What credit score is needed for Navy Federal?

What credit score do you need for Navy Federal

The Navy Federal credit card approval requirements include a credit score of at least 700 (good credit), in most cases. Other Navy Federal credit cards require a credit score of 750+ (excellent credit). However, Navy Federal also offers options for people with bad credit.

Cached

Can I get a credit card with Navy Federal with bad credit

The easiest Navy Federal credit card to get is the Navy Federal Credit Union nRewards® Secured Credit Card because you can get approved with Bad credit. The Navy Federal nRewards Secured Card requires a refundable deposit (minimum of $200), and the deposit becomes your credit limit.

Can you get denied at Navy Federal Credit Union

A personal loan from Navy Federal Credit Union is not hard to qualify for if you have enough income to afford the loan, and a valid bank account. Approval by Navy Federal Credit Union is never guaranteed, though, even if you meet all the requirements.

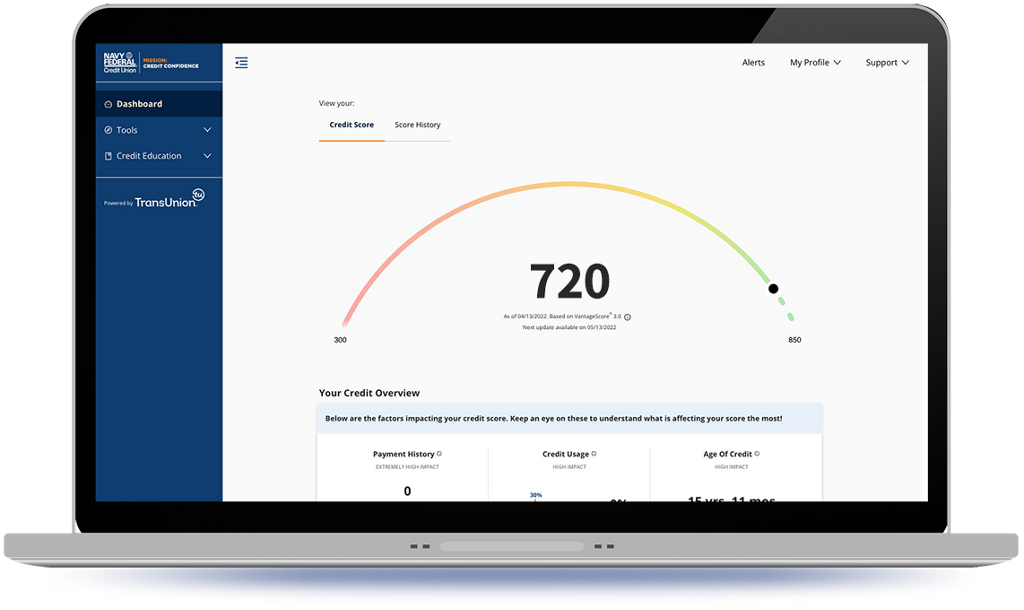

Does Navy Federal look at credit

We want to help you build great credit, so we offer FICO® Scores for free, for our primary cardholders. Your FICO® Score is calculated from the details in your credit report, including your credit history and record of past payments.

Does Navy Federal do a hard pull

Does Navy Federal Conduct a Hard Pull for Membership Navy Federal does not carry out a hard credit pull when you apply for membership. However, you may expect a hard pull if you apply for any form of credit, be it a credit card, a personal loan, an auto loan or a mortgage.

What is Navy Federal highest credit card limit

The Navy Federal Platinum Credit Card credit limit is between $500 and $50,000.

What is the personal line of credit limit for Navy Federal

At Navy Federal, members can request a personal loan of $250 to $50,000, with an APR that starts at 7.49% for a loan term of up to 36 months, 14.79% for 37 to 60 months and 15.29% for 61 to 180 months.

What is a good internal score for Navy Federal

Lenders decide their own credit score requirements. However, scores under 580 are generally considered to be poor, while “good credit” is usually anything over 670. A score over 800 is excellent.

Is Navy Federal hard to get

It's relatively hard to qualify for Navy Federal membership. You're only eligible if you are active military member, veteran, employee or retiree of the Department of Defense, or family member of someone in one of those groups.

Does everyone get approved for Navy Federal

So you're thinking of joining Navy Federal Credit Union Good news. If you're a servicemember, veteran of any branch of the armed forces or a Department of Defense employee, then you're eligible to join. Your immediate family and household members are also eligible.

Does Navy Federal do a hard pull to join

Applying for membership typically involves NFCU carrying out a soft credit inquiry unless you are applying for a credit card or a loan at the same time.

Who is eligible for Navy Federal

So you're thinking of joining Navy Federal Credit Union Good news. If you're a servicemember, veteran of any branch of the armed forces or a Department of Defense employee, then you're eligible to join. Your immediate family and household members are also eligible.

How to get Navy Federal 25k credit limit

Rules for asking for a NFCU CLIAlways ask for your credit limit to be increased to $25,000.You need to wait a minimum of three months before applying for a credit limit increase.You should also wait a minimum of 180 days in between applying for increases.

How many credit cards will Navy Federal give you

As a primary cardholder, you're able to have three Navy Federal credit cards. More credit cards could boost your credit score, which is important for getting loans and even saving on insurance rates. However, having multiple cards can also be riskier, as that increases your potential to rack up unsustainable debt.

What is the highest Navy Federal credit limit

The Navy Federal Platinum Credit Card credit limit is between $500 and $50,000.

How to get 20,000 credit limit with Navy Federal

How to Get a Navy Federal Credit Limit IncreaseOnline: To request a Navy Federal credit limit increase by logging in to your online account.Via secure message: You can also get a credit limit increase by sending a secure message through online banking.Over the phone: Call customer service at (888) 842-6328.

How do I build my Navy Federal score

Keep Up Good Credit HabitsMake payments on time, all the time. Pay credit card companies, utility bills and other accounts on time and always for at least the minimum payment.Use different types of accounts.Use your credit card regularly but keep your credit utilization low.Keep current credit card accounts open.

How do I get my Navy Federal internal score

There are three ways there are three ways I want to you know specify that there are three ways you can get your Navy Fed internal score the first way is you need to apply for a credit card and be

What qualifies you for Navy Federal

Active Duty, Retired & Veterans

Servicemembers in all branches of the armed forces are eligible for membership. This category includes: Active Duty members of the Army, Marine Corps, Navy, Air Force, Coast Guard, National Guard and Space Force. Delayed Entry Program (DEP)

Can a regular person get Navy Federal

You may join Navy Federal Credit Union without being in the military, provided you have some connection with the nation's defense organizations. For instance, you could be a civilian who works for the Department of Defense or have a sibling who serves in the U.S. Coast Guard.