What credit score do you need for payoff?

What credit score do you need for a payoff loan

Payoff offers a personal loan for fair credit borrowers. Payoff requires a FICO score of 640 or higher and a debt-to-income ratio of 50% or less. Borrowers must also be able to demonstrate at least three years of good credit with no delinquencies.

Does payoff hurt your credit score

Paying off your only line of installment credit reduces your credit mix and may ultimately decrease your credit scores. Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop.

Cached

Why did my credit score drop 40 points after paying off debt

Paying off debt can lower your credit score when: It changes your credit utilization ratio. It lowers average credit account age. You have fewer kinds of credit accounts.

How many points will my credit score increase when I pay off credit cards

If you're already close to maxing out your credit cards, your credit score could jump 10 points or more when you pay off credit card balances completely. If you haven't used most of your available credit, you might only gain a few points when you pay off credit card debt.

Cached

Does payoff do hard credit pulls

For added security, we do a hard inquiry right before your Payoff Loan is finalized to check for new unsecured personal loans as well as bankruptcies and delinquencies. A hard inquiry may impact your credit score, but the good news is Happy Money Members see an average increase of 40 points † to their credit score.

Is payoff a good idea

Payoff is legit and may be worthwhile

In some cases, it can be helpful, but only if the loan's APR, which can range from 5.99% to 24.99%, is lower than the credit cards you intend to pay off. Also, it's only beneficial if you can afford the monthly payment.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Does paying off collections improve credit score

And if you have multiple debt collections on your credit report, paying off a single collections account may not significantly raise your credit scores. But if you have a recent debt collection and it's the only negative item on your credit report, paying it off could have a positive effect on your score.

How can I raise my credit score 50 points fast

Here are some strategies to quickly improve your credit:Pay credit card balances strategically.Ask for higher credit limits.Become an authorized user.Pay bills on time.Dispute credit report errors.Deal with collections accounts.Use a secured credit card.Get credit for rent and utility payments.

Will banks negotiate a payoff

Contrary to conventional wisdom, lenders are often willing to negotiate with customers who want to lower their interest rates, develop payment plans or pursue other arrangements to better manage their debt.

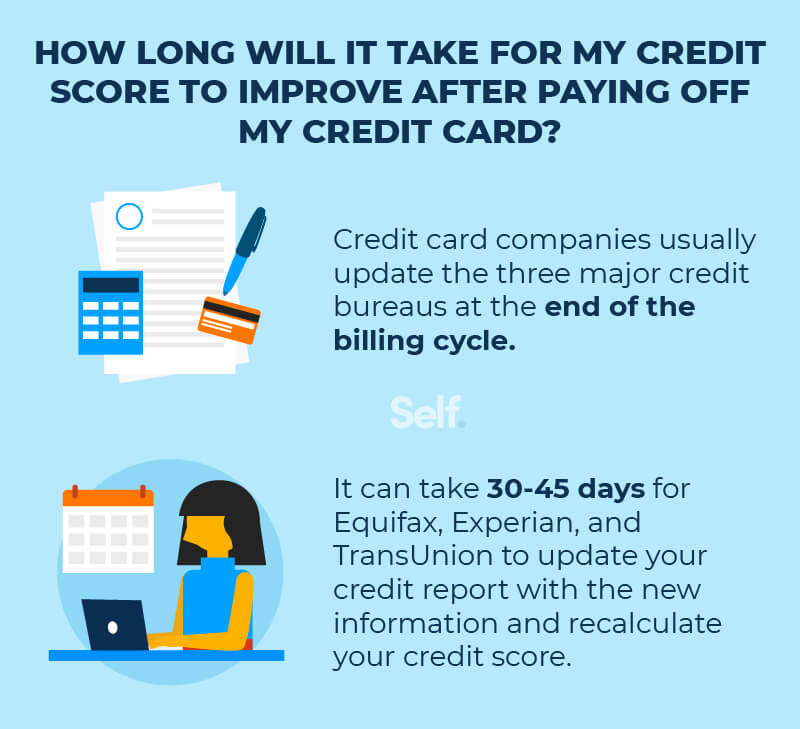

How long does a payoff take to hit your credit

How long does it take for my credit score to update after paying off debt It can often take as long as one to two months for debt payment information to be reflected on your credit score. This has to do with both the timing of credit card and loan billing cycles and the monthly reporting process followed by lenders.

Does payoff require proof of income

Proof of income (e.g. 2 recent pay stubs) Financial documentation (your last monthly bank statement or mortgage statement)

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

Should I pay off a 2 year old collection

Any action on your credit report can negatively impact your credit score, even paying back loans. If you have an outstanding loan that's a year or two old, it's better for your credit report to avoid paying it.

Will collections be removed if paid off

Once you've paid off an account in collections, it will eventually fall off your credit report. If you'd like to expedite the process, you can request a goodwill removal. Removing a paid collection account is up to the discretion of your original creditor, who doesn't have to agree to your request.

Can I raise my credit score 100 points in 30 days

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why did my credit score drop 30 points after paying off a car

Lenders like to see a mix of both installment loans and revolving credit on your credit portfolio. So if you pay off a car loan and don't have any other installment loans, you might actually see that your credit score dropped because you now have only revolving debt.

What documents does payoff require

The exact ones depend on the individual, but will generally include:Proof of identification (e.g. a driver's license or passport)Proof of income (e.g. 2 recent pay stubs)Financial documentation (your last monthly bank statement or mortgage statement)