What do I do if I didn’t get a 1095-A?

Can I file my taxes without my 1095-A

What to do with Form 1095-A. You can't file your federal taxes without Form 1095-A. You'll need it to "reconcile" — find out if there's any difference between the premium tax credit you used in 2023 and the amount you qualify for.

How can I find my 1095-A online

How to find your 1095-A onlineLog in to your HealthCare.gov account.Under "Your Existing Applications," select your 2023 application — not your 2023 application.Select “Tax Forms” from the menu on the left.Download all 1095-As shown on the screen.

Does everyone need a 1095-A

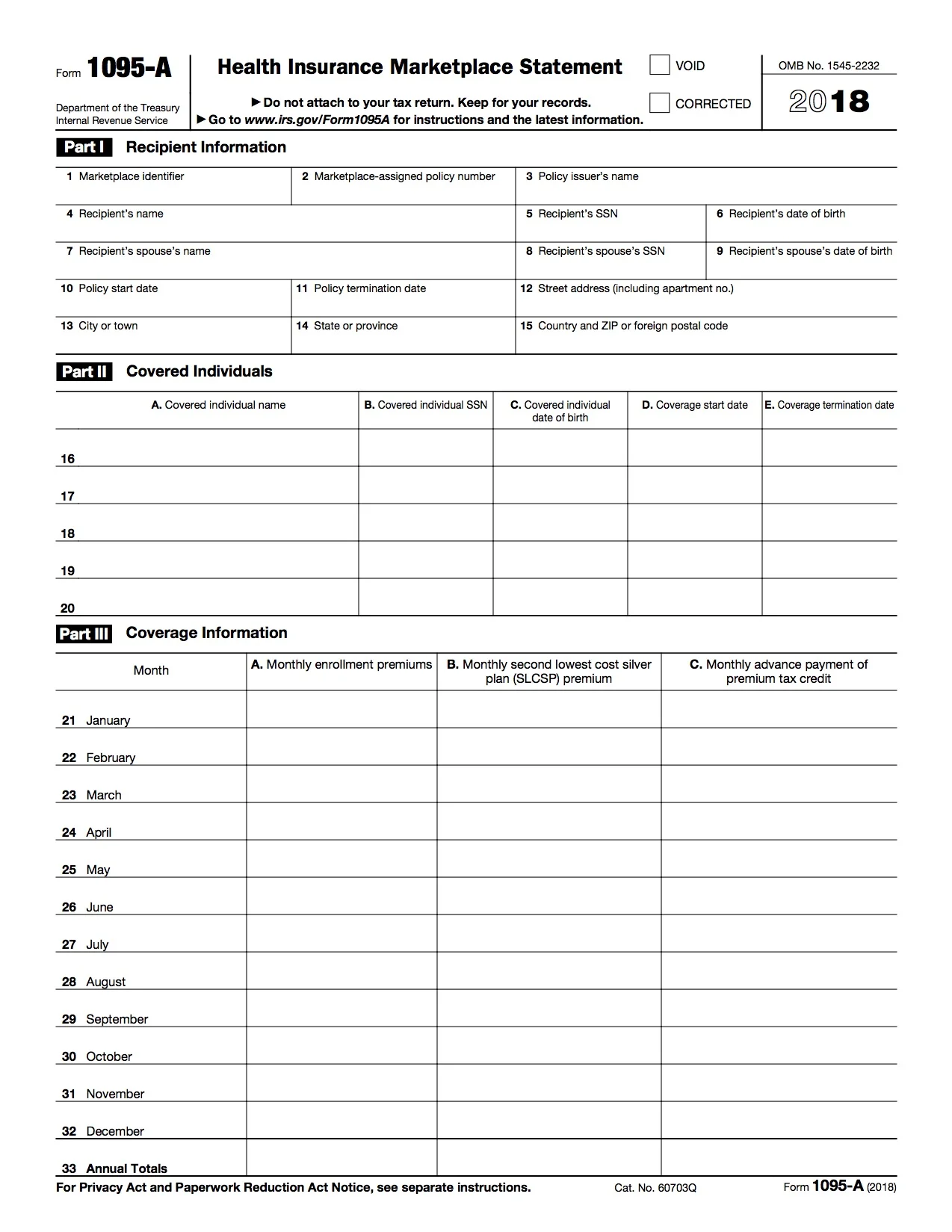

Form 1095-A: Marketplace Insurance Statement

Form 1095-A is sent by state and federal marketplaces to anyone who had marketplace coverage for the year. This form is absolutely required for taxpayers who received advance payments of the Premium Tax Credit (APTC) to help pay for health insurance coverage during the year.

Cached

What do I do if I have 1095-B and not a 1095-A

You will not add this to your return, Form 1095-B is informational only the IRS does NOT need any details from this form. The form verifies you had health insurance coverage. You can keep any 1095-B forms that you get from your employer for your records.

Is a 1095 a tax return

Form 1095-A gives you information about the amount of advanced premium tax credit (APTC) that was paid during the year to your health plan in order to reduce your monthly premium. This information was also reported to the IRS.

Who is required to file 1095

More In Forms and Instructions

Form 1095-C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a full-time employee for one or more months of the calendar. ALE members must report that information for all twelve months of the calendar year for each employee.

How do I get my 1095-a form from the IRS

Didn't receive IRS Form 1095-A Call us at (800) 300-1506. Get more information about your federal taxes (Form 1095-A).

How do I get my 1095-a form from Medi-Cal

Log into your HealthCare.gov account. Under "Your Existing Applications," select your 2023 application. Select “Tax Forms” from the menu on the left. Download all 1095-A forms shown on the screen.

When did 1095 become required

Sending out 1095-C forms became mandatory starting with the 2015 tax year. Employers send the forms not only to their eligible employees but also to the IRS. Employees are supposed to receive them by the end of January—so forms for 2023 would be sent in January 2023.

Who is required to complete 1095

ALE Members that offer health coverage through an employer-sponsored, self-insured health plan must complete Form 1095-C, Parts I, II, and III, for any employee who enrolls in the health coverage, whether or not the employee is a full-time employee for any month of the calendar year.

Do I have a 1095-A if I get insurance through my employer

Employers are not required to send employees 1095-A forms. Instead, the insurance company in the healthcare exchange is responsible for sending out this form to the enrolled individual.

Does the IRS still require proof of health insurance

Health care coverage documents

You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, it's a good idea to keep these records on hand. This documentation includes: Form 1095 information forms.

Why isn’t my 1095-a form online

Some reasons why you may not receive an IRS Form 1095-A or Form FTB 3895: You were enrolled in a minimum coverage plan (also known as catastrophic plan). You were enrolled in the Medi-Cal program. You were enrolled in employer health coverage through Covered California for Small Business (CCSB).

Who sends out the 1095-A form

Health Insurance Marketplaces furnish Form 1095-A to: IRS to report certain information about individuals who enroll in a qualified health plan through the Health Insurance Marketplace.

Who sends me my 1095 A form

You and the IRS will receive Form 1095-A if you had health coverage through the Marketplace. This form is essential for preparing your tax return if you received a premium subsidy or if you paid full price for coverage through the exchange and want to claim the premium subsidy on your tax return.

How do I add Form 1095 A to TurboTax

Here's how to enter your 1095-A in TurboTax:Open or continue your return.Select Search and enter 1095-a.Select Jump to 1095-a.Answer Yes and enter your 1095-A info on the next screen and select Continue. We don't need all the info from your 1095-A. We'll only ask about the info that affects your return.

What is a proof of Medi-Cal coverage letter

At the end of each plan year, you'll receive a 1095 form or letter, which provides details about your health insurance that you may need when filing your taxes, such as premium amounts and coverage dates. The 1095 form is sent by the health insurance marketplace or your insurance company.

What is the deadline for 1095 A

California. The employer deadline for furnishing Forms 1095-C to California employees who enrolled in coverage is January 31, 2023, and no extensions are available.

Are 1095 forms required for 2023

The employer must provide Form 1095-C or Form 1095-B to any individual who was covered by the self-funded plan in 2023. (Not just to full-time employees.) The deadline for furnishing these forms is March 2, 2023.

Who sends me my 1095-A form

You and the IRS will receive Form 1095-A if you had health coverage through the Marketplace. This form is essential for preparing your tax return if you received a premium subsidy or if you paid full price for coverage through the exchange and want to claim the premium subsidy on your tax return.