What does a Judgement mean on your credit report?

How bad is a Judgement on your credit report

Judgments Don't Affect Your Credit Score, But Can Impact Your Application. Since judgments are not included in credit reports, they won't be factored into credit score calculations.

Cached

How to remove a Judgement from your credit report

How to remove negative items from your credit report yourselfGet a free copy of your credit report.File a dispute with the credit reporting agency.File a dispute directly with the creditor.Review the claim results.Hire a credit repair service.

Cached

Why is there a Judgement on my credit report

Judgments. A judgment is a debt you owe through the courts due to a lawsuit. For example, if somebody sues you, and you lose, then the debt may show up on your credit report. Usually, this information stays on your credit report for 6 years.

How long does a Judgement last on your credit report

seven years

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

Will a judgement affect buying a house

Many mortgage companies will not lend to borrowers who have open or recently paid judgments. Judgments also keep credit scores low and can make them so low that you will not qualify for a mortgage even if it has been paid off. The effect a judgment has on your credit lessens over time.

How does a judgment affect you

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt.

Will a Judgement affect buying a house

Many mortgage companies will not lend to borrowers who have open or recently paid judgments. Judgments also keep credit scores low and can make them so low that you will not qualify for a mortgage even if it has been paid off. The effect a judgment has on your credit lessens over time.

How does a Judgement affect you

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt.

How does a judgement affect you

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt.

Does a Judgement ever expire

Money judgments automatically expire (run out) after 10 years. To prevent this from happening, you as the judgment creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

Can you negotiate after a Judgement

Negotiate With the Judgment Creditor

It's never too late to negotiate. The process of trying to grab property to pay a judgment can be quite time-consuming and burdensome for a judgment creditor.

Can you get a loan with a judgement on your credit

“The Mortgagee must verify that court-ordered Judgments are resolved or paid off prior to or at closing.” That is a good indication to the borrower that a judgment is not an automatic barrier to loan approval.

Does a Judgement against you ever go away

A judgment stays on your credit report for seven years, although in some cases — such as bankruptcy — the judgment can stay for as long as 10 years, and it does not matter what type of loan the judgment relates to: a car loan, a student loan, unpaid credit card debt, a personal loan, a cosigned loan, etc.

Can you get a Judgement reversed

Grounds For Vacating A Default Judgment

In California, for example, a judge can vacate a default judgment taken due to mistake, inadvertence, surprise, or excusable neglect. In New York, the rule is similar.

Will a civil Judgement affect buying a house

Many mortgage companies will not lend to borrowers who have open or recently paid judgments. Judgments also keep credit scores low and can make them so low that you will not qualify for a mortgage even if it has been paid off. The effect a judgment has on your credit lessens over time.

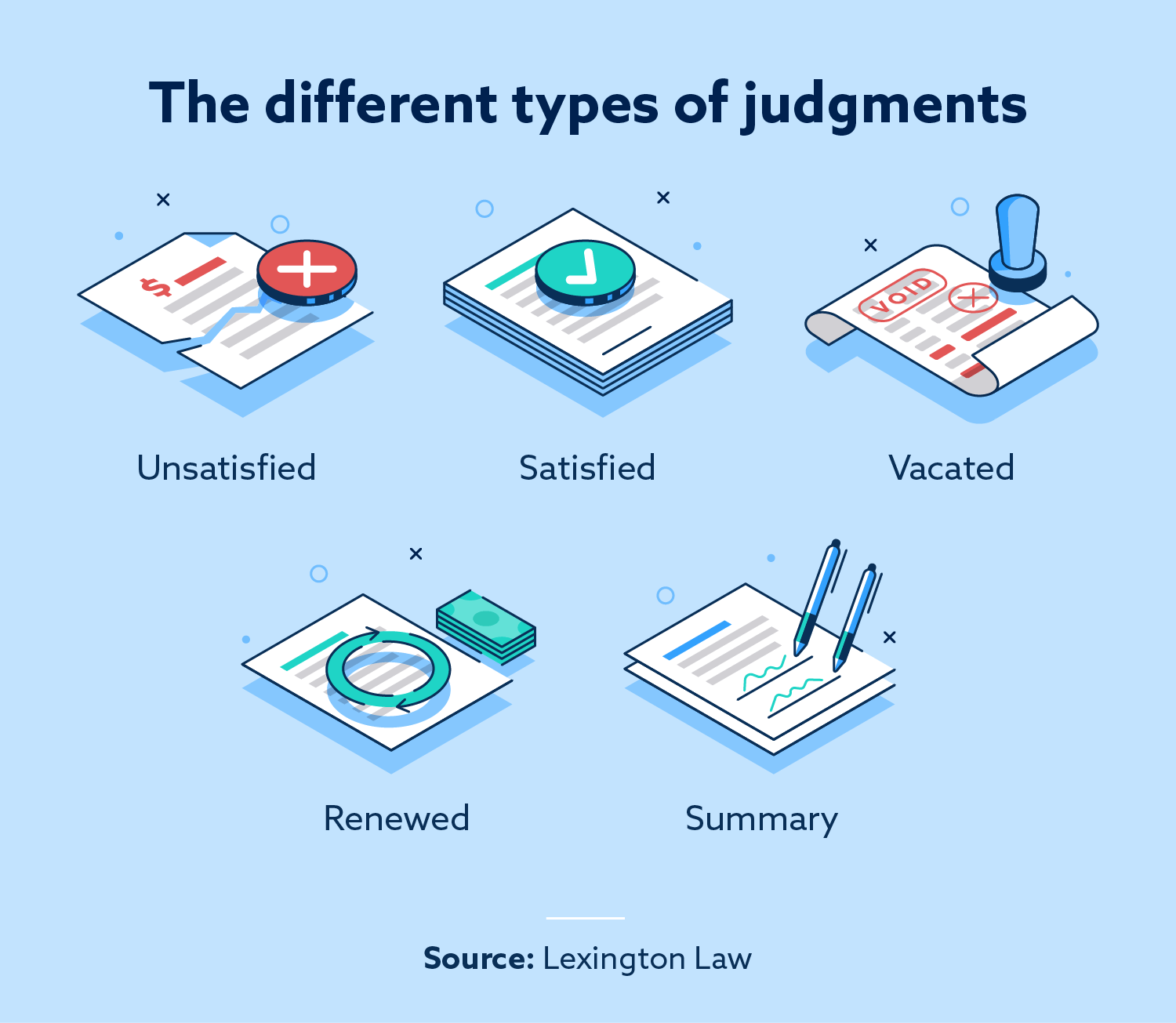

What are 3 types of Judgement

There are several types of judgments that will suffice in this situation. The pretrial types of judgments are as follows: Confession of Judgment, Consent Judgment, Default Judgment.

Can a creditor remove a Judgement

You may dispute a judgment on your credit report based on the following arguments: The Debt Was Paid. The credit agencies will remove the judgment from your credit report if you can show that you did, in fact, pay your debt on time.

How do you negotiate a Judgement settlement

There's a lot more to settling a judgment than I thought.Figure out who owns the judgment.Figure out who to contact about settling the judgment.Figure out the correct balance.Negotiate a settlement.Hope that you're getting a good deal on your settlement.Pay the agreed upon amount.

Can you get a loan with a Judgement on your credit

“The Mortgagee must verify that court-ordered Judgments are resolved or paid off prior to or at closing.” That is a good indication to the borrower that a judgment is not an automatic barrier to loan approval.

Will a civil Judgement hurt my credit

Civil Judgments Don't Impact Your Credit Scores Anymore

As a result, civil judgments currently don't appear in your credit history or hurt your credit scores. The changes also lead to the removal of liens from their credit reports.