What do you need to make a credit card?

What is required to make a credit card

You will need to have a regular income and provide proof of the same. Income requirement varies depending on the Credit Card being applied for. You can either be a salaried employee, or self-employed and managing your own business. Credit history – A good credit history is proof that you can manage your credit well.

What 5 things do you need to apply for a credit card

You're generally required to provide your legal name, birth date, address, Social Security number and annual income. Giving an issuer your Social Security number allows them to check your credit, which largely dictates whether or not you'll receive the card.

Cached

How do I get credit for the first time

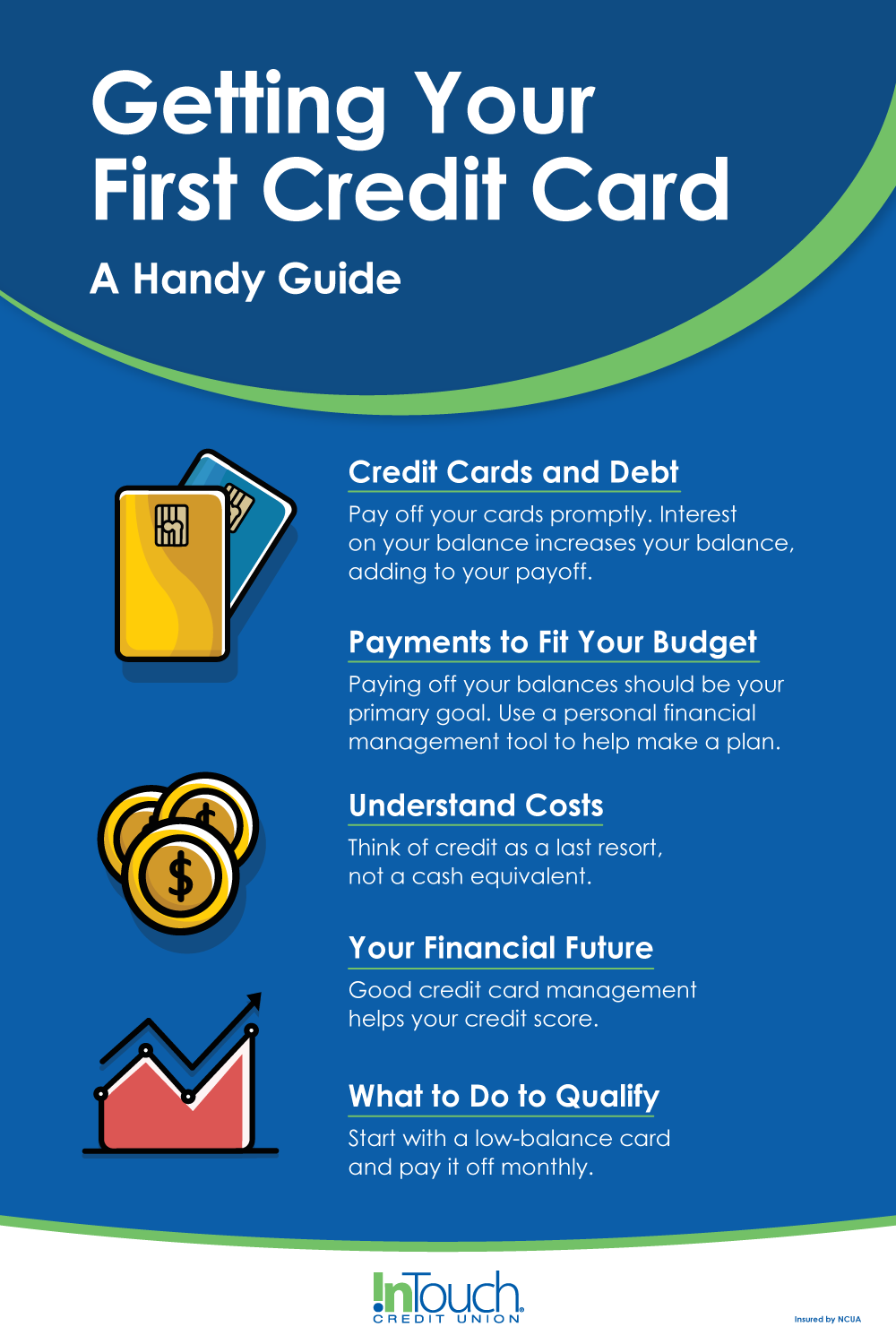

Here are four ways to get started.Apply for a credit card. Lack of credit history could make it difficult to get a traditional unsecured credit card.Become an authorized user.Set up a joint account or get a loan with a co-signer.Take out a credit-builder loan.

What ID do you need to get credit card

Photo ID (your driver's license, proof of age card or passport) Additional assets and income (such as a savings account or managed investments) Details of any existing loans, such as personal loans, a lease or other credit cards. History of credit – a recognition of debt default or bankruptcy.

Can I get credit card without job

Being unemployed doesn't disqualify you from credit card approval. While issuers do ask for your income, you may offer alternative forms of income on your application.

Can I get credit card without income proof

Secured Credit Card – You can apply for a secured credit card by providing a security deposit as collateral. Thus, no income proof is required for this credit card, and the credit limit is backed by the security deposit. Various banks and financial institutions in the country offer credit cards against fixed deposits.

Can I get a credit card without SSN

To get a credit card without a Social Security number you'll need to verify your identity another way, which is typical with an Individual Taxpayer Identification Number (ITIN). A number of major credit card issuers allow you to apply for cards online using an ITIN as a replacement for an SSN.

Can I get a credit card with no job

Being unemployed doesn't disqualify you from credit card approval. While issuers do ask for your income, you may offer alternative forms of income on your application.

How can I build my credit at 18 with no credit

Ways you can start building credit:Become an authorized user on a credit card.Consider a job.Get your own credit card.Keep track of your credit score.Make on time payments.Pay more than the minimum payment.

Can I get a credit card with no ID

To apply for credit, you'll need a form of identification accepted by the bank that issues the credit card. In many cases, that can be an individual taxpayer identification number.

How to get a credit card without a job

How to get a credit card with no jobApply for a secured card. A secured card can be a way to get access to credit even if you have limited income.Become an authorized user. Another option to access credit is to become an authorized user on a trusted friend's or family member's credit card account.Consider a co-signer.

Do I need an income to get a credit card

It isn't necessary to be employed to get a credit card. However, the Credit CARD Act of 2009 requires card issuers to consider your ability to repay any debt you incur with the account during the application process. In other words, not having a job won't stop you from getting approved, but not having any income might.

Which bank will give credit card easily

1. HDFC Bank instant approval credit card. HDFC Bank credit cards are not only 100% secure, but they also provide instant activation and ownership.

How much proof of income do I need for a credit card

But generally, you should report only income that can be verified by tax returns, a letter or some other document. “Use common sense,” says Ira Rheingold, executive director of the National Association of Consumer Advocates. “If you can't prove the income exists, you shouldn't list it.”

What cards don t require SSN

The two most popular card issuers for applicants without an SSN are American Express and Citibank. These issuers also both offer cards outside the U.S. and if you have an open account with either issuer in another country, your foreign credit activity will be considered.

What banks don’t require SSN

Here are some banks and credit unions that don't require you to have an SSN to open an account:Bank of America.Chase.Wells Fargo.Marcus by Goldman Sachs.Self-Help Federal Credit Union.Latino Credit Union.

Do you need proof of income for credit card

Credit card issuers are required by law to consider your ability to repay debt prior to extending a new line of credit. So, listing your annual income is a requirement on every credit card application. To that end, credit card issuers may also ask for proof of income, such as pay stubs, bank statements, or tax returns.

How to get a 700 credit score at 18

How to start building credit at age 18Understand the basics of credit.Become an authorized user on a parent's credit card.Get a starter credit card.Build credit by making payments on time.Keep your credit utilization ratio low.Take out a student loan.Keep tabs on your credit report and score.

What credit score will I have at 18

The credit history you start with at 18 is a blank slate. Your credit score doesn't exist until you start building credit. To begin your credit-building journey, consider opening a secured credit card or ask a family member to add you as an authorized user on their account.

How to get a credit card without proof of income

How to get a credit card with no jobApply for a secured card. A secured card can be a way to get access to credit even if you have limited income.Become an authorized user. Another option to access credit is to become an authorized user on a trusted friend's or family member's credit card account.Consider a co-signer.