What checks Cannot be cashed?

Can some checks not be cashed

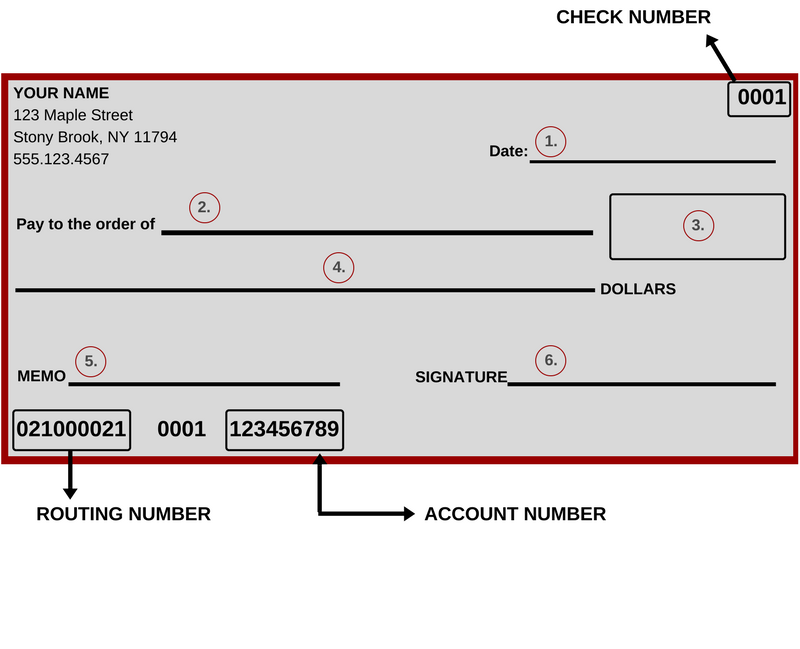

The main reason banks refuse to cash checks is due to insufficient funds, but checks can be rejected for other reasons, too, including unreadable or invalid account and routing numbers, improper formatting, a missing or invalid signature, or the elapse of too much time since the printed date.

Cached

Which type of check has not been cashed yet

The definition of an outstanding check is a check that has been written, but it hasn't been cashed-deposited by the bank, or otherwise cleared the bank. An outstanding check can be a personal or a business check.

What kind of checks Cannot be mobile deposited

The following are not eligible for Mobile Deposit: international checks, U.S. savings bonds, U.S. postal money orders, remotely created checks (whether in paper form or electronically created), convenience checks (checks drawn against a line of credit), non-American Express traveler's checks, cash, checks that are …

Where can I cash a $20000 check without a bank account

Cash it at the issuing bank (this is the bank name that is pre-printed on the check) Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.) Cash the check at a check-cashing store. Deposit at an ATM onto a pre-paid card account or checkless debit card account.

Do banks verify checks before cashing

Because paper checks have no actual monetary value themselves, banks have to verify whether the transaction can actually be completed or not.

Can banks deny cashing a check

No, a bank or credit union is not obligated to cash the check. If you go to a bank or credit union where neither you nor the person writing the check has an account, the bank or credit union will often refuse to cash the check.

What checks are too old to be cashed

The Uniform Commercial Code (UCC) is a collection of laws and regulations meant to harmonize the laws of sales and regulations across the U.S. The UCC tells banks that they are under no obligation to accept personal or business checks that are older than 180 days (6 months).

What is the oldest check you can cash

6 months

Banks don't have to accept checks that are more than 6 months (180 days) old. That's according to the Uniform Commercial Code (UCC), a set of laws governing commercial exchanges, including checks. Banks are still allowed to process an old check as long as the institution believes the funds are good.

Do some checks not work with mobile deposit

Traveler's checks. Checks payable to any person or entity other than you (i.e., payable to another party and then endorsed to you). Checks payable to you and another party who is not a joint owner on the account.

Are all checks eligible for mobile deposit

Can I deposit any check by mobile check deposit Personal, business and government checks are generally accepted for mobile deposit. Other payment forms, such as money orders or international checks, might not be accepted for mobile deposit from your bank.

Where can I cash a $50000 check without a bank account

If you want to cash a large check without a bank account, you'll need to visit the bank or credit union that issued the check to you. If you're not an account holder, you may also be charged a fee for the service.

Can I cash a $20000 check at Walmart

Walmart MoneyCenter Services

Customers can cash personal checks up to $200 and all other checks up to $5,000 for instant cash or have the amount added to a Walmart MoneyCard. Order customizable checks online or in-store.

At what point will a bank not cash a check

Personal, business, and payroll checks are good for 6 months (180 days). Some businesses have “void after 90 days” pre-printed on their checks. Most banks will honor those checks for up to 180 days and the pre-printed language is meant to encourage people to deposit or cash a check sooner than later.

What does a bank need to verify a check

Verifying a cashier's check is just like verifying any other check. You will need to contact the issuing bank and provide them with the check number, the amount the check was issued for, and the name of the account holder (the person who issued you the check).

Do banks have to verify checks before cashing

Because paper checks have no actual monetary value themselves, banks have to verify whether the transaction can actually be completed or not. When the check is captured, financial institutions use a variety of data points to make a judgment about the validity of the check.

Why wont Walmart cash my check

Walmart uses an electronic approval system based on the social security number you enter on the keypad. Based on this data, the computer will approve or deny your check to be cashed. Checks are denied for a variety of reasons, including entering the wrong social or having cashed bad checks at Walmart in the past.

Can a 2 year old check be cashed

The Uniform Commercial Code (UCC) is a collection of laws and regulations meant to harmonize the laws of sales and regulations across the U.S. The UCC tells banks that they are under no obligation to accept personal or business checks that are older than 180 days (6 months).

Can I deposit a 20 year old check

The Uniform Commercial Code says banks are under no obligation to accept checks, personal or business, more than 180 days old.

Can you cash a 2 year old check

Can you cash a 2-year-old check Yes, you can cash a 2-year-old check in theory, but the bank won't be legally obligated to process it for you. If you have a 2-year-old check lying around, your best bet is to take up the matter with your bank, the payer, or perhaps even get the state involved.

Why would a check be rejected for mobile deposit

The check is folded or torn. The check isn't signed on the front or on the back. The check does not include the “For Mobile Deposit Only at TCU” endorsement on the back. The check amount doesn't match what the member entered.