What credit card can you get at 16?

Can you get a credit card at 16

Getting a credit card before 18

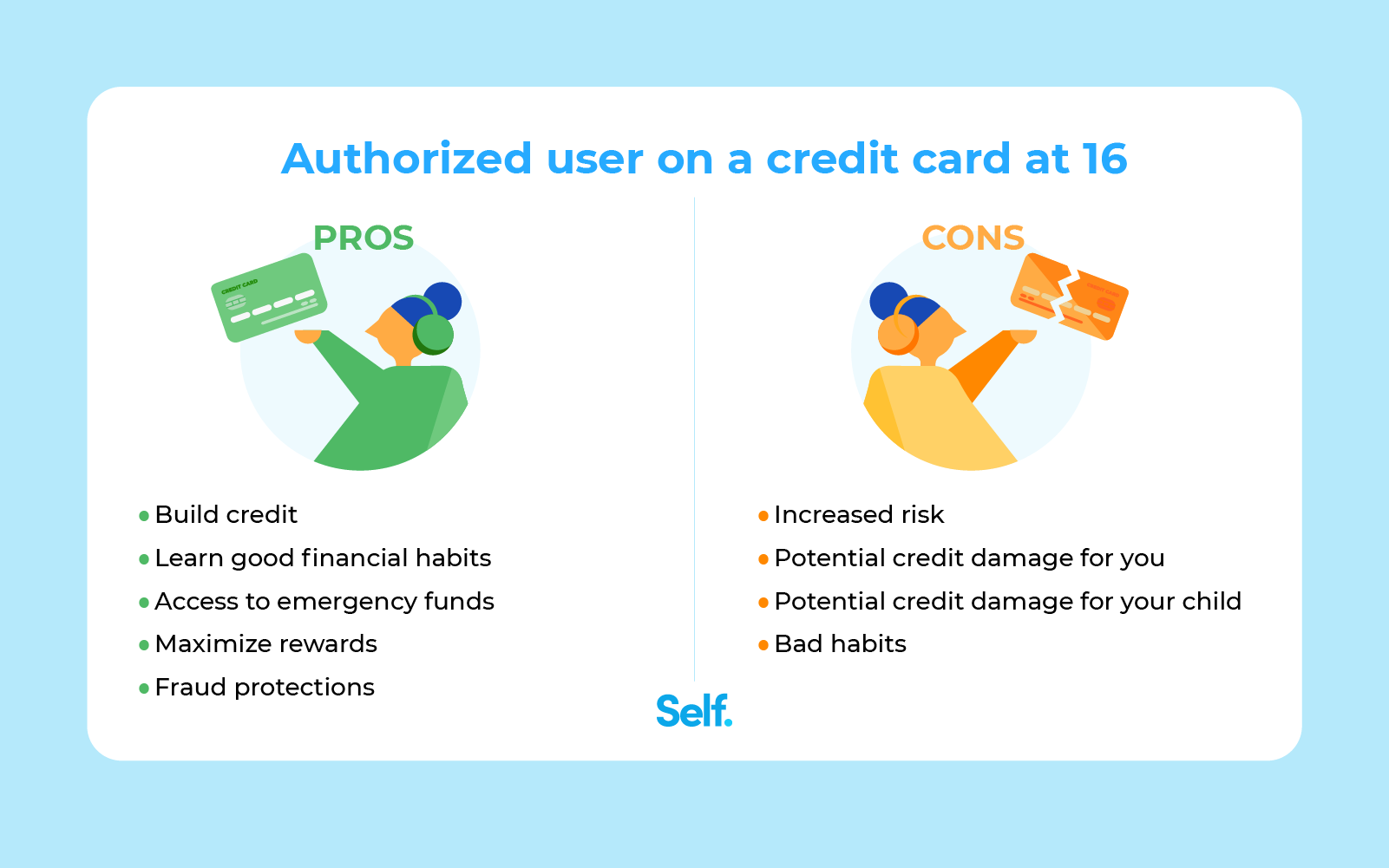

Kids younger than 18 typically can't open their own credit card. But they may be able to access credit in other ways. One is by becoming an authorized user on someone else's credit card account. An authorized user is a person a cardholder has granted access to use their account.

Cached

Can a 16 year old get a credit card in bank America

You can get a credit card at Bank of America if you are at least 18 years old (21 if you're from Puerto Rico), among other requirements. If you're younger, there's no way to apply for a Bank of America credit card, or any other credit card for that matter.

Can a 16 year old have a debit or credit card

Most teen debit cards are designed as mobile-first applications, with the ability to sign up online. If the teen is under 18 years of age, there typically needs to be a joint account holder (parent or guardian) who is at least 18 years old to sign up for an account.

Cached

What is the youngest age to get a credit card

The general rule of thumb is that cardholders must be at least 18 years old. However, if you are under 21 and lack a credit history or have a credit history that's not great, most credit card issuers will require you to show proof of income to verify that you can independently pay your bills.

What is the minimum age to build credit

age 18

Generally, the minimum age at which a child can start building credit is age 18. However, age restrictions can differ by state, product and financial institution. For example, states have different regulations surrounding whether a child under 18 can co-sign on a student loan.

What banks allow minors to have credit cards

Each credit card issuer enforces a specific age limit for authorized users:American Express —13 years old.Bank of America — No minimum age.Capital One — No minimum age.Chase — No minimum age.Citi — No minimum age.Discover — 15 years old.U.S. Bank — 16 years old.Wells Fargo — No minimum age.

How can I build my credit at 16

How to build credit for teensEducate about credit basics.Consider authorized users on your credit card.Open a checking or savings account.Get a job.Pay bills on time.Obtain a secured credit card.Explore student credit cards.Look into a credit-builder loan.

What bank account can I open at 16

At the age of 16, teens can set up their account in the branch without a parent or guardian, as long as they have the correct documentation, such as proof of identity and address.

Can I build my child’s credit

If you're interested in building your child's credit before they turn 18, you can explore adding them as an authorized user to one or more of your credit cards. There is no legal minimum age for adding a child as an authorized user, however you should check your credit card issuer's policies.

How can a 16 year old build a credit score

How to build credit for teensEducate about credit basics.Consider authorized users on your credit card.Open a checking or savings account.Get a job.Pay bills on time.Obtain a secured credit card.Explore student credit cards.Look into a credit-builder loan.

How can I build credit as a minor

How to help your teenager establish creditEducate your teenager on the basics of credit.Check their credit reports.Open checking and savings accounts in your teen's name.Add your teen as an authorized user.Research opening student or secured cards.Lead by example.Discuss the benefits of good credit.

How do I start my child’s credit

8 tips for parents to help their children build good credit earlyStart early.Teach the difference between a debit card and a credit card.Incentivize saving.Help them save early for a secured credit card.Co-sign a loan or a lease.Add your child as an authorized user.Have them report all possible forms of credit.

At what age can a kid get a credit card

18

Kids can't open their own credit card account until they turn 18, and will need to prove independent income until they're 21. But even before then, minors can benefit from becoming authorized users on a family member's credit account.

Can a 16 year old have a 700 credit score

Regardless of your age, those who are initially building their credit score can start from 500 to 700, with those in their 20s having an average score of 660.

Should I start building credit at 16

Building credit for your child will help them establish a positive credit history and empower them to borrow for big purchases later in life. The good news is your child doesn't have to be 18 to start building credit. Get on the path to establishing credit for your child and help them secure a strong financial future.

Can a 16 year old open a bank account without parents chase

To open an account in the branch, students must have a parent or guardian with them. The parent or guardian must have a qualifying checking account. Qualifying accounts exclude Chase High School Checking, Chase College Checking, Chase Secure Checking and Chase First Checking.

Can a 16 year old open a bank account alone

Since minors generally can't open bank accounts by themselves, you'll typically need to be a joint owner of the account, which may actually be a good thing. It'll give you the chance to compare banks and find features that are important to both of you.

What is the youngest age you can start building credit

Generally, the minimum age at which a child can start building credit is age 18. However, age restrictions can differ by state, product and financial institution. For example, states have different regulations surrounding whether a child under 18 can co-sign on a student loan.

At what age can you build credit

Generally, the minimum age at which a child can start building credit is age 18. However, age restrictions can differ by state, product and financial institution. For example, states have different regulations surrounding whether a child under 18 can co-sign on a student loan.

Can a minor build credit

The process of building credit generally begins at age 18, though individual states, products and financial institutions have their own specific rules. Although minors typically don't have credit reports, parents can take certain actions to help children under 18 build good credit once they are of age.