What causes finance charge in credit card?

Why am I getting finance charges on my credit card

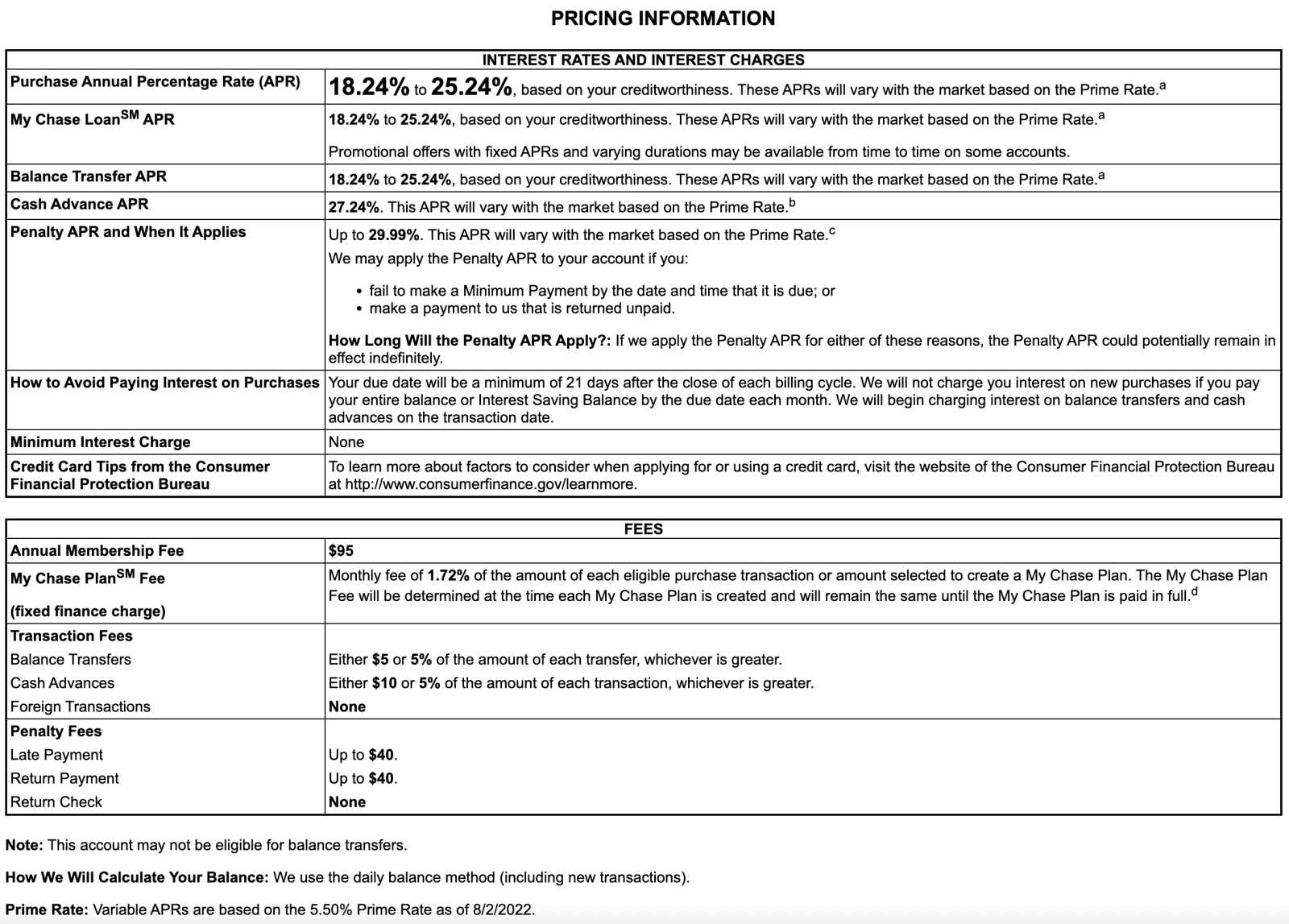

Key points about: the different types of finance charges on a credit card. Any fee you incur from using your credit card is considered a finance charge. Interest, penalty fees, annual fees, foreign transaction fees, cash advance fees, and balance transfer fees are all finance charges.

How do I avoid finance charges on my credit card

Pay your balance in full

By paying your balance in full every month, your credit card will not issue a finance charge to your account. A grace period lets you avoid finance charges if you pay your balance in full before the due date. The grace period is typically between 21 to 25 days.

How do they come up with a finance charge

A finance charge is the total amount of interest and loan charges you would pay over the entire life of the mortgage loan. This assumes that you keep the loan through the full term until it matures (when the last payment needs to be paid) and includes all pre-paid loan charges.

Cached

Are finance charges normal

When you carry a credit card balance from one billing cycle to the next, you'll usually incur a finance charge. While having a credit card with an intro 0% APR may keep you from paying interest as part of your finance charges, you could still be charged fees.

Can finance charges on credit card reversed

In some cases, banks may offer to waive or reduce the charges if the customer has a good payment history and is requesting a reversal for the first time. To request a reversal, you can contact your bank's customer service department and explain the situation.

Is finance charge bad for credit

Paying the finance charge is like paying more towards your balance that will shorten the life of your debt but it will not affect the credit score.

What affects finance charges

Finance charges are the cost of borrowing money and can vary depending on key factors like how much you borrow, current rates, which lender you choose and your credit score.

Do finance charges hurt credit score

Paying the finance charge is like paying more towards your balance that will shorten the life of your debt but it will not affect the credit score.

Can you lower your finance charge

While you may not avoid finance charges in every situation, you may be able to lower your finance charges by getting a lower interest rate, taking out a loan to pay your balance or transferring a credit balance to a card with lower fees.

Can you reduce finance charges

While you may not avoid finance charges in every situation, you may be able to lower your finance charges by getting a lower interest rate, taking out a loan to pay your balance or transferring a credit balance to a card with lower fees. Take a look at finance charge disclosures to compare.

What are finance charges based on

A billed finance charge is specifically stated on a borrower's billing statement, typically for credit card balances or other types of loans. It is based on the borrower's outstanding balance, interest rate, and applicable fees or charges.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

What determines what your finance charge will be

Your finance charge on a credit card is based on your interest rate for the types of transactions you're carrying a balance on. These include purchases, balance transfers, and cash advances, each of which might have a different interest rate, and therefore a different amount you owe in each of those categories.

Can you avoid a finance charge by paying early

You may be able to avoid finance charges on credit cards by paying your balance in full each month by the due date. And while you usually can't avoid finance charges on installment loans, you would pay less in charges if you paid off the loan early.

Can you beat a finance charge

Make Extra Payments on Principal Loan Amounts

But if you can swing it, you can get out from under some of the finance charge burden that comes with a mortgage or auto loan by paying more than you owe every month. The finance charge on those loans is tied to the amount of your outstanding balance.

What is the 15 3 rule

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

Do credit card companies like when you pay in full

Yes, credit card companies do like it when you pay in full each month. In fact, they consider it a sign of creditworthiness and active use of your credit card. Carrying a balance month-to-month increases your debt through interest charges and can hurt your credit score if your balance is over 30% of your credit limit.

What are examples of finance charges

A finance charge is the total amount of money a consumer pays for borrowing money. This can include credit on a car loan, a credit card, or a mortgage. Common finance charges include interest rates, origination fees, service fees, late fees, and so on.

Does it hurt your credit to pay your balance early

If you are looking to increase your score as soon as possible, making an early payment could help. If you paid off the entire balance of your credit card, you would reduce your ratio to 40%. According to the Consumer Financial Protection Bureau, it's recommended to keep your debt-to-credit ratio at no more than 30%.

Can financing ruin your credit

Taking out a personal loan is not bad for your credit score in and of itself. However, it may affect your overall score for the short term and make it more difficult for you to obtain additional credit before that new loan is paid back.