What credit score does regions bank use?

What is the credit score needed for credit card with Regions Bank

Applicants with a credit score of at least 600 and up to 850 may be eligible for Regions Bank Preferred Line of Credit. Regions Bank Preferred Line of Credit does not have or does not disclose a minimum annual income eligibility requirement.

Cached

What credit score do banks use most

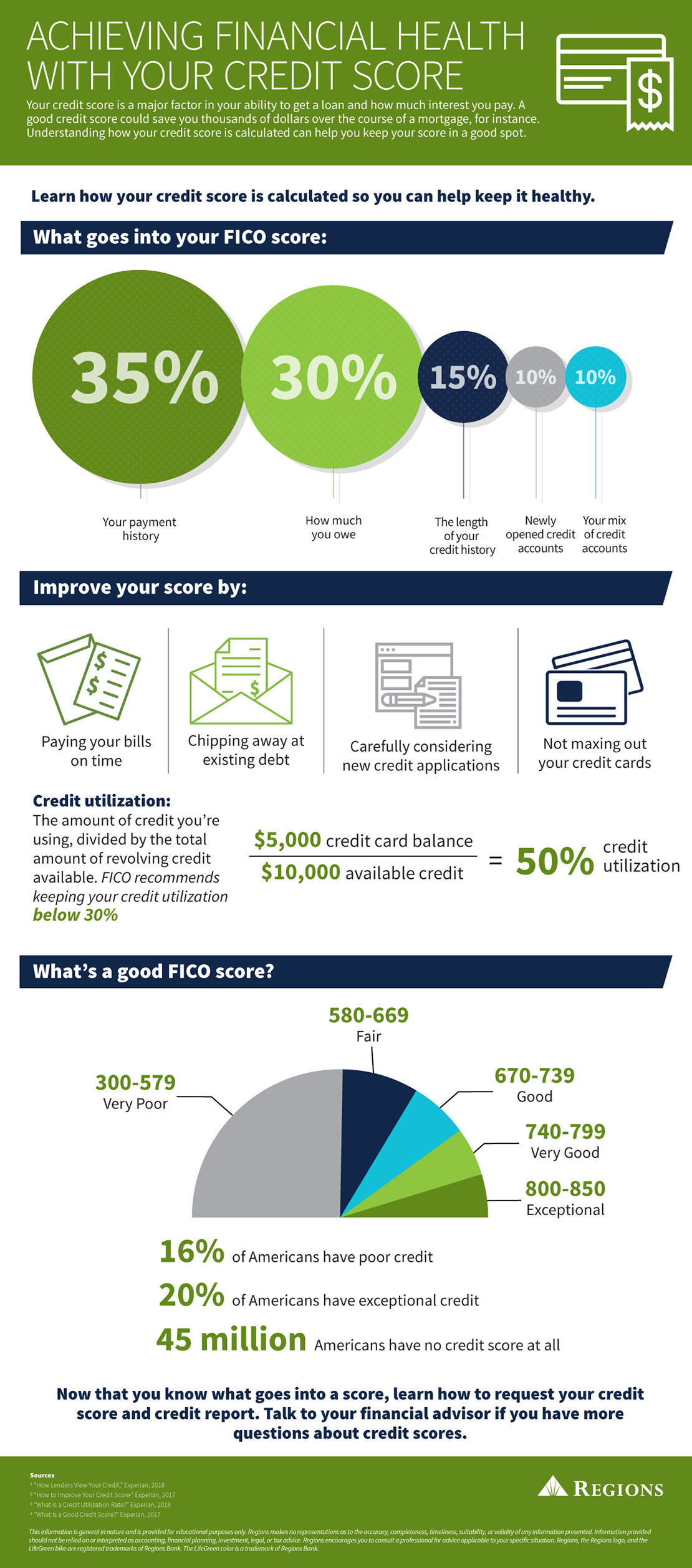

the FICO credit score

Which credit score do lenders actually use Most lenders use the FICO credit score when assessing your creditworthiness for a loan. According to FICO, 90% of the top lenders use FICO credit scores.

How do I check my FICO score Regions

Visit Annualcreditreport.com. By law, every 12 months you're eligible to receive a free copy of your credit report from each of the three major credit reporting agencies through this central website. You can also request a copy by phone or mail. Have your personal information ready.

Cached

Does Regions Bank provide credit score

Most lenders in the U.S., including Regions, use FICO® Scores when evaluating a consumer's credit worthiness. Reviewing your FICO® Scores can help you learn how lenders view your credit risk and allow you to better understand your financial health.

Cached

What is Regions credit limit

The Regions Credit Line is a small-dollar, revolving line of credit with limits of $500 up to $3,000 dollars. It has a fixed annual percentage rate of 21.90%.

Can you get a credit card with a 559 credit score

The best type of credit card for a 559 credit score is a secured credit card. Secured cards give people with bad credit high approval odds and have low fees because cardholders are required to place a refundable security deposit.

Which banks pull from Equifax

Some of the major credit card companies that use Equifax include American Express, Bank of America, Capital One, Chase, Citi, Discover, and Wells Fargo. These companies use Equifax to verify your identity, check your credit history, and evaluate your credit score.

Is Equifax or TransUnion more accurate

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Is A FICO score the same as a credit score

A FICO score is a specific type of credit score—one calculated by credit-scoring company FICO. And while FICO has multiple scoring models of its own, FICO scores generally range from 300 to 850—and the higher the score, the better.

Is FICO your actual score

Is "credit score" the same as "FICO® score" Basically, "credit score" and "FICO® score" are all referring to the same thing. A FICO® score is a type of credit scoring model. While different reporting agencies may weigh factors slightly differently, they are all essentially measuring the same thing.

What credit score do banks use TransUnion or Equifax

An Equifax credit score isn't used by lenders or creditors to assess a consumers' creditworthiness. Instead, many lenders use FICO Scores® to help determine a potential borrower's creditworthiness. FICO uses credit scores from the three reporting agencies, including Equifax and Transunion, to determine their score.

Why is my FICO score different than my credit score

Why is my FICO® score different from my credit score Your FICO Score is a credit score. But if your FICO score is different from another of your credit scores, it may be that the score you're viewing was calculated using one of the other scoring models that exist.

What is a normal credit limit to have

A good credit limit is above $30,000, as that is the average credit card limit, according to Experian. To get a credit limit this high, you typically need an excellent credit score, a high income and little to no existing debt.

What is an acceptable credit limit

As such, if you have one of these cards, you might consider a $5,000 credit limit to be bad and a limit of $10,000 or more to be good. Overall, any credit limit of five figures or more is broadly accepted as a high credit limit. The main exception to the usual credit limit rules are secured credit cards.

Can I get a Walmart credit card with a 520 credit score

The Walmart Credit Card credit score requirement is 640 or higher, which means people with fair credit or better have a shot at getting approved for this card. The Walmart® Store Card also requires at least fair credit for approval.

What credit cards can I get with a 570 credit score

Popular Credit Cards for a 570 Credit ScoreNo Annual Fee: Capital One Quicksilver Secured Cash Rewards Credit Card.Unsecured: Credit One Bank® Platinum Visa® for Rebuilding Credit.No Credit Check: OpenSky® Secured Visa® Credit Card.Cash Back: U.S. Bank Cash+® Visa® Secured Card.

Is TransUnion or Equifax closer to FICO

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Which is more accurate TransUnion or Equifax

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Is a TransUnion credit score of 650 good

A very poor credit score is in the range of 300 – 600, with 601 – 660 considered to be poor. A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850.

Which credit score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.