What does a Chase alert text look like?

How do I know if a Chase text is real

If you have any doubts about whether an email, phone call or text message is actually from us, please call the toll-free number on the back of your credit/debit card or the toll-free number on your statement. We'll help figure out if you're dealing with a scam.

CachedSimilar

Does Chase Bank send text alerts

You can receive alerts via email, text message and push notification when there is a charge, refund or other transaction on your account, when a balance transfer or payment has posted, to get balance and available credit limit amounts, when a payment is due, or when a payment has posted.

What is the text number for Chase

24273

Chase makes it easy to check your account balance from any mobile phone that can send and receive texts. Just text us at 24273 (Chase) and we'll text back your account balance and more.

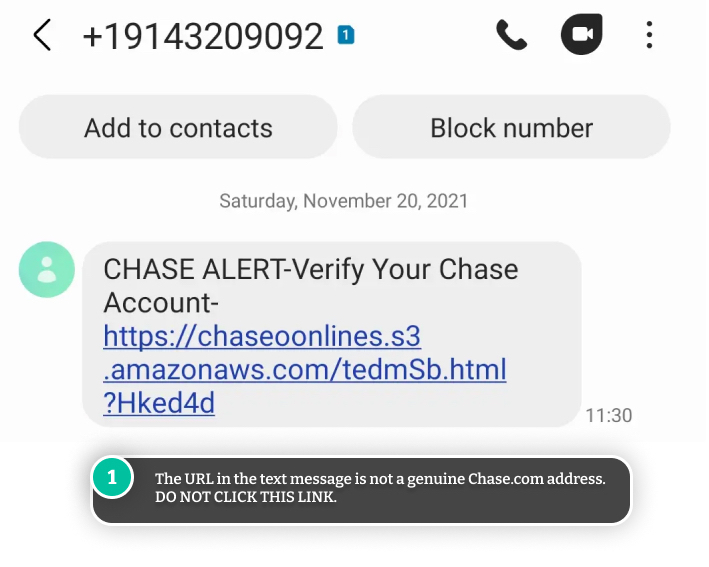

Are Chase Alerts legit

They aren't legitimate. If you get any emails like these, don't respond to them.

CachedSimilar

What is a Chase alert

Account Alerts are notifications about your account sent as an email, text message, or push notification. Alerts can remind you when your payment is due, notify you when your balance reaches a set amount, and much more. You can choose the alerts that are right for you, click Account Alerts to get started.

How do I receive text messages from Chase

Sign up for Chase Mobile

Sign in to Chase OnlineSM and select “Text banking” in the profile & settings menu. Enter and verify your mobile phone number to receive a text message with an 8-digit verification code.

What are Chase alerts

Account Alerts are notifications about your account sent as an email, text message, or push notification. Alerts can remind you when your payment is due, notify you when your balance reaches a set amount, and much more. You can choose the alerts that are right for you, click Account Alerts to get started.

What is Chase verification code

Where is the security code (CVV) on a debit card The security code can be found on the front or back of a debit card depending on which bank or credit union you use. With Chase debit cards, the three-digit code appears on the back of the card to the right side of the white signature strip.

How do you know if a bank alert is real

1) Verify the sender's information: A legitimate bank alert will always have the bank's name and logo, as well as the sender's email address or phone number matching the bank's official contact details. You can cross-check this information on the bank's website or by calling the bank directly.

What is Chase alert

Account Alerts are notifications about your account sent as an email, text message, or push notification. Alerts can remind you when your payment is due, notify you when your balance reaches a set amount, and much more. You can choose the alerts that are right for you, click Account Alerts to get started.

What does an alert on a bank account mean

Text or email alerts to help notify you of large deposits and guard against low balance, unusual activity and fraud. Set Up Alerts. The more you stay on top of your money, the more money you'll have to stay on top of.

What is an account alert

Account alerts are optional email and mobile messages that alert you to important account activity according to your preference. These can play a critical role in helping you to keep your accounts safe and secure.

Does your bank send text messages

Your bank will never send you text messages asking you to confirm your account details or reset your password. Such SMSes are from scammers.

What are 3 types of banking alerts

The three primary ways your bank sends alerts are:Text message.Email message.Mobile push notification.

How many digits is a Chase verification code

Sign in to Chase OnlineSM and select “Text banking” in the profile & settings menu. Enter and verify your mobile phone number to receive a text message with an 8-digit verification code.

Why is Chase sending me a code

When you sign in for the first time or with a device we don't recognize, we'll ask you for your username, password and a temporary identification code, which we'll send you by phone, email or text message. Once you give us the identification code, we'll sign you securely into your accounts.

What are the 3 most common alerts notifications people use for mobile banking

Let's dive into the most common customer transaction alerts and push notifications.Available Balance & Cleared Checks.Debit or Deposit Transactions.Failed Transactions or NSF Notifications.A High or Low balance Amount.Online Transfers and Pending ACH Transactions.Login Attempts or Failures.

Why did Chase lock my account due to suspicious activity

Suspicious activity

If we can't reach you, we might place a temporary hold on your online activity to make sure it's you and not someone else using your account.

How does Chase bank alert you

You can receive alerts by email, text message and push notification when there's a charge, refund or other transaction on your account, when a balance transfer or payment has posted, to get balance and available credit limit amounts, when a payment is due, or when a payment has posted.

How do banks notify you of suspicious activity

When suspicious activity is identified, banks are required by law to report it to the Financial Crimes Enforcement Network (FinCEN) through the filing of a Suspicious Activity Report (SAR).