What credit score do I need for the surge card?

What score do you need for a surge credit card

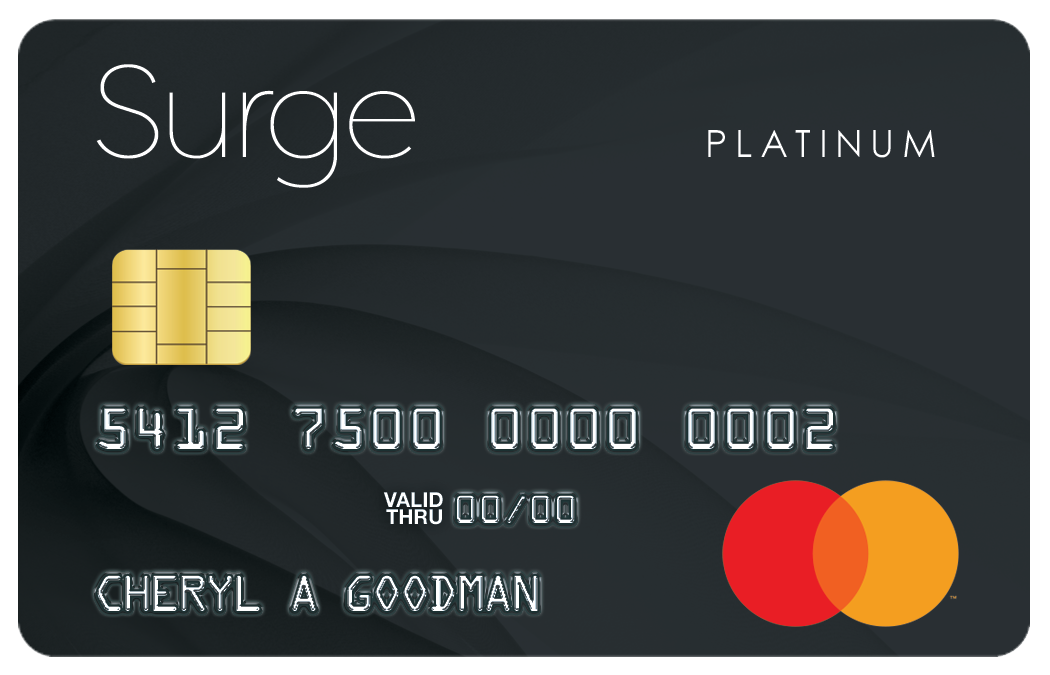

The Surge® Platinum Mastercard® is for consumers who don't have perfect credit. It requires a minimum credit score of 500. This is a poor FICO score, good enough for only a handful of unsecured credit cards. If your score is below 500, consider a secured card instead.

Cached

How easy is it to get a surge card

The main Surge Credit Card approval requirements are that an applicant must be at least 18 years old with a valid Social Security number or Individual Taxpayer Identification number. Applicants must also have a physical U.S. address, enough income to make monthly minimum payments.

Cached

What is the initial credit limit for the surge Mastercard

$300 to $1,000

The initial credit limit for the Surge Mastercard ranges from $300 to $1,000. After six months of on-time payments, you can double your credit limit.

Cached

Does surge do a hard credit pull

For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company. Yes, the Surge Credit Card does a hard pull on your credit.

Can I get a credit card with a score of 511

Credit Cards with a 511 Credit Score

The best type of credit card for a 511 credit score is a secured credit card. Secured cards give people with bad credit high approval odds and have low fees because cardholders are required to place a refundable security deposit.

Can you get a credit card with a score of 594

Obtaining a credit card with a credit score of 594 is manageable, but there is a big risk that the lender will charge you a high-interest rate and that other banks will deny your application.

How do I know if I got approved for a surge credit card

You can check your Surge Credit Card application status by calling the issuer's customer service department at (866) 449-4514. However, in most cases, you can expect a decision almost immediately on the application page, with a letter to follow within a few days.

How long does it take to get a surge card after approval

After you apply for credit and are approved it is a very fast process to get your brand new credit card. If you're approved, your new Surge credit card and welcome materials containing important Surge card info will be mailed within (3) business days.

What is Capital One minimum credit limit

$300

The minimum credit limit is $300, and the average cardholder may achieve a typical credit limit of $2,000. If you have good credit (not this card's prime audience), your credit line may reach $5,000.

What is a starter credit limit

Generally, first-time credit card applicants receive small credit limits. A credit limit of $500 to $1,000 is average for a first credit card, but it may be higher if you have, say, a history of on-time car payments on your credit file.

Does surge credit card help build credit

Your Surge credit card account can help you rebuild or improve your credit score when you make your payments on-time and you keep your balance under your credit limit.

How many points does a hard pull take off your credit

five points

How does a hard inquiry affect credit While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®. And if you have a good credit history, the impact may be even less.

Can I get a Walmart credit card with a 520 credit score

The Walmart Credit Card credit score requirement is 640 or higher, which means people with fair credit or better have a shot at getting approved for this card. The Walmart® Store Card also requires at least fair credit for approval.

Can you get approved with a 500 credit score

It is 200 points away from being a “good” credit score, which many people use as a benchmark, and 140 points from being “fair.” A 500 credit score won't knock any lenders' socks off, but it shouldn't completely prevent you from being approved for a credit card or loan, either.

Can I get a credit card with a 552 credit score

With an 552 credit score, you're unlikely to get approved for a traditional credit card. Credit cards are unsecured forms of debt, so banks tend to be a bit more cautious compared to loans backed by specific assets, like mortgages and auto loans.

What credit bureau does Surge Mastercard pull from

It's an option for those who have difficulty getting approved for an unsecured credit card and don't want to give a security deposit — as secured credit cards require. As you use the Surge Platinum credit card, the issuer will report your usage to all three major credit bureaus — TransUnion, Experian and Equifax.

How long does it take to get a surge credit card once approved

After you apply for credit and are approved it is a very fast process to get your brand new credit card. If you're approved, your new Surge credit card and welcome materials containing important Surge card info will be mailed within (3) business days.

How do you tell if you will get approved for a credit card

Your credit score is the biggest single factor in whether you'll be approved. If your credit score is high, you should qualify for a relatively low-interest rate and better perks. If your credit score is low, you'll qualify only for a higher-interest card.

What is the highest credit limit for Capital One Walmart card

Credit limits for a Walmart credit card can range from $150 to over $5,000. Several factors go into determining your credit limit, including your annual income and credit history. Where can I use a Walmart credit card The Capital One® Walmart Rewards™ Mastercard® can be used anywhere Mastercard is accepted.

What is the Quicksilver card limit

What is the Capital One Quicksilver credit limit The Capital One Quicksilver credit limit depends on your income, creditworthiness and payment history. According to anecdotal reports, the card's credit limit can be as low as $750 and as high as $10,000.