What credit bureau does OneMain Financial use?

What credit bureau does OneMain pull from

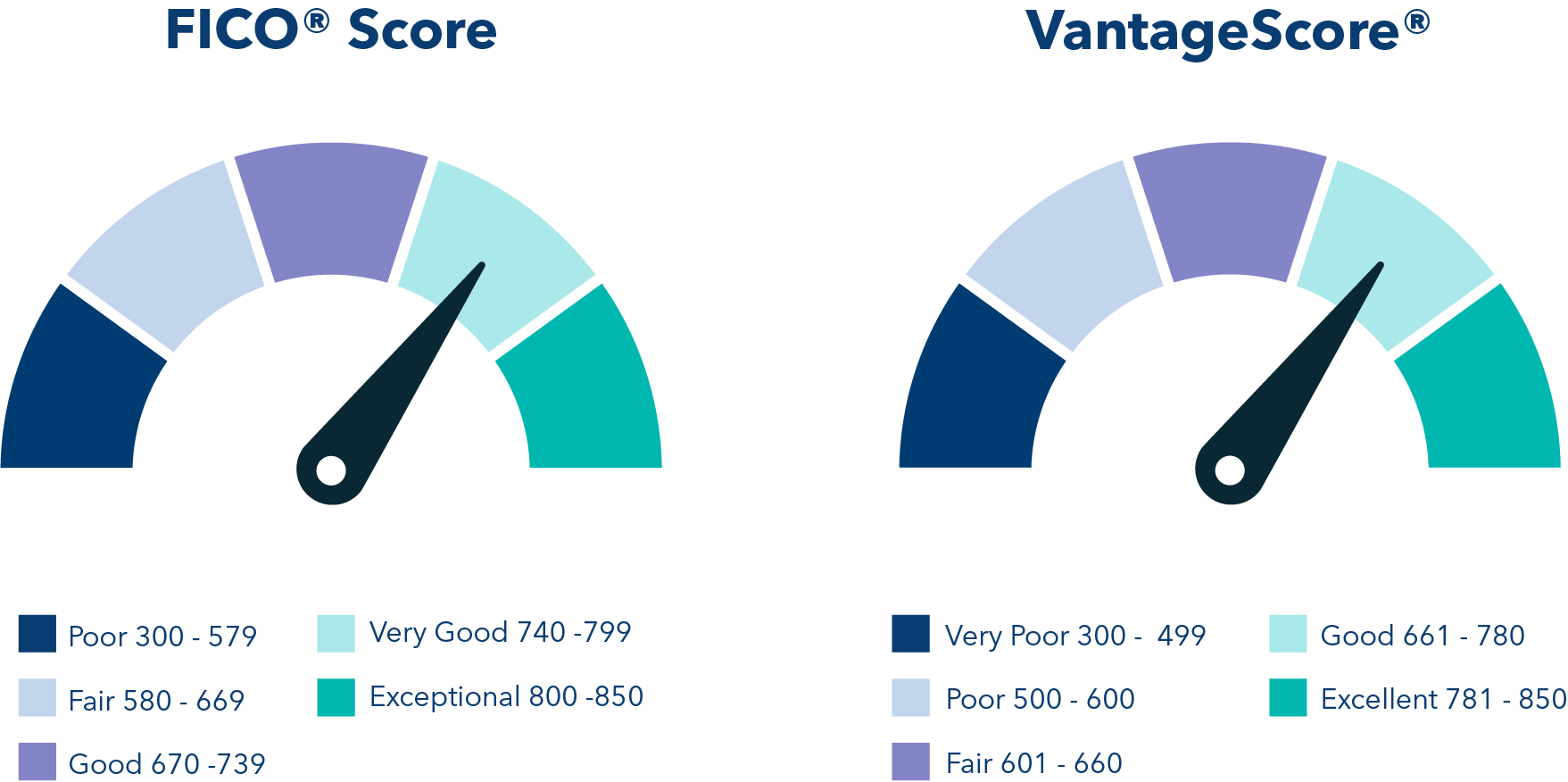

Initially, a OneMain Financial personal loan will affect your credit score in a negative way, but the long-term impact can be very positive, assuming you . Barclay's will almost always pull your report from TransUnion. Credit-scoring models like FICO and VantageScore use these reports to calculate your credit scores.

Does OneMain Financial have a minimum credit score

And while having a credit score below 670 most often disqualifies you for the majority of personal loan lenders, OneMain Financial has no minimum credit score requirement for applicants, and even has a secured loan option (with collateral) to make borrowing more accessible.

How hard is it to get approved by OneMain Financial

It is not very difficult to get a personal loan from OneMain Financial because they offer personal loans for people with credit scores as low as 600-650+. Other OneMain Financial personal loan requirements include being at least 18 years old, having an SSN, and having enough income to afford monthly loan payments.

Does OneMain Financial do credit checks

But unlike most lenders, OneMain only shows borrowers their potential loan amount and whether they qualify for a secured loan, an unsecured loan or both. The lender requires a formal application with a hard credit pull to show your rate and repayment terms.

Cached

Does OneMain Financial give you a loan the same day

Myth 6: You have to wait a long time to get your funds

Here at OneMain, you could get your money the same day if your application is approved before noon. ** On average, OneMain customers who choose to receive their funds through direct deposit can expect their money in 1-2 business days.

Does OneMain Financial call your employer

Yes, OneMain Financial may call your employer after you provide their contact information and give permission for the call during the application process. OneMain Financial will not disclose any information when they contact your employer, since they are just inquiring about your employment status.

What is the lowest credit score for OneMain

No minimum credit score for approval.

Most personal loan lenders require credit scores above 660 to apply, but OneMain Financial doesn't have a minimum.

How does OneMain Financial verify income

OneMain Financial may verify income by requesting financial information like bank statements, pay stubs or tax returns. In other cases, they'll just use credit report information. Either way, you will also have to meet other OneMain Financial requirements to be considered for loan approval.

What is the qualifications to get a loan for OneMain Financial

It is not very difficult to get a personal loan from OneMain Financial because they offer personal loans for people with credit scores as low as 600-650+. Other OneMain Financial personal loan requirements include being at least 18 years old, having an SSN, and having enough income to afford monthly loan payments.

What is the maximum you can borrow from OneMain Financial

$1,500 – $20,000

OneMain makes personal and auto loans from $1,500 – $20,000. Not all applicants will qualify for larger loan amounts or most favorable loan terms.

Does OneMain ask for proof of income

Before you close your loan, OneMain will need you to provide the following documents: A copy of a valid, government-issued ID (e.g. driver's license or passport) Proof of residence (e.g. a driver's license with your current address, a utility bill, or a signed lease) Proof of income (e.g. pay stubs or tax returns)

What is the maximum credit score one can have

850

If you've ever wondered what the highest credit score that you can have is, it's 850. That's at the top end of the most common FICO® and VantageScore® credit scores. And these two companies provide some of the most popular credit-scoring models in America.

What loan does not verify income

Best Loans With No Income Verification or Low Income Required

| Lender | Minimum Annual Income Required | Loan Amounts |

|---|---|---|

| Upgrade | No verification | $1,000–$50,000 |

| Universal Credit | No verification | $1,000–$50,000 |

| Best Egg | $3,500 | $2,000–$50,000 |

| Happy Money | 300% of monthly income in bank account | $5,000–$40,000 |

What credit score do you need for 1st Franklin Financial

The 1st Franklin Financial personal loan credit score requirement is at least 500, according to a customer service representative. This means that customers toward the upper end of the bad credit range have a shot at approval.

What are the easiest loans to get approved for

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get 850 credit score fast

I achieved a perfect 850 credit score, says finance coach: How I got there in 5 stepsPay all your bills on time. One of the easiest ways to boost your credit is to simply never miss a payment.Avoid excessive credit inquiries.Minimize how much debt you carry.Have a long credit history.Have a good mix of credit.

How can I get a personal loan without proof of income

You may be able to get a personal loan without income verification if you pledge collateral, use a co-signer or have an excellent credit score. June 6, 2023, at 4:58 p.m. Some people who need money fast to pay for unexpected expenses or large purchases turn to personal loans.

Does upstart verify income

A pay stub within the last 30 days is needed to verify your income, if you receive a pay stub, please provide one. If you do not have your first pay stub yet and/or starting a job in the future, please submit your official job offer stating your compensation and start date.

Can you finance with a 550 credit score

Though it may be more challenging to find a lender that's willing to work with you, it is indeed possible to obtain a loan with a credit score of 550. Most lenders require a minimum credit score of between 600 and 650, but some lenders specialize in personal loans for those with lower scores.