What credit bureau does OneMain Financial report to?

Which credit bureau does OneMain Financial pull

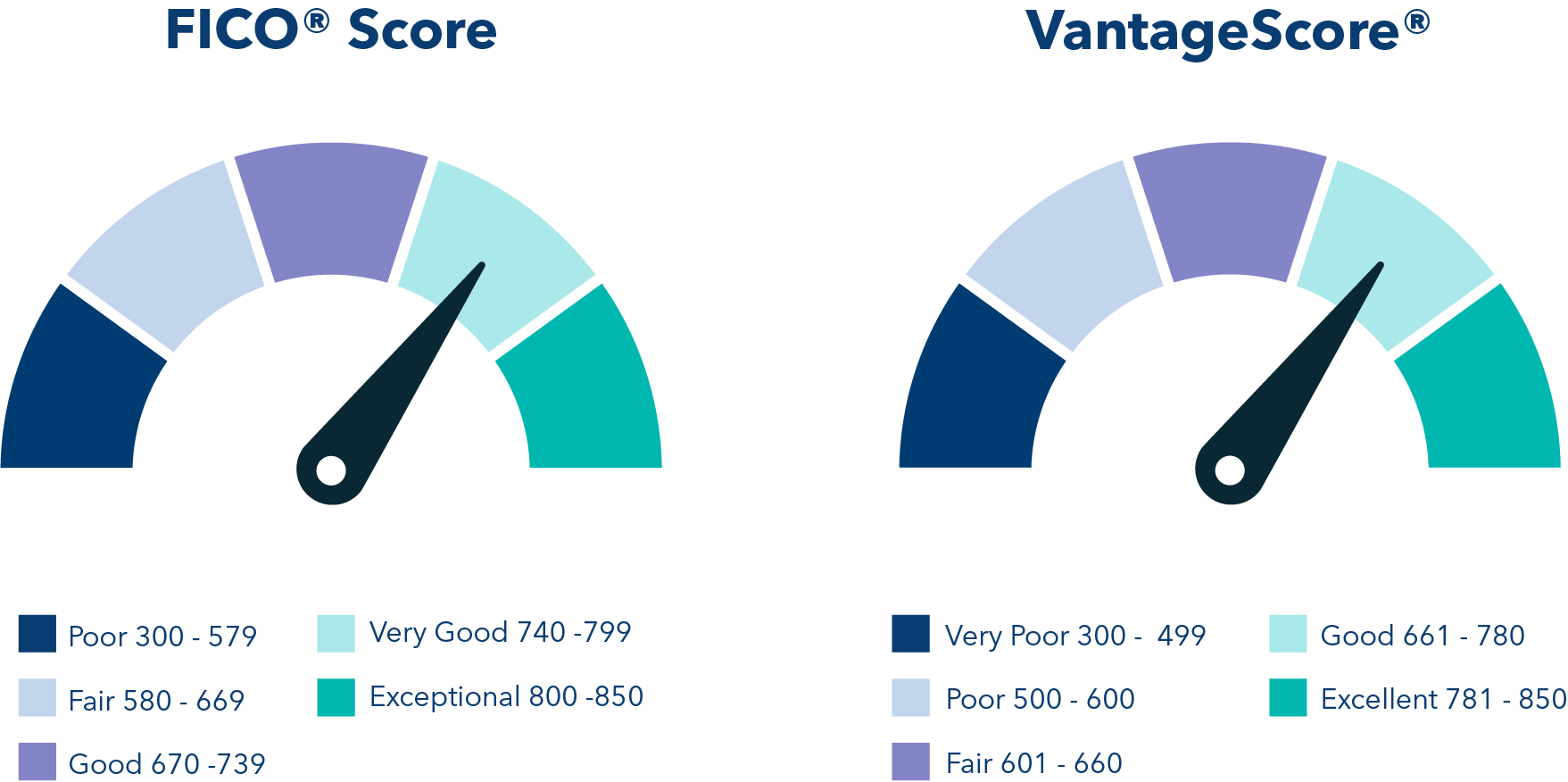

Initially, a OneMain Financial personal loan will affect your credit score in a negative way, but the long-term impact can be very positive, assuming you . Barclay's will almost always pull your report from TransUnion. Credit-scoring models like FICO and VantageScore use these reports to calculate your credit scores.

Who does OneMain Financial report to

OneMain reports account information to the Credit Reporting Agencies after each month end. For instance, in September, we report the account status as of August 31st. OneMain account updates are typically posted to customers' credit reports by the Credit Reporting Agencies around the 10th-15th of each month.

CachedSimilar

Does OneMain Financial have a minimum credit score

And while having a credit score below 670 most often disqualifies you for the majority of personal loan lenders, OneMain Financial has no minimum credit score requirement for applicants, and even has a secured loan option (with collateral) to make borrowing more accessible.

Does OneMain Financial help build credit

OneMain Financial reports payments to all three major credit bureaus, so on-time payments will help build your credit score, but missed payments will hurt it. Setting up automatic payments and keeping an eye on your budget are two ways to manage your loan payments.

Cached

How hard is it to get approved by OneMain Financial

It is not very difficult to get a personal loan from OneMain Financial because they offer personal loans for people with credit scores as low as 600-650+. Other OneMain Financial personal loan requirements include being at least 18 years old, having an SSN, and having enough income to afford monthly loan payments.

What credit score is the main one

FICO scores are generally known to be the most widely used by lenders. But the credit-scoring model used may vary by lender. While FICO Score 8 is the most common, mortgage lenders might use FICO Score 2, 4 or 5. Auto lenders often use one of the FICO Auto Scores.

What bank owns OneMain Financial

OneMain's roots stretch back to 1912 when it was founded by Alexander E. Duncan as Commercial Credit Company in Baltimore, Maryland. Through a series of mergers and acquisitions, Commercial Credit Company eventually became a subsidiary of Citigroup and was known as CitiFinancial.

Is OneMain Financial a predatory lender

Is OneMain Financial a predatory lender OneMain Financial is a legitimate personal loan lender that offers a similar application and approval process as other vetted lenders. While its minimum APR is higher compared to some competitors, its rates are much lower compared to other types of short-term loans.

What is the lowest credit score for OneMain

No minimum credit score for approval.

Most personal loan lenders require credit scores above 660 to apply, but OneMain Financial doesn't have a minimum.

What is the maximum you can borrow from OneMain Financial

$1,500 – $20,000

OneMain makes personal and auto loans from $1,500 – $20,000. Not all applicants will qualify for larger loan amounts or most favorable loan terms.

Which credit score is the hardest

Here are FICO's basic credit score ranges:Exceptional Credit: 800 to 850.Very Good Credit: 740 to 799.Good Credit: 670 to 739.Fair Credit: 580 to 669.Poor Credit: Under 580.

Does OneMain Financial check your bank account

OneMain Financial may verify income by requesting financial information like bank statements, pay stubs or tax returns.

How do I get out of my OneMain loan

To cancel your loan, please contact the branch listed on your loan agreement or call (800) 961-5577.

What is the maximum credit score one can have

850

If you've ever wondered what the highest credit score that you can have is, it's 850. That's at the top end of the most common FICO® and VantageScore® credit scores. And these two companies provide some of the most popular credit-scoring models in America.

Can you have multiple loans with OneMain

Generally speaking, you can get more than one personal loan from the same lender, and there is no limit to the number of loans you can have at once — you'll just need to get approved. However, it's important to keep in mind that how many loans you can have at once varies by lender, as well as state laws.

What Credit Bureau is usually the lowest

Your Equifax score is lower than the other credit scores because there is a slight difference in what is reported to each credit agency and each one uses a slightly different method to score your data. Your Experian, Equifax and TransUnion credit reports should be fairly similiar.

Which of the 3 credit scores is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

How does OneMain Financial verify income

OneMain Financial may verify income by requesting financial information like bank statements, pay stubs or tax returns. In other cases, they'll just use credit report information. Either way, you will also have to meet other OneMain Financial requirements to be considered for loan approval.

Will OneMain take me to court

You might be wondering, “will One Main Financial sue me” Well, the simple answer is yes. Every lawsuit starts with a Summons and Complaint.

How long does it take to get a 850 credit score

Most people who have an 850 credit score have at least seven years of perfect payment history. Essentially, to get an 850 credit score, you just need to follow one simple strategy: make all of your payments on time for a long time.