What deductions did the TCJA eliminate?

Did the TCJA trimmed or eliminated many deductions and increased the standard deduction

The Tax Cuts and Jobs Act (TCJA) increased the standard deduction from $6,500 to $12,000 for individual filers, from $13,000 to $24,000 for joint returns, and from $9,550 to $18,000 for heads of household in 2023. As before, the amounts are indexed annually for inflation.

What did the Tax Cuts and Jobs Act of 2023 change

The Tax Cuts and Jobs Act was the largest overhaul of the tax code in three decades. The law created a single corporate tax rate of 21%. Many of the tax benefits set up to help individuals and families will expire in 2025. Certain values are adjusted annually for inflation.

What did the TCJA eliminate for fringe benefits

Under the TCJA, companies may no longer deduct expenses that they incurred by supplying qualified employee transportation fringe benefits. These benefits generally include qualified parking, transit passes, certain types of highway transportation, and reimbursements for qualified bicycle commuting.

Cached

What are the formerly 2% deductions

The 2% rule referred to the limitation on certain miscellaneous itemized deductions, which included things like unreimbursed job expenses, tax prep, investment, advisory fees, and safe deposit box rentals.

What are the standard deduction amounts based on the TCJA tax law changes

Under the Tax Cuts and Jobs Act for the tax years beginning after December 31, 2023 and before January 1, 2026, the standard deduction has been increased for each filing status: $24,000 for married individuals filing a joint return, $18,000 for head-of-household filers, and $12,000 for all other taxpayers.

What expenses are no longer deductible

Expenses such as union dues, work-related business travel, or professional organization dues are no longer deductible, even if the employee can itemize deductions.

What changes did the Tax Cuts and Jobs Act TCJA make to the standard deduction

Introduction. The Tax Cuts and Jobs Act (TCJA), passed in December 2023, made several significant changes to the individual income tax. These changes include a nearly doubled standard deduction, new limitations on itemized deductions, reduced income tax rates, and reforms to several other provisions.

What major change was the 2023 tax reform

The most significant and noticeable change made by the TCJA was the corporate income tax rate. Under the TCJA, Congress permanently lowered the corporate tax rate from the top 35 percent to a flat 21 percent for tax years beginning after December 31, 2023.

What fringe benefits are excluded from taxes

Which Fringe Benefits Are Excluded From Taxes The IRS allows several fringe benefits to be excluded from taxes. This list includes (but is not limited to) benefits include adoption expenses, group-term life insurance, retirement planning services, and de minimis benefits, such as certain meals and employee parties.

What are five fringe benefits which are exempt from taxation

Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance and educational assistance.

When did 2% itemized deductions go away

Personal Expenses that Are No Longer Deductible

Specifically, the TCJA suspended for 2023 through 2025 a large group of deductions lumped together in a category called "miscellaneous itemized deductions" that were deductible to the extent they exceeded 2% of a taxpayer's adjusted gross income.

What are 3 itemized deductions I could claim now

Types of itemized deductionsMortgage interest you pay on up to two homes.Your state and local income or sales taxes.Property taxes.Medical and dental expenses that exceed 7.5% of your adjusted gross income.Charitable donations.

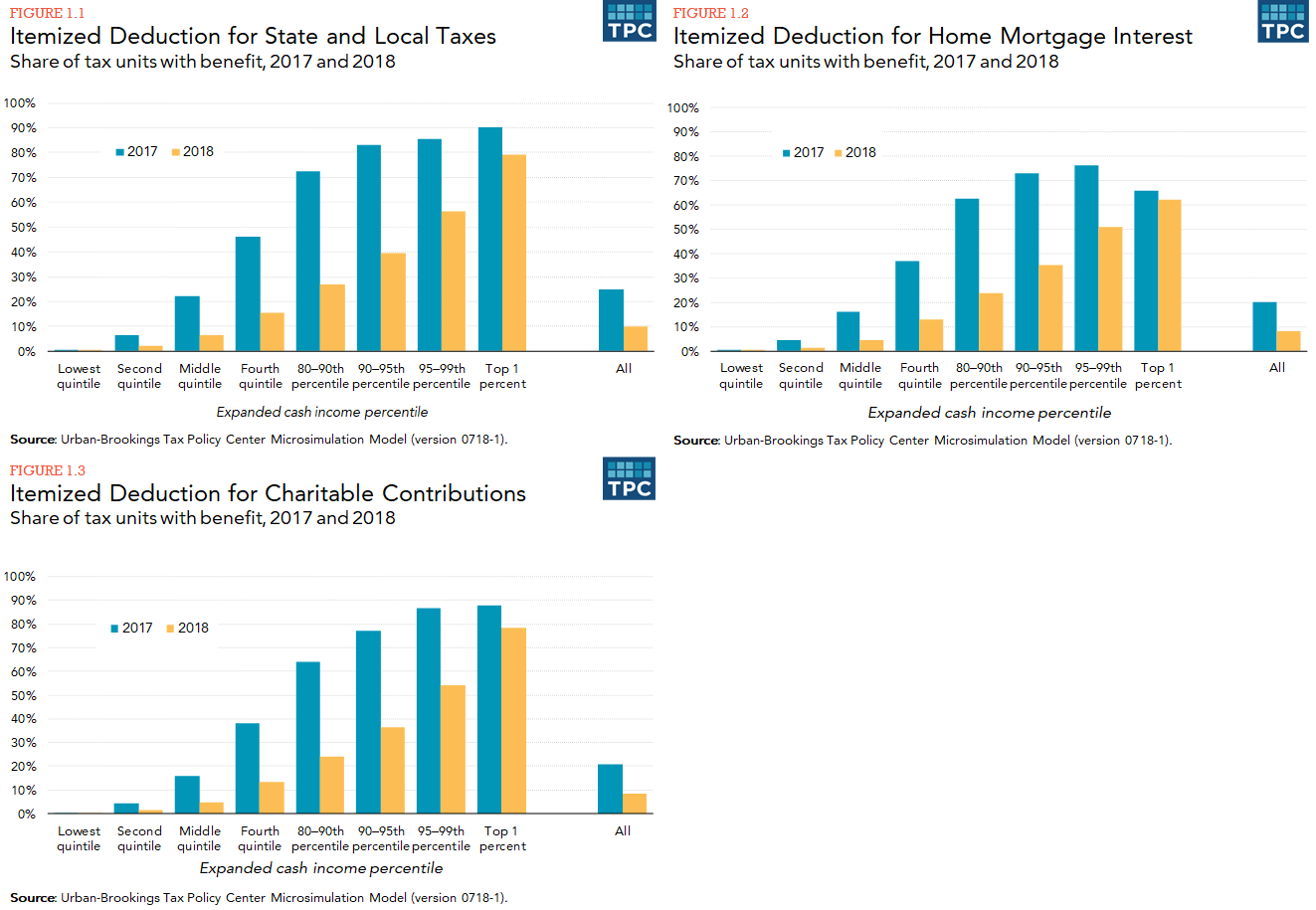

What did the TCJA cap state and local tax deductions at

Among other items, the Tax Cut and Jobs Act (TCJA) capped the state and local tax (SALT) deduction at $10,000 per year through tax year 2025. NACo opposed this portion of the Tax Cuts and Jobs Act.

What is the TCJA state and local tax deduction

The SALT deduction allows taxpayers to deduct state and local taxes paid from their federally taxable income, however the 2023 Tax Cuts and Jobs Act (TCJA) capped the deduction at $10,000 per year through 2025.

What itemized deductions are allowed in 2023

For 2023, as in 2023, 2023, 2023, 2023 and 2023, there is no limitation on itemized deductions, as that limitation was eliminated by the Tax Cuts and Jobs Act.

Did they remove mortgage interest deduction

The final bill repeals the deduction for interest paid on home equity debt through 12/31/2025. Interest is still deductible on home equity loans (or second mortgages) if the proceeds are used to substantially improve the residence.

What changes did the Tax Cuts and Jobs Act TCJA make to the standard deduction how do you think this change will affect charitable giving in future tax years

It increased the standard deduction to $12,000 for singles and $24,000 for couples, capped the state and local tax deduction at $10,000, and eliminated other itemized deductions—steps that significantly reduced the number of itemizers and hence the number of taxpayers taking a deduction for charitable contributions.

What changed in US tax in 2023

For tax year 2023, the IRS increased the value of some different tax benefits, while leaving some the same as last year: Personal and dependent exemptions remain $4,050. The standard deduction rises to $6,350 for single, $9,350 for head of household, and $12,700 for married filing jointly.

What are three examples of excluded fringe benefits

Benefits not allowed.Archer MSAs. See Accident and Health Benefits in section 2.Athletic facilities.De minimis (minimal) benefits.Educational assistance.Employee discounts.Employer-provided cell phones.Lodging on your business premises.Meals.

What does not qualify as a tax free de minimis fringe benefit

Cannot be cash, cash equivalent, vacation, meals, lodging, theater or sports tickets, or securities.