What credit score do you need to be approved on Carvana?

Is it hard to get approved for Carvana

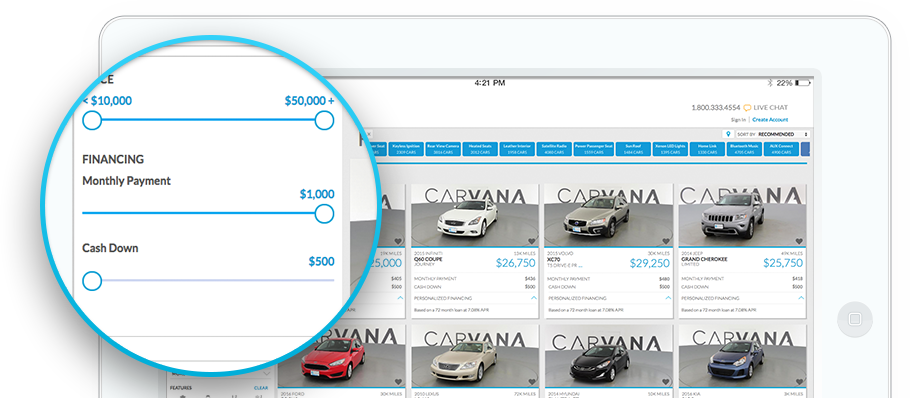

99% of customers who apply get approved and your terms are good for 45 days. There's no impact to your credit and you can see your actual down payment and monthly payment on all vehicles in our inventory.

Cached

What’s the minimum credit score for Carvana

Carvana has no minimum credit score or credit history requirements and says it extends credit to customers with a broad range of credit profiles. This includes car buyers with bad credit — typically FICO scores below 630 — who may have trouble getting loans from traditional dealerships and lenders.

Cached

Can you get denied on Carvana

Carvana considers working with consumers regardless of their credit history — although there are age and income minimums. Because it doesn't require people to have minimum credit scores for a car loan, you might qualify for a Carvana loan even if you have low credit scores.

Cached

How does Carvana qualify you

As long as you are 18 years or older†, make at least $4k per year, and have no active bankruptcies, you can finance your purchase through Carvana. To get started, you can fill out the financing application here. Don't worry, filling out the application will not impact your credit!

How does Carvana verify income

You can upload your 2 most recent, consecutive pay stubs for your proof of income or address verification. We may also look at pay stubs as part of your employment verification. You may be asked to submit pay stub documents during the purchase process.

How fast is the Carvana process

Options for receiving payment are: Certified Check ACH direct deposit into your checking or savings account The ACH transfers normally take between 2-5 business days. The appointment is fast, we confirm the basic details about your vehicle and complete final sale documents, ensuring you're paid as quickly as possible.

Is Carvana a good option for bad credit

Yes. As long as you are 18 years or older†, make at least $4k per year, and have no active bankruptcies, you can finance your purchase through Carvana. To get started, you can fill out the financing application here. Don't worry, filling out the application will not impact your credit!

Does Carvana always verify income

Carvana performs an income verification to help calculate your yearly income and ensure we're providing you the correct financing terms to set you up for financial success with your vehicle loan. Carvana also performs an employment verification to confirm that you're an active employee at the company indicated.

How does Carvana verify down payment

To verify funds, you can link your bank account through Plaid from your Order Placed Dashboard or provide photos of a cashier's check for the down payment made out to Carvana.

How long does Carvana take to approve

How long does Carvana take to approve Approving a car for sale takes between two and fifteen minutes to approve. Around 99 percent of online car sellers who apply get approved, and their contracts and terms are good for 45 days.

What should I put for income for Carvana

You can upload your 3 most recent, consecutive months of bank statements for your proof of income or address verification. We may also look at bank statements as part of your employment verification. Some customers may be required to upload additional income documents when placing an order.

Does Carvana check your bank account

When applying for Carvana financing, we may provide an option to connect with Plaid to verify your bank account information after receiving your terms. This allows us to determine if you qualify for a down payment reduction.

What is better CarMax or Carvana

Which Is Better: Carvana or CarMax Carvana is a better option if you look for convenience and ease of use in your purchases and trades. On the other hand, CarMax is ideal for people who want to test drive the car beforehand and who do not mind going to their nearest CarMax location to do it.

How long does it take for Carvana to approve you

Once you've uploaded your documents, we'll typically verify that we have everything we need within 1-2 days. However, we may extend beyond that timeframe on occasion and we appreciate your patience as we work to quickly verify your documents.

Can I get a car with a 530 credit score

Can you finance a car with a 530 credit score You can finance a car with a 530 credit score. Lenders will charge a higher interest rate, but you can still get a vehicle.

Can I finance a car with a 500 credit score

And, yes, if you are in that 500–600 credit score range, obtaining the financing to buy a car is doable. Even a small percentage of individuals with deep subprime credit scores – 500 or below – obtained auto financing in 2023.

How does Carvana confirm income

You can upload your 2 most recent, consecutive pay stubs for your proof of income or address verification. We may also look at pay stubs as part of your employment verification. You may be asked to submit pay stub documents during the purchase process.

Why would Carvana deny me

If something increased your debt or debt-to-income ratio, that could have led to a denial. Look for errors: Make sure all your information is correct. You may have typed your name or Social Security number wrong.

What does Carvana verify income

You can upload your 2 most recent, consecutive pay stubs for your proof of income or address verification. We may also look at pay stubs as part of your employment verification. You may be asked to submit pay stub documents during the purchase process.

What credit score is needed to buy a car at CarMax

There's no disclosed minimum credit score for a CarMax auto loan. This lender accommodates borrowers with a range of credit profiles, including first-time buyers. As with all lenders, the higher your credit score, the more likely you are to qualify for special deals, promotional offers and lower APRs.