What credit score do you need for a TJ Maxx card?

Is it hard to get a TJ Maxx credit card

Yes, the TJX Store Card will do a hard pull. You will need a credit score of at least 640 to get it, which is on par with what most store cards require. There is no way to pre-qualify for the TJX Store Card.

Cached

What is the starting limit on a TJ Maxx credit card

T.J. Maxx credit cards often have low credit limits, and many cardholders start with a credit limit of $200.

Cached

What credit report does TJ Maxx pull

The TJX Store Card mainly uses TransUnion for approval. That doesn't mean it won't use Experian or Equifax, or all of them when doing a hard pull on your credit report. But don't worry about the randomness of it. If you're using your credit responsibly, all of these reports should reflect that.

What credit score do you need for Marshalls card

620 or above

What credit score is needed for a Marshalls Credit Card You'll need a credit score of 620 or above to qualify for a TJX Rewards credit card.

Cached

Can I get a TJ Maxx credit card with bad credit

You need fair credit to get approved for the TJX credit card, which means a credit score of 620 or above.

Can I use my TJ Maxx credit card at Walmart

It can be used anywhere Mastercard is accepted, but if you don't frequently shop under the TJX brand umbrella, you'll rack up rewards slowly and may find redemptions limiting. There's also a store-only version of this card. It offers some of the same perks, but can be used only at T.J. Maxx and its family of stores.

What is a beginner credit limit

Generally, first-time credit card applicants receive small credit limits. A credit limit of $500 to $1,000 is average for a first credit card, but it may be higher if you have, say, a history of on-time car payments on your credit file.

How much should I spend on my credit card if my limit is $2000

What is a good credit utilization ratio According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.

What is the minimum credit score for Synchrony Bank

What's the Synchrony Bank credit card credit score requirement It depends on the credit card you are interested in. Most credit cards offered by Synchrony Bank are designed for people with fair (640 – 699), good (700 – 749) or excellent (750 – 850) credit.

What FICO score does Synchrony Bank use

Find out your score and how to improve it when you enroll in Synchrony's® free credit score program with VantageScore®. VantageScore® is a top credit scoring model used by many lenders when they consider whether or not to approve applications and decide what rates and terms to offer.

What credit score do you need for a amazon card

Typically, you can qualify for Synchrony's Amazon store cards with a fair credit score (580 to 669). On the other hand, you'll likely need at least a good credit score (670 to 739) to qualify for one of the Amazon Visa cards from Chase.

What is the Maxx credit score

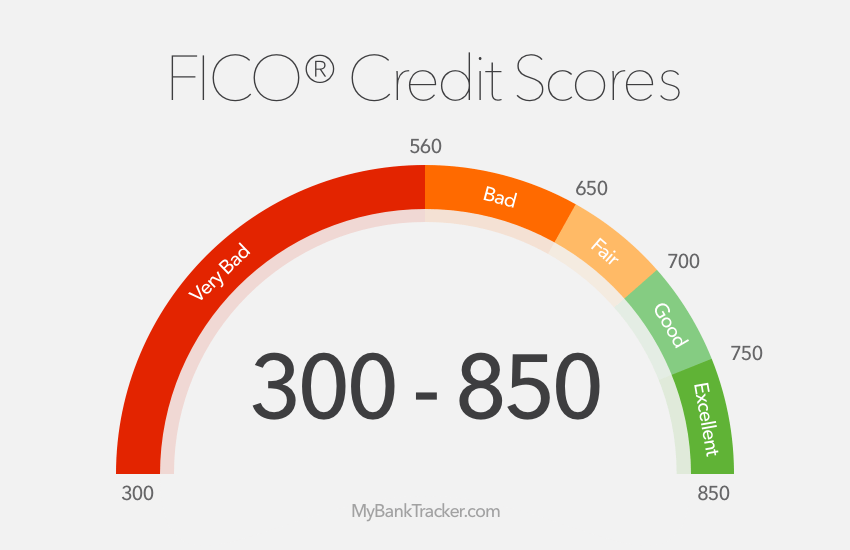

What Is a Good FICO® Score The base FICO® Scores range from 300 to 850, and a good credit score is between 670 and 739 within that range. FICO creates different types of consumer credit scores.

Does TJ Maxx do a credit check

You will have to undergo a hard credit inquiry to apply for a T.J. Maxx credit card. Your Social Security number is used when the credit check is performed so that your credit file can be obtained.

Does TJ Maxx credit card build credit

High interest rates on a TJ Maxx card

Like most store cards, the TJ Maxx credit card comes with a high interest rate. Using the card wisely can help establish credit history and prevent the likelihood of having to pay an astronomical final price.

Can I use my TJ Maxx card at Target

Must be used at T.J. Maxx stores (and related brands) One drawback of just about any store credit card is that you can often only use it to make purchases with that one brand.

How can I build my credit with a $500 credit card

5 steps to build credit with a credit cardPay on time, every time (35% of your FICO score) Paying on time is the most important factor in building good credit.Keep your utilization low (30% of your FICO score)Limit new credit applications (15% of your FICO score)Use your card regularly.Increase your credit limit.

What is the best minimum credit score

Lenders generally see those with credit scores 670 and up as acceptable or lower-risk borrowers. Those with credit scores from 580 to 669 are generally seen as “subprime borrowers,” meaning they may find it more difficult to qualify for better loan terms.

What’s the minimum payment on a $5000 credit card

The minimum payment on a $5,000 credit card balance is at least $50, plus any fees, interest, and past-due amounts, if applicable. If you were late making a payment for the previous billing period, the credit card company may also add a late fee on top of your standard minimum payment.

How much should you use if your credit limit is 500

You should aim to use no more than 30% of your credit limit at any given time. Allowing your credit utilization ratio to rise above this may result in a temporary dip in your score.

What credit score do I need for an Amazon card

Typically, you can qualify for Synchrony's Amazon store cards with a fair credit score (580 to 669). On the other hand, you'll likely need at least a good credit score (670 to 739) to qualify for one of the Amazon Visa cards from Chase.