What does available credit mean Discover card?

Does available credit mean I can spend it

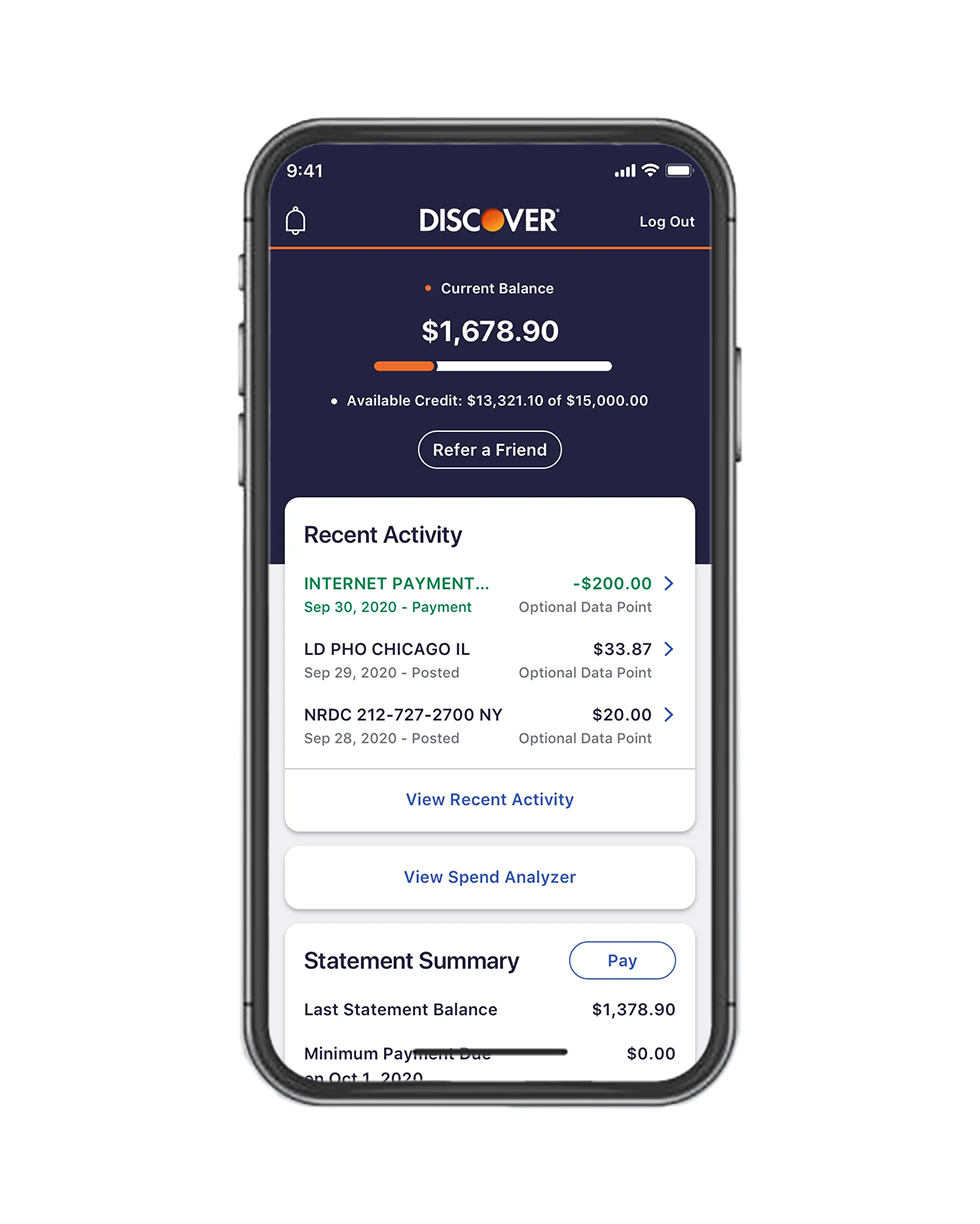

There are two numbers you should know before you swipe that plastic: Your credit limit and your available credit. Your credit limit is the maximum amount you can charge on your credit card, and your available credit is what's left for you to use after factoring in your current balance.

Cached

What is the difference between Discover balance and available credit

Your current balance is the total of all the posted transactions as of the previous business day. Your available credit is figured by subtracting your current balance (or amount already used) from your credit limit and adding any outstanding charges that have not posted yet.

Cached

How long does it take for available credit after payment on Discover

Discover will credit payments to your account the same day if they're received by midnight Eastern Time, 6 days a week. Discover does not process payments on Saturday. If Discover receives a payment after midnight on a Friday, or on a bank holiday, it will credit to your account the next business day.

Why is my Discover card paying but no available credit

If you've paid off your credit card but have no available credit, the card issuer may have put a hold on the account because you've gone over your credit limit, missed payments, or made a habit of doing these things.

How much should I spend on a $300 credit limit

You should try to spend $90 or less on a credit card with a $300 limit, then pay the bill in full by the due date. The rule of thumb is to keep your credit utilization ratio below 30%, and credit utilization is calculated by dividing your statement balance by your credit limit and multiplying by 100.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

Is available credit good or bad

The more available credit you have, the lower your credit utilization ratio is likely to be, and that translates into a higher credit score. However, if you're the type of person who looks at your available credit as a free license to increase your debt, more available credit could backfire.

What happens if I go over my credit limit but pay it off immediately

If it is a one-time event and you quickly pay your balance so that it is well below the limit, it may have little or no impact on your credit report. But if you tend to stay close to your limit and go over your credit limit repeatedly, your credit score will suffer.

Does Discover available credit include pending transactions

How does a Pending Transaction affect my Account balance and credit limit Pending Transactions are deducted from your available credit immediately, but are not included in your Account balance.

Why does my credit card say available credit

Available Credit- How much you have left for this cycle. An authorization limit that is the dollar value of the remaining available credit associated with a cardholder's account.

Why can’t I spend my available credit

If all available credit has been used, then the credit limit has been reached, the account is maxed out, and the available credit is zero. If the account has reached the credit limit, some credit card companies will allow the account balance to exceed the limit, but others will decline new transactions.

How much of a $700 credit limit should I use

NerdWallet suggests using no more than 30% of your limits, and less is better. Charging too much on your cards, especially if you max them out, is associated with being a higher credit risk.

How much of a $500 credit limit should I use

It's commonly said that you should aim to use less than 30% of your available credit, and that's a good rule to follow.

Is a $500 credit limit good

A $500 credit limit is good if you have fair, limited or bad credit, as cards in those categories have low minimum limits. The average credit card limit overall is around $13,000, but you typically need above-average credit, a high income and little to no existing debt to get a limit that high.

How much of a $1,500 credit limit should I use

NerdWallet suggests using no more than 30% of your limits, and less is better. Charging too much on your cards, especially if you max them out, is associated with being a higher credit risk.

How much of my $500 credit limit should I use

Lenders generally prefer that you use less than 30 percent of your credit limit. It's always a good idea to keep your credit card balance as low as possible in relation to your credit limit. Of course, paying your balance in full each month is the best practice.

What is 30 percent of $500 credit limit

Answer: 30% of 500 is 150.

= 150.

How much should you spend on a $500 credit limit

It's commonly said that you should aim to use less than 30% of your available credit, and that's a good rule to follow.

Can I spend more than my available credit

Can you go over your credit limit Yes, you can go over your credit limit, but there's no surefire way to know how much you can spend in excess of your limit. Card issuers may consider a variety of factors, such as your past payment history, when deciding the risk of approving an over-the-limit transaction.

What is available credit after payment

That means the available credit for a credit card holder is the amount left when you subtract all your purchases (and the interest on those charges) from the maximum credit limit on the credit card. Once the account balance reaches the credit limit, the account has been maxed out and the available credit is zero.