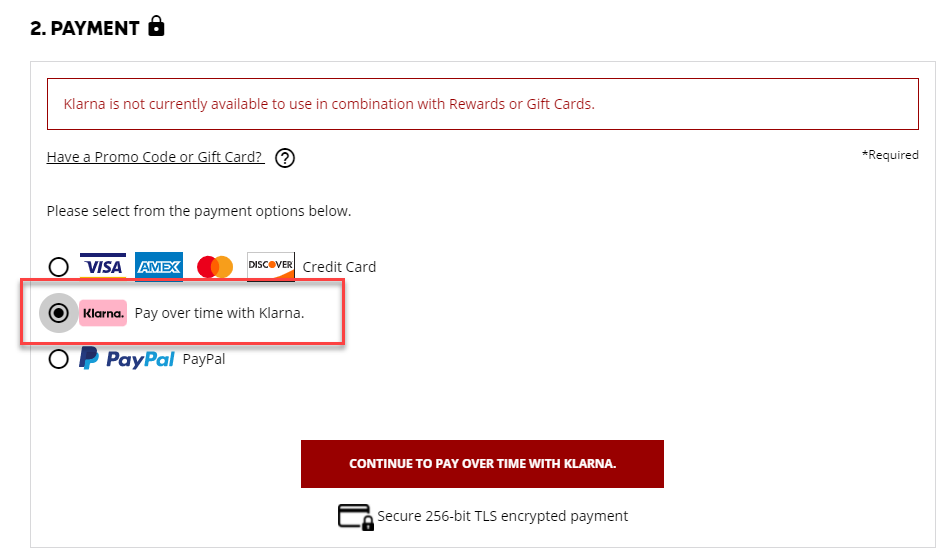

What can Klarna not be used for?

Can I use Klarna to Pay for anything

The Klarna Card is a virtual Visa card that you can use to make purchases. You can make purchases online directly using the card at a retailer's checkout or by adding it to Apple Pay or Google Pay. You can use your virtual Klarna card anywhere Visa is accepted.

What are the limits for Klarna

There is no predefined spending limit when using Klarna.

Can I use Klarna credit card on anything

Our One-time card enables you to use Klarna payment options at any prepaid card accepting online store in the US. You can use the One-time card at the store's checkout, like any regular credit card.

Why isn t Klarna approving my payment method

Attempting too many purchases in a short amount of time may result in being rejected (fraud prevention) The approval decision is not based solely on credit score, but rather multiple internal data points such as past payment history.

Cached

Can I pay my electric bill with Klarna

Can I use Klarna to buy anything Almost! But there are some exceptions: Utility bill or rent payments.

Can I withdraw money with Klarna

Can I withdraw money when paying for a purchase in a store No, you cannot withdraw money when paying for a purchase in a store.

Does Klarna build credit

Klarna is not a good idea if you:

Want to build credit: Most BNPL lenders do not report payments to the credit bureaus, and Klarna is no different. Showing a history of on-time payments to the bureaus can help you build credit, which opens the door to more affordable financing options in the future.

Does Klarna lower your credit score

Klarna performs a soft credit check which does not affect your credit score and will not be visible to other lenders when: Deciding to Pay in 4. Preferring to Pay in 30 days.

Can I withdraw money from Klarna

The Klarna Card does not allow cash withdrawal, but lets you use Klarna's payment options everywhere. That means you can pay later or finance your purchases everywhere with your Klarna Card.

Can I buy food with Klarna

Find the best tasting food, drinks and snacks available with the use of Klarna. Klarna is available around the world with a variable offering, choose one that suits you best.

What credit score is needed for Klarna

Klarna does not have a minimum credit score requirement for its pay-in-four credit product. While Klarna does not report on-time payments of pay-in-four loans to the credit bureaus, it may report missed payments.

What is the difference between Afterpay and Klarna

Both Afterpay and Klarna can be used to pay for your online and in-store shopping. However, you can only use Afterpay as a payment method at partner retailers and participating stores. Klarna, on the other hand, can be used as a payment method at almost any store that accepts card payments.

Can I pay my gas with Klarna

All users have to do is find a gas station in the app, create a $75 digital card, and use it to pay. Any unused funds will be returned to their account.

Can I transfer money from Klarna to my bank account

On the app:

On the Payment method screen, select Bank transfer. Review your transfer details and tap Continue to be sent to Klarna to finish your transaction. Select your country and bank and tap Next. Enter your banking details and tap Next to complete the transfer with your online bank.

Can you borrow cash from Afterpay

Afterpay offers interest-free financing on its point-of-sale loans. All you need to do is make installment payments on or before each due date. If you borrow $6,000, you are only responsible for repaying $6,000. Even if you miss a payment, you are not charged interest, since there is no interest rate.

How much credit score do I need to use Klarna

Do I need a good credit score for Klarna Klarna doesn't set a minimum credit score to qualify for its finance products.

Is using Klarna too much bad

Using Klarna can also negatively affect your credit score if you apply to use financing and if you take out a payment holiday. These could impact your ability to take out a new credit card or even a mortgage.

What are the pros and cons of Klarna

Klarna review summary: Pros and cons

| Pros | Cons |

|---|---|

| No prepayment, annual or membership fees | Charges returned payment and late fees |

| Multiple finance avenues consumers can take advantage of | To qualify for longer financing terms, you may have to go through a hard credit check |

Can I use Klarna to get cash

The Klarna Card does not allow cash withdrawal, but lets you use Klarna's payment options everywhere. That means you can pay later or finance your purchases everywhere with your Klarna Card.

Can you pay rent with Klarna

Can I use Klarna to buy anything Almost! But there are some exceptions: Utility bills or rent payments.