What day in September will we get the Child Tax Credit?

What day to expect Child Tax Credit

More In Credits & Deductions

If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), you can expect to get your refund by February 28 if: You file your return online. You choose to get your refund by direct deposit. We found no issues with your return.

Are we receiving Child Tax Credit this month

Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th. Families who normally aren't required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

Cached

What is the October Child Tax Credit

The Child Tax Credit reached 61.1 million children in October and, on its own, contributed to a 4.9 percentage point (28 percent) reduction in child poverty compared to what the monthly poverty rate in October would have been in its absence.

What month did the Child Tax Credit end

The reason why is that the enhancements that Congress made to the child tax credit were temporary. They all expired on December 31, 2023, including the monthly payments, higher credit amount, letting 17-year-olds qualify, and full refundability.

What if I didn’t get my child tax credit payment

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

When to expect tax refund 2023 with EITC

The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if they chose direct deposit and there are no other issues with their tax return.

What if I didn’t get my Child Tax Credit payment

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

What time does the IRS deposit refunds

More In Refunds

Sunday: 12 a.m. (Midnight) to 7 p.m. Monday: 12 a.m. (Midnight) to 6 a.m. Tuesday: 3:30 a.m. to 6 a.m. Wednesday: 3:30 a.m. to 6 a.m.

Why did I get a $250 deposit from the IRS

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

Why did I get $800 from the IRS

You could be owed hundreds of dollars. The IRS says 1.5 million people are owed a median refund of more than $800 because they haven't filed their 2023 tax return yet.

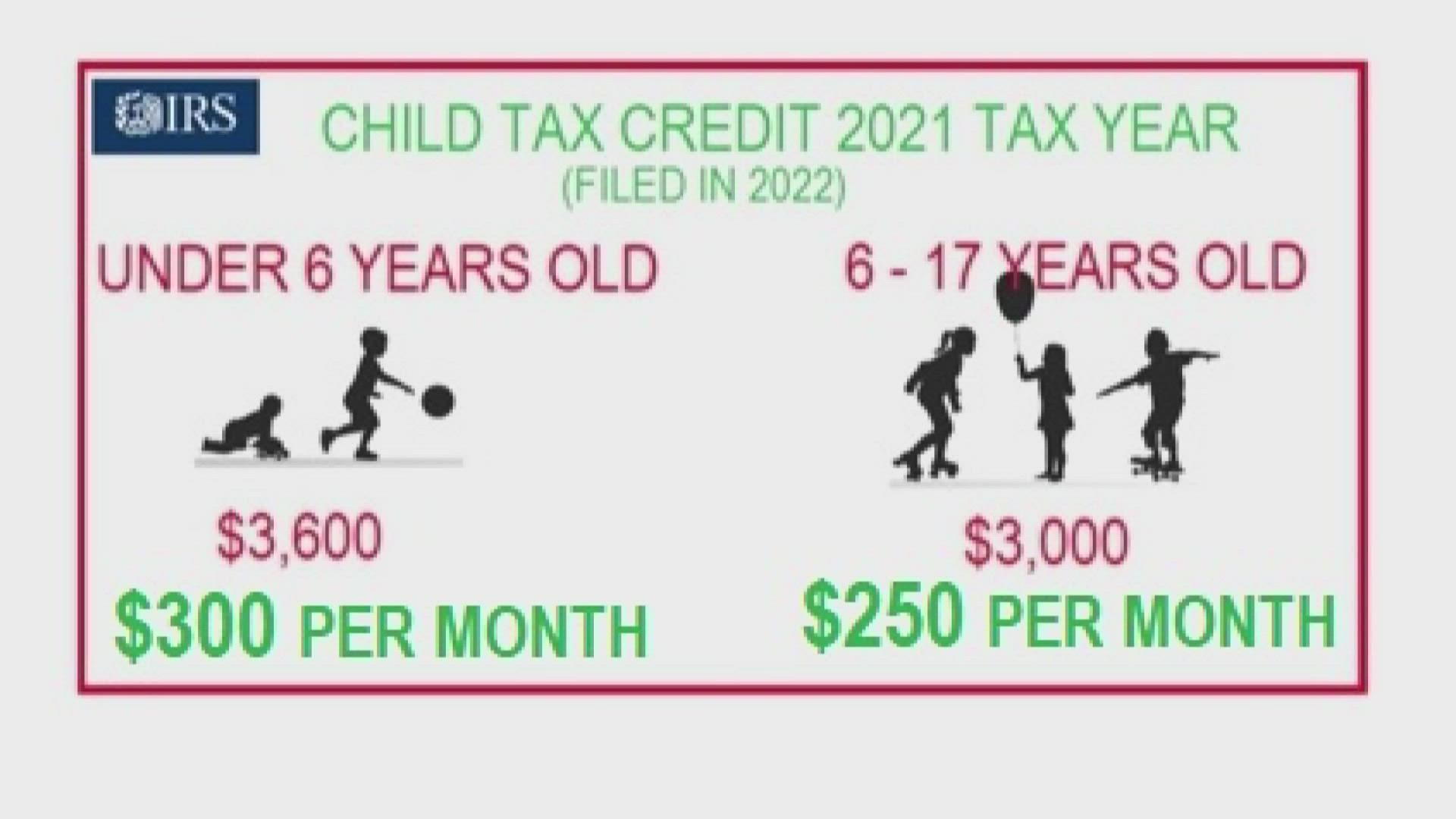

Has the Child Tax Credit been extended

The American Rescue Plan, signed into law on March 11, 2023, expanded the Child Tax Credit for 2023 to get more help to more families. It has gone from $2,000 per child in 2023 to $3,600 for each child under age 6. For each child ages 6 to 16, it's increased from $2,000 to $3,000.

Will monthly Child Tax Credit continue in 2023

Rather than once a year, monthly payments were made available. Even families who owed little to no federal taxes could receive money. While the credit remains available for 2023 tax preparation, the benefits parents can receive are back to normal (pre-pandemic) limits.

How much is eic per child 2023

Find the maximum AGI, investment income and credit amounts for tax year 2023. The maximum amount of credit: No qualifying children: $600. 1 qualifying child: $3,995.

Will my refund be bigger in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.

What time will the IRS send direct deposits

The IRS generally issues tax refunds through direct deposit within 21 days of processing your tax return. While the exact day of the week that your refund will be deposited can vary, the IRS typically issues refunds on weekdays, Monday through Friday.

What day does the IRS direct deposit

If you file your tax return electronically and select direct deposit, you will typically get your refund within 21 days of the IRS accepting your return. It can take up to six weeks for those who file a paper return and choose for direct deposit to receive their refund.

What is the refund for Governor Kemp

Single filers and married individuals who file separately could receive a maximum refund of $250. Head of household filers could receive a maximum refund of $375. Married individuals who file joint returns could receive a maximum refund of $500.

When can I expect my GA surplus refund

Please allow 6-8 weeks for Surplus Tax Refunds to be issued (if you filed by the April 18, 2023 deadline) Keep reading to learn more about the eligibility requirements and how to check the status of your Surplus Refund.

Why did I get $400 from IRS today

Why is the rebate for 400 dollars The 400 dollar tax rebate amount has been used as it equates to the sum most Californian residents pay in state excise taxes on gasoline per year, according to Petrie-Norris.

What money is the IRS sending out now

Stimulus Update: IRS Announces Average Payments of $1,232 Sent to Millions. Here's Who Is Getting Them. Many or all of the products here are from our partners that compensate us. It's how we make money.