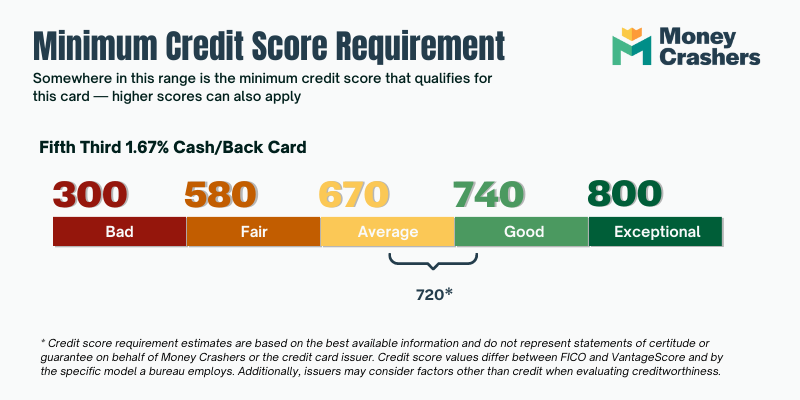

What credit score do you need for a Fifth Third card?

Can I get approved for a credit card with 530 credit score

It is 170 points away from being a “good” credit score, which many people use as a benchmark, and 110 points from being “fair.” A 530 credit score won't knock any lenders' socks off, but it shouldn't completely prevent you from being approved for a credit card or loan, either.

What is the credit rating of Fifth Third Bank

Deposit and Debt Ratings

| Moody's | Standard & Poor's | |

|---|---|---|

| Short-Term | P-2 | A-2 |

| Short-Term Deposit | P-1 | No rating |

| Long-Term Deposit | A1 | A-# |

| Senior Debt | A3 | A- |

Which credit bureau does Fifth Third use

Yes, Fifth Third Bank Personal Line of Credit reports your account activity to the following credit reporting agencies: Equifax. Experian. Transunion.

What is the minimum credit score to get a credit card

There is no minimum credit score needed for a credit card. Even borrowers with poor credit (a score of 300) or no credit card at all can qualify for some credit cards. However, options for bad-credit borrowers are limited and usually come with a high annual percentage rate (APR) and fees.

What credit card can I get with a 592 score

Popular Credit Cards for a 592 Credit ScoreBest Overall: Discover it® Secured Credit Card.No Credit Check: OpenSky® Secured Visa® Credit Card.Unsecured: Credit One Bank® Platinum Visa® for Rebuilding Credit.Rewards & No Annual Fee: Capital One Quicksilver Secured Cash Rewards Credit Card.

What credit card can I get with a 550 to 600 credit score

Capital One Platinum Secured Credit Card

The is an excellent secured credit card for people with 550-600 credit scores largely because of its low minimum opening security deposit. A $49 security deposit will instantly grant a $200 credit line.

Does Fifth Third Bank have a line of credit

Whether your needs are large or small, we offer personal loan and line of credit options with fast and easy access to money for what matters to you.

What is the minimum amount to open an account with Fifth Third Bank

No minimum deposit required to open a checking or savings account. Account must be funded within 45 days of opening.

What banks pull from Equifax only

PenFed Credit Union is the only loan company that uses only your Equifax credit data. In most cases, you won't be able to determine beforehand which credit bureaus your lender will use. In some cases, lenders will pull your credit report from two or even all three major credit bureaus.

What type of card is Fifth Third Bank

Mastercard® Debit Card Benefits:

Accepted at millions of locations worldwide. Easily track purchases with our Mobile App or Online Banking. Get cash at more than 40,000 fee-free ATMs.

Can I get a credit card with a 520 credit score

It is 180 points away from being a “good” credit score, which many people use as a benchmark, and 120 points from being “fair.” A 520 credit score won't knock any lenders' socks off, but it shouldn't completely prevent you from being approved for a credit card or loan, either.

What can I get with a 580 credit score

What Does a 580 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Unsecured Credit Card | YES |

| Home Loan | YES (FHA Loan) |

| Personal Loan | MAYBE |

| Auto Loan | MAYBE |

What credit card can I get with a 588 score

Popular Credit Cards for a 588 Credit ScoreBest Overall: Discover it® Secured Credit Card.No Credit Check: OpenSky® Secured Visa® Credit Card.Unsecured: Credit One Bank® Platinum Visa® for Rebuilding Credit.Rewards & No Annual Fee: Capital One Quicksilver Secured Cash Rewards Credit Card.

What credit cards can I get with a 602 credit score

Credit cards you can get with a 600 credit scoreUpgrade Cash Rewards Visa®: Fair to good (580–740)Capital One QuicksilverOne Cash Rewards Credit Card: Fair to good (580-740)Mission Lane Cash Back Visa Credit Card: Fair to good (580-740)Capital One Platinum Credit Card: Fair to good (580-740)

What credit card can I get with a 512 score

Popular Credit Cards for a 512 Credit ScoreBest Overall: Discover it® Secured Credit Card.No Credit Check: OpenSky® Secured Visa® Credit Card.Unsecured: Credit One Bank® Platinum Visa® for Rebuilding Credit.Rewards & No Annual Fee: Capital One Quicksilver Secured Cash Rewards Credit Card.

What store card can I get with a 620 credit score

The best store credit card you can get with a 620 credit score is the Amazon.com Secured Credit Card, which has a $0 annual fee and offers 2% cash back on Amazon purchases if you are a Prime member. It requires a minimum security deposit of $100, making it easier to get with bad credit.

What credit score do you need for line of credit

Personal lines of credit are typically reserved for consumers with a good credit score, which is 670 or higher using the FICO scoring model. Since personal lines of credit aren't secured by an asset like your car or a house, your credit is weighed as your ability to repay what you borrowed.

What is the minimum credit limit on a line of credit

The minimum credit limit is often between $1,000 and $2,000, while some cards have a maximum of up to $100,000. However, not every credit card has a maximum.

Does 5 3 require a deposit to open an account

There is no monthly service charge, no minimum deposit needed to open an account, and no minimum balance required. If you let your account sit for a period of 12 months without any deposits or withdrawals, you may be charged a $5 dormant account monthly fee. Learn more.

Does Fifth Third have a spending limit

Daily limits are assigned for your protection. To find more information on your daily limit or to lower your specific limit, please contact Customer Service at 800-972-3030 or visit your local Fifth Third Banking Center. The standard daily purchase and cash limits are printed on the materials that come with the Card.