What does ACH credit IRS mean?

What is an ACH payment from the IRS

Payment options include Automated Clearing House (ACH), in which your payment is debited from your checking or savings account, or debit/credit card. These options are available using Pay.gov® and are convenient, safe, and secure and available 24/7.

Why did I get an ACH credit

Direct deposit

Direct deposits from an employer to an employee's checking account are a type of ACH credit. The employer has likely set up an automatic recurring ACH transfer that operates as a credit—pushing the money from their bank account to yours.

What is a ACH tax credit

Electronic Funds Transfer – Automated Clearing House (ACH) Credit. The ACH Credit method allows you to transfer funds by instructing your financial institution to debit your account and credit the Department's bank account. This transfer is initiated by you through your financial institution.

What does ACH mean on my checking account

The Automated Clearing House (ACH) is the primary system that agencies use for electronic funds transfer (EFT). With ACH, funds are electronically deposited in financial institutions, and payments are made online.

Is a tax refund an ACH payment

Yes, an RDFI may post IRS tax refunds received through the Automated Clearing House (ACH) network using the account number only.

Does IRS use ACH for direct deposit

Once the identifying code is entered into the Addenda Information Field, the full refund amount is returned to the IRS via ACH direct deposit through the Treasury Department's Bureau of Fiscal Service.

Is an ACH considered a bad check

An Automated Clearing House (ACH) return is the equivalent of a bounced check. An ACH return occurs when a registrant provides bank information in order to make a payment; however, the payment is returned by the bank for one of many reasons, the most common of which include: Insufficient funds.

What is an example of an ACH payment

ACH Processing Examples:

Direct deposit from an employer (your paycheck) Paying bills with a bank account. Transferring funds from one bank account to another (Venmo, PayPal, etc.) Sending a payment to the IRS online.

What are examples of ACH payments

ACH Processing Examples:Direct deposit from an employer (your paycheck)Paying bills with a bank account.Transferring funds from one bank account to another (Venmo, PayPal, etc.)Sending a payment to the IRS online.Customers paying a service provider.Businesses paying vendors and suppliers for products and services.

Why did I get an unexpected tax refund

— Some people received refund checks from the IRS even though they were told they owed them money. Is it simply just a nice surprise or a mistake One tax expert says it could be the result of an error in completing the return, so the IRS corrected it and sent a refund.

How long does it take for the IRS to process an ACH payment

How do I know my payment actually got to the IRS and on time Your confirmation number confirms that you've approved IRS to make the bank withdrawal. If the withdrawal is successful, you will get credit for the day you selected in Direct Pay, though it may take up to two business days to actually process.

Is an ACH payment a check payment

ACH stands for Automated Clearing House, a U.S. financial network used for electronic payments and money transfers. Also known as “direct payments,” ACH payments are a way to transfer money from one bank account to another without using paper checks, credit card networks, wire transfers, or cash.

What is an example of an ACH credit transfer

An ACH credit is a type of ACH transfer where funds are pushed into a bank account. That is, the payer (e.g. customer) triggers the funds to be sent to the payee (e.g. merchant). For example, when an individual sets up a payment through their bank or credit union to pay a bill, this would be processed as an ACH credit.

Who uses ACH payments

Businesses in the US use ACH payments for paying bills, wages, mortgages, and loans, and for making direct deposits. Electronic payments made through the ACH network must follow guidelines provided by the National Automated Clearing House Association, or NACHA.

What happens if the IRS accidentally sends you money

Call the IRS toll-free at 800-829-1040 (individual) or 800-829-4933 (business) to explain why the direct deposit is being returned.

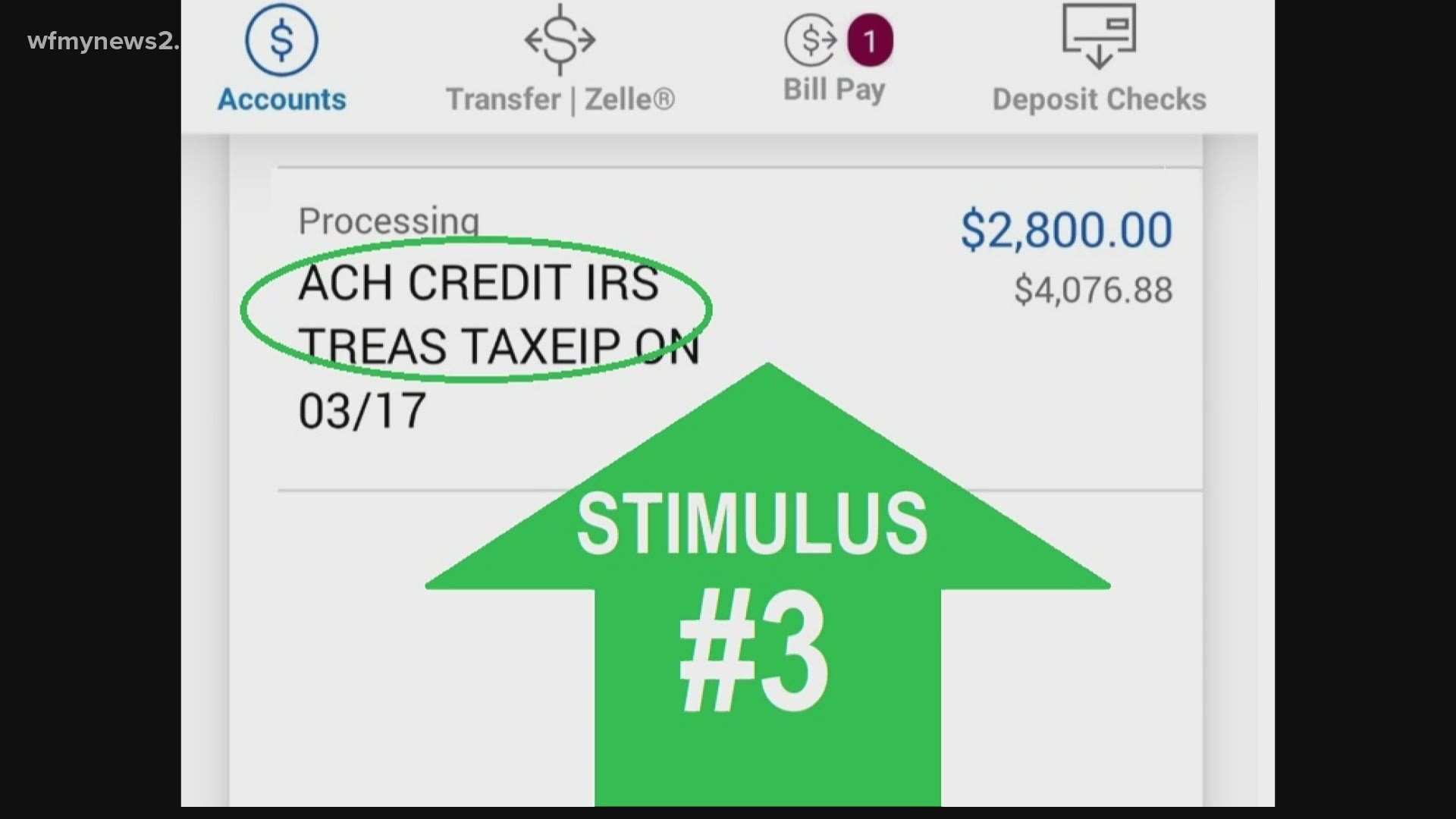

Why did I just receive money from the IRS

It could be: A refund from a filed tax return, including an amended tax return or an IRS tax adjustment to your tax account – this will show as being from the IRS (“IRS TREAS 310”) and carry the code “TAX REF.”

What is the difference between ACH credit and ACH deposit

The main difference between an ACH credit and an ACH debit is that an ACH credit transaction is initiated by the sender of funds (typically a bank), whereas an ACH debit transaction is initiated by the receiver of funds, where the bank receives a payment request by the payee, and then sends the funds per request.

Is it safe to receive ACH payments

ACH payments go through a clearinghouse that enforces rules and regulations while keeping account numbers confidential. Because of this, ACH payments are more secure than other forms of payment. Paper checks that pass through multiple hands, clearly display bank details and are too often lost or stolen.

Why did IRS send me money

It could be: A refund from a filed tax return, including an amended tax return or an IRS tax adjustment to your tax account – this will show as being from the IRS (“IRS TREAS 310”) and carry the code “TAX REF.”

What to do if you get an unexpected tax refund

Call the IRS toll-free at 800-829-1040 (individual) or 800-829-4933 (business) to explain why the direct deposit is being returned.