What Chase credit card I can get with a 670 credit score?

Can I get Chase Freedom Unlimited with 670 credit score

In general, you need a credit score of at least 670 to get approved for the Freedom Unlimited card.

Cached

Can I get a credit card with 670 credit

One of the best credit cards you can get with a 670 credit score is the Upgrade Cash Rewards Visa®. This card offers unlimited 1.5% cash back on all purchases (after you pay the bill) and has a $0 annual fee.

What can I get with a credit score of 670

What Does a 670 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Unsecured Credit Card with No Annual Fee | YES |

| Unsecured Credit Card with Rewards | YES |

| Home Loan | YES |

| Auto Loan | YES |

What credit score is needed for Chase credit card

For most Chase credit cards, you need at least good credit to be approved, which is a credit score of at least 670. A score of 740 or higher bumps you into the “very good” credit range and gives you an even stronger chance at approval. This score requirement is standard for most rewards credit cards.

Cached

What’s the easiest Chase card to get

Chase Freedom® Student credit card

Chase has one good starter credit card, the Chase Freedom® Student credit card, but it's only available to students. It offers 1% cash back on purchases plus a $50 bonus after your first purchase and a $20 good standing reward after every account anniversary.

What is the minimum credit score for Chase Freedom Card

690 or better

You'll need good to excellent credit to qualify for the Chase Freedom Unlimited®. Generally speaking, this is defined as a credit score of 690 or better.

Can I get an AmEx card with a 670 credit score

In other words, you'll likely need a score in at least the "good" range to qualify for an AmEx card. Other American Express cards will usually require even higher scores. According to the score ranges from FICO, that means American Express applicants typically have at least a 670 score: Exceptional.

What credit score do I need for Chase Freedom Flex

670 or higher

What credit score do you need for the Chase Freedom Flex You'll need a good to excellent credit score (a FICO score of 670 or higher) to qualify for the Freedom Flex.

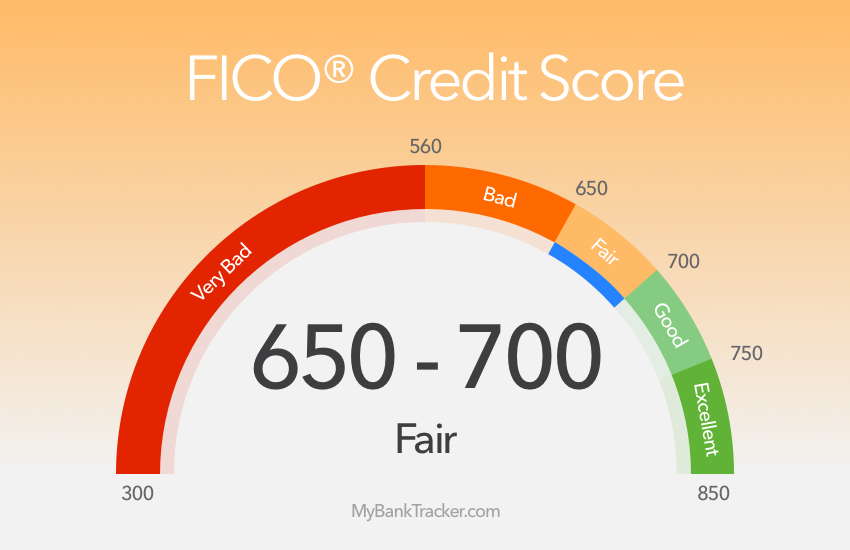

Is 670 considered good credit

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What APR will I get with a 670 credit score

Borrowers with an 670 credit score are considered to be relatively low risk when it comes to paying money back. Statistical default rates range from 4.6% for consumers in the 660-679 FICO Score range to 1.9% for those in the 720-739 range.

Which Chase credit card is easy to get approved for

Chase Freedom® Student credit card

The best Chase starter credit card is the Chase Freedom® Student credit card because it accepts applicants with limited credit history and reports to the three major credit bureaus on a monthly basis. Freedom Student also rewards cardholders with 1% cash back on all purchases, and it has a $0 annual fee.

Is it hard to be approved by Chase

To qualify for the Chase Sapphire Preferred and Chase Sapphire Reserve, you'll likely need very good (740 or higher) to excellent credit (800 or higher). However, you'll likely have the best odds of approval for any Chase card if your credit score is in the very good to excellent range.

Is there a Chase credit card for bad credit

Chase doesn't offer a credit card for bad credit, but you may be approved for the Chase Slate® card with a fair or better credit score. The Chase Freedom® Student credit card also considers applicants who have limited credit, but that is not the same as having bad credit.

Can I get a Chase Freedom Flex with a 650 credit score

The Chase Freedom Flex credit score requirement is 700+. This means that you need at least good credit to get this card.

What credit score is needed for Amazon credit card

670 to 739

Typically, you can qualify for Synchrony's Amazon store cards with a fair credit score (580 to 669). On the other hand, you'll likely need at least a good credit score (670 to 739) to qualify for one of the Amazon Visa cards from Chase.

What is the lowest credit score for American Express

According to the score ranges from FICO, that means American Express applicants typically have at least a 670 score: Exceptional. 800 and above.

What is the minimum credit score for Chase Sapphire Preferred

Generally, you'll need to have a credit score of at least 700 in order to qualify for the Chase Sapphire Preferred® Card.

How long does it take to go from 670 to 700 credit score

How Long Can It Take to Build a Credit Score Of 800-850

| Initial Score | Avg. time to reach 700* | Avg. time to reach 750* |

|---|---|---|

| 350 – 400 | 2+ years | 2-3 years |

| 450 – 500 | 18 months – 2 years | 2 – 3 years |

| 550 – 600 | 12-18 months | 1-2 years |

| 650 – 700 | – | 3 months – 1 year |

Can I buy a house with 670 credit score

670–740: Good credit – Borrowers are typically approved and offered good interest rates. 620–670: Acceptable credit – Borrowers are typically approved at higher interest rates.

Is 670 a good credit score to buy a house

670–740: Good credit – Borrowers are typically approved and offered good interest rates. 620–670: Acceptable credit – Borrowers are typically approved at higher interest rates.