What credit score do insurance companies use?

Do insurance companies use credit score

Although some insurance companies still look at your actual credit report, most insurance companies using credit information are using a “credit score.” A credit score is a snapshot of your credit at one point in time.

CachedSimilar

What is the best credit score for insurance

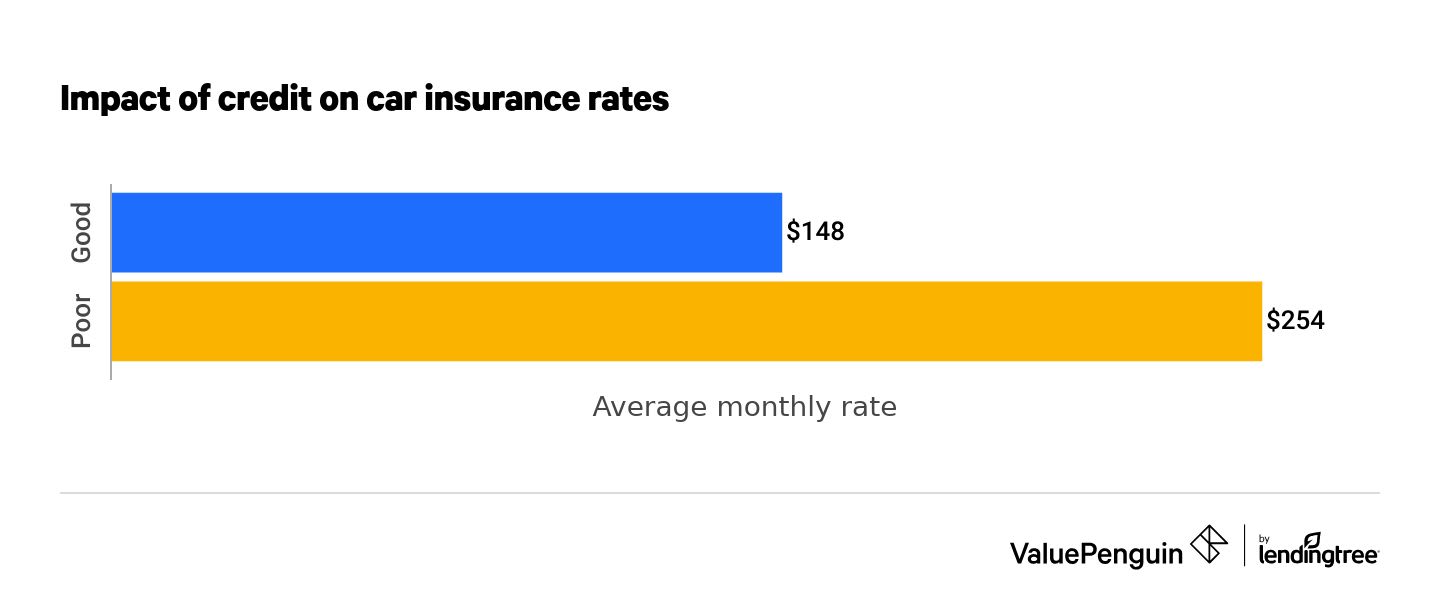

What, then, is a good credit score to get a car insurance policy with competitive prices A score in the “good” range — between 670 and 739, according to the FICO scoring model — is generally considered to be the baseline for competitive pricing.

How is a insurance credit score determined

Generally, five different factors are used to determine your credit-based insurance score: payment history, outstanding debt, credit history length, pursuit of new credit and credit mix.

CachedSimilar

What is the insurance credit score scale

What is a good insurance score

| Score range | Rating |

|---|---|

| 776 – 977 | Good |

| 626 – 775 | Average |

| 501 – 625 | Below average |

| 200 – 500 | Poor |

Nov 29, 2023

Cached

Do insurance companies do hard credit checks

It is true that insurance companies check your credit score when giving you a quote. However, what they're doing is called a 'soft pull' — a type of inquiry that won't affect your credit score. You'll be able to see these inquiries on your personal credit reports, but that's it.

Does Allstate use credit scores

It's important to understand that while Allstate uses certain elements from your credit history, we never see your credit score, and we're not evaluating your overall credit worthiness. We simply use elements from your credit report that have proven effective in predicting insurance losses.

Does insurance do a hard credit pull

Does getting insurance quotes affect your credit score No, there is no hard credit pull when you get a car insurance quote, so shopping around won't affect your credit score. A hard credit pull generally happens when you apply for credit, such as a mortgage or credit card.

Can you be turned down for insurance because of your credit score

In some cases, your credit won't be used to determine your insurance premium. If you live in California, Hawaii, Massachusetts or Michigan your credit score isn't a rating factor.

What is a good LexisNexis score

Here is an example of scores and rankings from the LexisNexis website: Good: 776-997. Average: 626-775. Below average: 501-625.

Does it hurt your credit score to get insurance quotes

It is true that insurance companies check your credit score when giving you a quote. However, what they're doing is called a 'soft pull' — a type of inquiry that won't affect your credit score. You'll be able to see these inquiries on your personal credit reports, but that's it.

What is level 1 credit score

Tier 1 credit is generally defined as a credit score of 750 or higher. The term is most commonly used among auto lenders, but other lenders use it as well. People with tier 1 credit have the highest level of creditworthiness and will usually receive the most favorable terms on loans and lines of credit.

Do car insurance companies do a hard or soft credit check

Insurance quotes do not affect credit scores. Even though insurance companies check your credit during the quote process, they use a type of inquiry called a soft pull that does not show up to lenders. You can get as many inquiries as you want without negative consequences to your credit score.

Is the insurance credit check soft or hard

It is true that insurance companies check your credit score when giving you a quote. However, what they're doing is called a 'soft pull' — a type of inquiry that won't affect your credit score. You'll be able to see these inquiries on your personal credit reports, but that's it.

Does Progressive look at credit scores

California, Hawaii, Massachusetts, Michigan, and Washington do not allow the use of credit scores to determine car insurance rates whatsoever. So, your credit score will not affect your rates with Progressive in these states.

What credit bureau does Allstate use

Here at Allstate Identity Protection, we partner with TransUnion to provide our credit monitoring service, so we reached out to the agency to learn more.

What score do you need with Experian to be fair

580 to 669

Fair credit scores are scores that fall within a certain range—580 to 669 for FICO® Scores and 601 to 660 for VantageScore credit scores. The fair range is above poor credit but below good credit, and it aligns with the subprime score range.

What is a fair Transunion score

661 – 720

Understanding credit score ranges

A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. Some people want to achieve a score of 850, the highest credit score possible.

Is 600 a good first credit score

Your score falls within the range of scores, from 580 to 669, considered Fair. A 600 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

How different is Credit Karma score to FICO

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

Does insurance run a hard credit check

It is true that insurance companies check your credit score when giving you a quote. However, what they're doing is called a 'soft pull' — a type of inquiry that won't affect your credit score. You'll be able to see these inquiries on your personal credit reports, but that's it.