What does credit do with insurance?

What does credit have to do with insurance

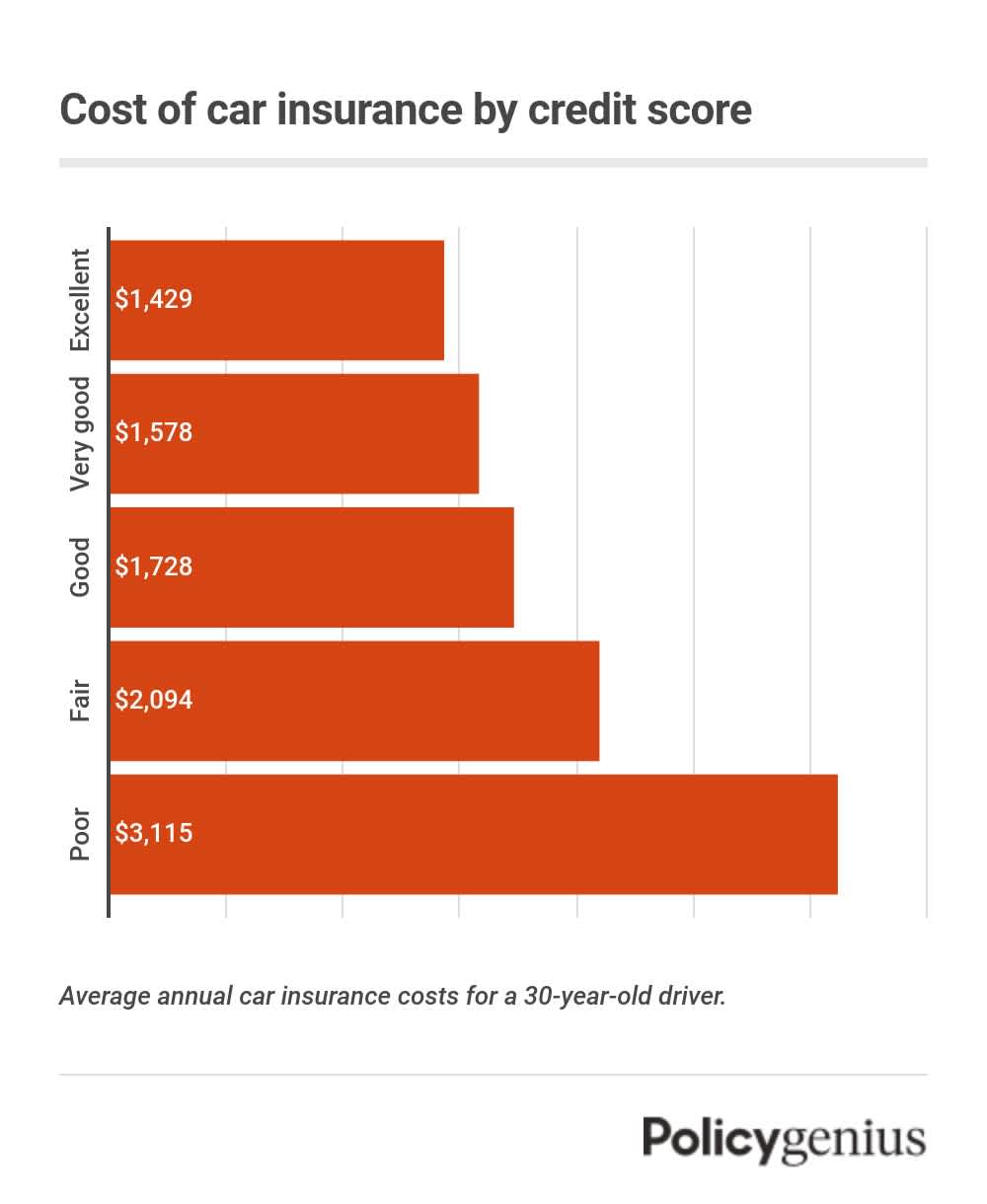

Statistical analysis shows that those with worse insurance score are more likely to file a claim. Those with better credit scores tend to get into fewer accidents and cost insurance companies less than their worse-scoring counterparts.

Cached

Does insurance go to credit

No, insurance companies don't report to credit bureaus. Credit agencies won't know if you make all your car insurance payments late or on time, and your credit won't be affected either way.

Why do insurance companies run your credit

Insurance companies check your credit score in order to gauge the risk they'll take to insure you. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

What is a good credit score for car insurance

A good insurance score is roughly 700 or higher, though it differs by company. You can improve your auto insurance score by checking your credit reports for errors, managing credit responsibly, and building a long credit history.

Why does insurance run credit

Insurance companies check your credit score in order to gauge the risk they'll take to insure you. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

Why do insurance companies use your credit score

Why do insurance companies use credit information Some insurance companies have shown that information in a credit report can predict which consumers are likely to file insurance claims. They believe that consumers who are more likely to file claims should pay more for their insurance.

Can you be turned down for insurance because of your credit score

In some cases, your credit won't be used to determine your insurance premium. If you live in California, Hawaii, Massachusetts or Michigan your credit score isn't a rating factor.

Why does credit affect car insurance

The reason insurers check your credit is because studies have shown that credit rating tends to be a good indicator of how many claims a driver will file. That allows insurers to match more expensive rates with drivers who will likely use their insurance more.

Does changing insurance affect credit

No, switching car insurance isn't bad and won't lead to penalties or hits to your credit score. Drivers typically don't incur cancellation fees, even mid-policy. While it can be a pain to switch car insurance companies in the middle of your contract, you won't face any negative consequences for doing so.

Do insurance claims affect credit score

Insurance companies don't report information about your premium payments or claims (or lack thereof) to the national credit bureaus. Some insurers use credit checks to help set your premiums, however, and failure to pay insurance bills could lead to negative entries on your credit report.

What is a good credit based insurance score

776 to 997

According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score. So, what is a good insurance score Anything over 775.

Will your credit score go down if you don t pay your insurance to cancel it

No, canceling your car insurance policy won't affect your credit score. Credit reports don't include information about when you purchase or cancel car insurance policies, which means there is no impact on your credit score.

Why do insurance companies check credit

Why do auto insurers check credit Your credit history factors into your credit-based insurance score, which insurance companies use to help predict the likelihood of a future accident or claim. Note that certain states have laws that don't allow the use of credit information as part of car insurance pricing.

Why does credit matter for insurance

The reason insurers check your credit is because studies have shown that credit rating tends to be a good indicator of how many claims a driver will file. That allows insurers to match more expensive rates with drivers who will likely use their insurance more.

Why is insurance tied to credit score

The reason insurers check your credit is because studies have shown that credit rating tends to be a good indicator of how many claims a driver will file. That allows insurers to match more expensive rates with drivers who will likely use their insurance more.

Do insurance companies run your credit for a quote

Insurance quotes do not affect credit scores. Even though insurance companies check your credit during the quote process, they use a type of inquiry called a soft pull that does not show up to lenders. You can get as many inquiries as you want without negative consequences to your credit score.

What is the highest insurance score you can have

The higher your insurance score, the better an insurer will rate your level of risk in states where insurance scores are a rating factor. According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.

Does cancelling insurance hurt credit

No, canceling your car insurance policy won't affect your credit score. Credit reports don't include information about when you purchase or cancel car insurance policies, which means there is no impact on your credit score.

Do car insurance companies run your credit

Do all auto insurance companies check your credit Most insurers use credit checks to create a credit-based insurance score to help set your rate. Some insurers provide auto insurance with no credit check, which might seem appealing if you have a poor credit history.

Does unpaid insurance go on your credit

While your auto insurance payment history will not directly affect your credit, you'll want to avoid any significant payment issues that may be turned over to a collection agency or reported to your state's DMV.