What does a 823 credit score get you?

What can I do with a credit score of 823

With an 823 credit score, you are well-positioned to qualify for any financial product, from the best credit cards and personal loans to the best auto loans and mortgages. An 823 credit score doesn't guarantee you approval, however, because your income and existing debt obligations matter, too.

Cached

What is the mortgage rate for a credit score of 823

823 credit score mortgage loan options

With an 823 credit score, you should be eligible for the lowest possible mortgage rates. While mortgage rates fluctuate daily, the national average interest rate for someone with a credit score of 823 is 2.36 percent on a 30-year loan (as of April 2023).

Cached

What can you get with a 825 credit score

A credit score of 825 will generally qualify you for a lender's best interest rates. As a real-world example, the average 30-year fixed mortgage interest rate was just over 7% as of late October 2023. However, the average rate paid by a homebuyer whose FICO credit score was 760 or higher was 6.583%.

Who gets 850 credit score

People with perfect scores are typically older

The majority of people with 850 credit scores are above the age of 57, according to Experian's report. About 70% of people with perfect credit scores are baby boomers (defined by Experian as people age 57 to 75) and members of the silent generation (ages 75 and above).

How many people have a credit score of 823

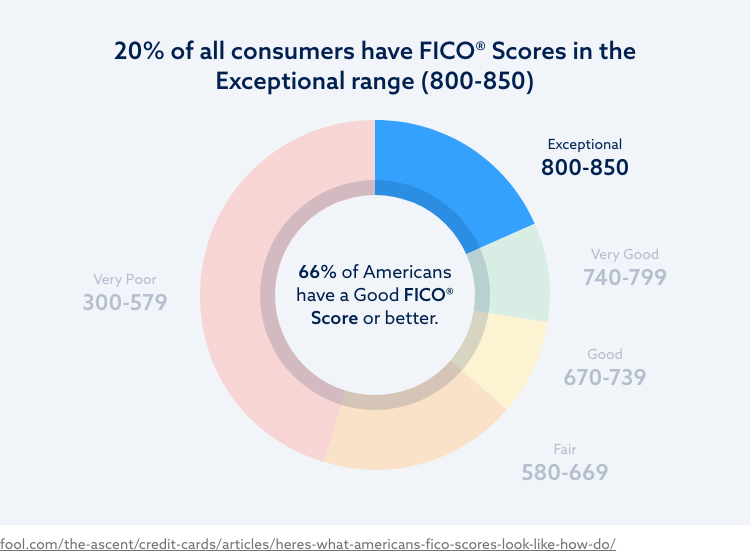

Your FICO® Score and is well above the average credit score. Consumers with scores in this range may expect easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

What is a good credit score for a 300k house

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

What percentage of the population has a 825 credit score

21% of all consumers have FICO® Scores in the Exceptional range.

Is 800 credit score rare

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Does anyone have 900 credit score

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

What does a 900 credit score give you

A credit score of 900 is either not possible or not very relevant. The number you should really focus on is 800. On the standard 300-850 range used by FICO and VantageScore, a credit score of 800+ is considered “perfect.” That's because higher scores won't really save you any money.

How rare is an 840 credit score

Your 840 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What will an 800 credit score get me

An 800-plus credit score shows lenders you are an exceptional borrower. You may qualify for better mortgage and auto loan terms with a high credit score. You may also qualify for credit cards with better rewards and perks, such as access to airport lounges and free hotel breakfasts.

What credit score do you need to buy a $500000 house

620

To qualify for most types of mortgages, you'll need a credit score of at least 620. Some loan types, such as FHA loans, accept lower scores, but a higher score will almost always get you the lowest available interest rate. And that could save you a significant amount over your loan term.

What credit score is needed for a $350 000 house

Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

How rare is 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How common is a 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

Will I ever get an 800 credit score

But exceptional credit is largely based on how well you manage debt and for how long. Earning an 800-plus credit score isn't easy, he said, but “it's definitely attainable.”