What credit limit can I get with 750?

How much of a 750 credit limit should I use

NerdWallet suggests using no more than 30% of your limits, and less is better. Charging too much on your cards, especially if you max them out, is associated with being a higher credit risk.

What will a 750 credit score get me

A 750 credit score generally falls into the “excellent” range, which shows lenders that you're a very dependable borrower. People with credit scores within this range tend to qualify for loans and secure the best mortgage rates. A 750 credit score could help you: Qualify for a mortgage.

What credit limit can I get with 720

A credit score of 720 means that you should be able to qualify for most loans and credit cards. You may not get the best interest rates, but you should still be able to get a loan with a reasonable interest rate. You can borrow up to $100,000 with a 720 credit score.

What credit limit can I get with a 760 credit score

How much can I borrow with a 760 credit score

| Lender | Loan Amounts | APRs |

|---|---|---|

| LightStream | $5,000 – $100,000 | 7.99% – 25.99% |

| SoFi | $5,000 – $100,000 | 8.99% – 25.81% |

| Wells Fargo | $3,000 – $100,000 | 7.49% – 23.74% |

| USAA | $2,500 – $100,000 | 7.24% – 17.65% |

What is 30 of 2000 credit limit

According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.

What is a normal credit limit to have

A good credit limit is above $30,000, as that is the average credit card limit, according to Experian. To get a credit limit this high, you typically need an excellent credit score, a high income and little to no existing debt.

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2023, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.

Can I buy a car with a 750 credit score

750 is a good credit score that can get you car loans with equally as good rates. They aren't the best, but they are still in the top five. More specifically, you would be able to qualify for apr rates of anywhere from 3% to 6% for a new car loan and 5% to 9% for a used car loan.

What is a normal credit card limit

What is considered a “normal” credit limit among most Americans The average American had access to $30,233 in credit across all of their credit cards in 2023, according to Experian. But the average credit card balance was $5,221 — well below the average credit limit.

How to build credit past 720

How to Improve a 720 Credit ScoreDispute Inaccurate Entries on Your Credit Report.Pay Off Collections Accounts.Reduce Your Credit Utilization.Pay All Your Bills On Time.Check Out Your Personalized Credit Analysis on WalletHub.

What will a 760 credit score get me

At 760, consumers will likely qualify for the same top credit cards, loans and interest rates than they would with any score higher. “The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select.

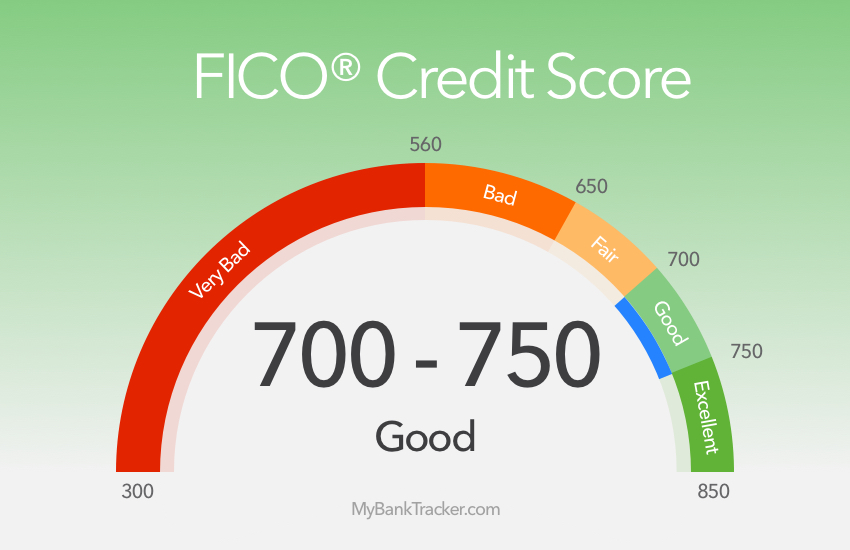

How good is a 750 credit score

Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 750 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders' better interest rates and product offers.

What is 30 percent of $500 credit limit

Answer: 30% of 500 is 150.

= 150.

What is minimum credit limit $500

A minimum credit limit is the lowest amount of credit available for a specific card. Standard personal credit card limits usually start at $500. A maximum credit limit is the most you could charge to a credit card, and it usually goes up to $15,000. However, some cards have no limit or set the limit high at $100,000.

What is the lowest credit limit

Your first credit limit may be as low as $100 if your first credit card is from a retail store, but you might be approved for a slightly larger credit limit up to $500 if your first credit card is issued by a bank or credit card company.

What is a minimum credit limit

A minimum credit limit is the lowest amount of credit available for a specific card. Standard personal credit card limits usually start at $500. A maximum credit limit is the most you could charge to a credit card, and it usually goes up to $15,000. However, some cards have no limit or set the limit high at $100,000.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

How to increase credit score from 750 to 900

It's not as difficult as you might think, although it does require you to take smart steps to improve your credit, including:Pay Your Bills on Time, Every Time.Keep Your Credit Card Balances Low.Be Mindful of Your Credit History.Improve Your Credit Mix.Review Your Credit Reports.

Can I get a 30k car loan 750 credit score

It is possible to qualify for a car loan with any credit score, although the lower your credit score, the higher the interest rate you can expect to pay.

What is the minimum credit limit

The meaning of minimum credit limit is the least amount of credit that the bank will offer you on application. The maximum limit is the most that the lender will offer you to borrow.