What does a 750 credit rating mean?

What can a 750 credit score get you

A 750 credit score generally falls into the “excellent” range, which shows lenders that you're a very dependable borrower. People with credit scores within this range tend to qualify for loans and secure the best mortgage rates. A 750 credit score could help you: Qualify for a mortgage.

Cached

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2023, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.

Cached

What percentage of the population has a credit score of 750

Credit Score Statistics FAQ

According to FICO's most recent report in April 2023, 23.3% of the US population have an excellent credit score of 800 and more, while another 23.1% have a credit score of between 750 and 799.

Is a 750 credit limit good

So, if you're assigned a credit limit of $750, that's probably a pretty good limit. If you applied for a regular cash back rewards card, however, that same $750 limit could be considered a low credit limit. That's because the best cash back cards often have starting limits in the $1,500 to $2,500 range.

Is there a difference between a 750 and 800 credit score

A 750 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range (800-850), you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs.

Is A 900 credit score good

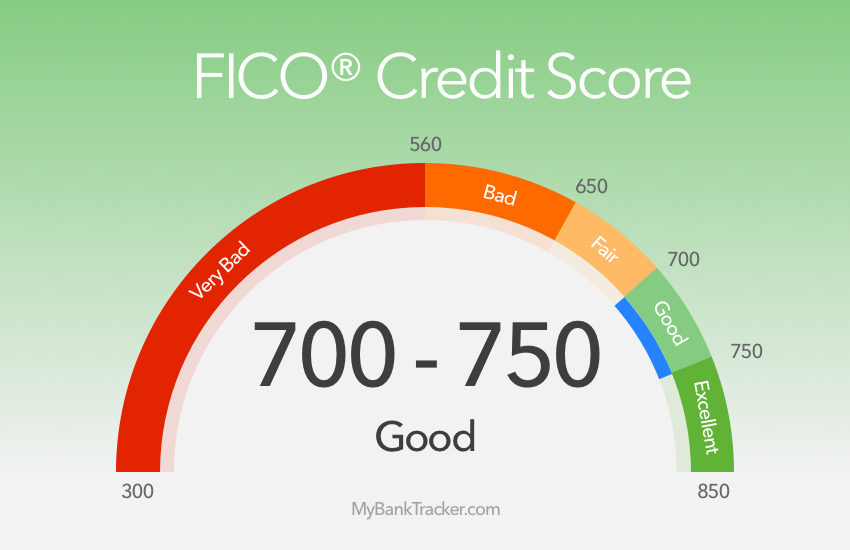

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How to raise my credit score from 750 to 800

How to Get an 800 Credit ScorePay Your Bills on Time, Every Time. Perhaps the best way to show lenders you're a responsible borrower is to pay your bills on time.Keep Your Credit Card Balances Low.Be Mindful of Your Credit History.Improve Your Credit Mix.Review Your Credit Reports.

What credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.

What kind of credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.

Does anyone have 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Will I ever get an 800 credit score

But exceptional credit is largely based on how well you manage debt and for how long. Earning an 800-plus credit score isn't easy, he said, but “it's definitely attainable.”

What is the average credit score by age

Average FICO Score Nearly Unchanged Among All Generations

| Average FICO® Score by Generation | ||

|---|---|---|

| Generation | 2023 | 2023 |

| Silent Generation (77+) | 760 | 760 |

| Baby boomers (58-76) | 740 | 742 |

| Generation X (42-57) | 705 | 706 |

Can I get a 20k loan with 750 credit score

You should have a 640 or higher credit score in order to qualify for a $20,000 personal loan. If you have bad or fair credit you may not qualify for the lowest rates. However, in order to rebuild your credit you may have to pay higher interest rates and make on-time payments.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

Why is it so hard to get a 800 credit score

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

How rare is a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

How many people have an 800 credit score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

What’s a good credit score to buy a house

620 or higher

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Can I get a $50,000 personal loan with 700 credit score

You will likely need a minimum credit score of 660 for a $50,000 personal loan. Most lenders that offer personal loans of $50,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.