What credit score do Navy Federal use?

What FICO score does Navy Federal use

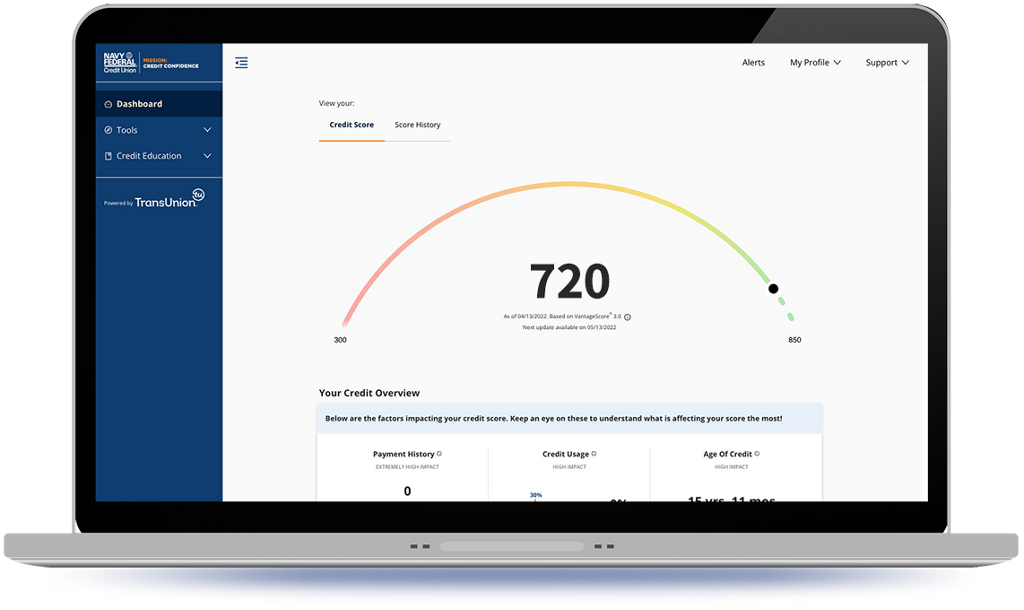

Navy Federal normally uses TransUnion for credit card applications. However, they may pull an inquiry from any of the three major credit bureaus (Equifax, TransUnion, and Experian) when evaluating a credit card application.

Cached

What is a good internal credit score for Navy Federal

Lenders decide their own credit score requirements. However, scores under 580 are generally considered to be poor, while “good credit” is usually anything over 670. A score over 800 is excellent.

Is Navy Federal based on credit

All other Navy Federal Credit Card rates range from 10.74% APR to 18.00% APR, are based on product type and creditworthiness, and will vary with the market based on the U.S. Prime Rate.

What credit score do you need for a platinum Navy Federal card

a 700 or greater

Usually a 700 or greater credit score is needed for the Navy Federal Platinum Card. However, if you have other accounts with Navy Fed you may be able to open up an account with a lower credit score.

Cached

Does Navy Federal check Equifax

Navy Federal is known to use credit scores from the three top credit bureaus: Equifax, TransUnion and Experian.

What is Navy Federal highest credit card limit

The Navy Federal Platinum Credit Card credit limit is between $500 and $50,000.

Can I get a Navy Federal credit card with a 650 credit score

The Navy Federal credit card approval requirements include a credit score of at least 700 (good credit), in most cases. Other Navy Federal credit cards require a credit score of 750+ (excellent credit).

What is Navy Federal minimum credit limit

$500

The starting credit limit for the Navy Federal Credit Union cashRewards Credit Card is at least $500. This is the guaranteed limit for everyone approved for the card. Chances are, you could receive a higher limit if your credit score and income are good enough for you to qualify.

Can I get a Navy Federal credit card with bad credit

Other Navy Federal credit cards require a credit score of 750+ (excellent credit). However, Navy Federal also offers options for people with bad credit. You also have to be an NFCU member to apply for one of their credit cards. In addition, the issuer will also verify your credit history and ability to pay.

Which Navy Federal card is the easiest to get approved for

The easiest Navy Federal credit card to get is the Navy Federal Credit Union nRewards® Secured Credit Card because you can get approved with Bad credit. The Navy Federal nRewards Secured Card requires a refundable deposit (minimum of $200), and the deposit becomes your credit limit.

Does Navy Federal use Equifax or TransUnion

Navy Federal is known to use credit scores from the three top credit bureaus: Equifax, TransUnion and Experian.

Can you get denied at Navy Federal Credit Union

A personal loan from Navy Federal Credit Union is not hard to qualify for if you have enough income to afford the loan, and a valid bank account. Approval by Navy Federal Credit Union is never guaranteed, though, even if you meet all the requirements.

How to get Navy Federal 25k credit limit

Rules for asking for a NFCU CLIAlways ask for your credit limit to be increased to $25,000.You need to wait a minimum of three months before applying for a credit limit increase.You should also wait a minimum of 180 days in between applying for increases.

What is the highest Navy Federal credit limit

The Navy Federal Platinum Credit Card credit limit is between $500 and $50,000.

Is Navy Federal credit card a hard pull

Does Navy Federal Conduct a Hard Pull for Membership Navy Federal does not carry out a hard credit pull when you apply for membership. However, you may expect a hard pull if you apply for any form of credit, be it a credit card, a personal loan, an auto loan or a mortgage.

Can I get approved for a Navy Federal credit card with bad credit

The easiest Navy Federal credit card to get is the Navy Federal Credit Union nRewards® Secured Credit Card because you can get approved with Bad credit. The Navy Federal nRewards Secured Card requires a refundable deposit (minimum of $200), and the deposit becomes your credit limit.

What credit score do you need for a Navy Federal personal loan

NFCU does not have a minimum credit score requirement; however, borrowers with higher credit scores have a better chance of qualifying and receiving favorable terms. We recommend a minimum score of 670.

Is it hard to get approved for Navy Federal

It's relatively hard to qualify for Navy Federal membership. You're only eligible if you are active military member, veteran, employee or retiree of the Department of Defense, or family member of someone in one of those groups.

Is it easy to get approved with Navy Federal

A personal loan from Navy Federal Credit Union is not hard to qualify for if you have enough income to afford the loan, and a valid bank account. Approval by Navy Federal Credit Union is never guaranteed, though, even if you meet all the requirements.

What is the max credit limit with Navy Federal

Editorial and user-generated content is not provided, reviewed or endorsed by any company. The Navy Federal Platinum Credit Card credit limit is between $500 and $50,000.