What does EMV stand for in credit cards?

What is EMV in credit card processing

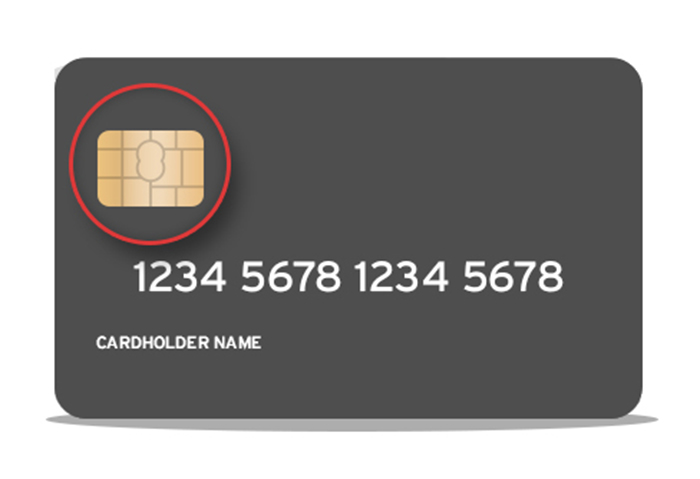

What does EMV stand for EMV is short for Europay, MasterCard, and Visa, the 1994 founders. It's a secure software for payments and commonly refers to a credit card with a smart chip. The EMV standard is a security technology used worldwide for all payments done with credit, debit, and prepaid EMV smart cards.

What is the difference between EMV and chip card

EMV chip cards are much more secure than magnetic stripe cards. While magnetic chips retain static information, EMV chips store a digital code that changes with every purchase. This one-time digital signature is hard to copy and makes it much more difficult for fraudsters to steal data from a chip card.

How do I know if my credit card has an EMV chip

Put simply, it's that small, metallic square you'll see on your card. That's a computer chip, and it's what sets EMV cards apart from traditional credit cards that use a magnetic stripe.

Cached

Do all credit cards have an EMV chip

Every credit card issued in the U.S. is equipped with EMV® technology. All EMV® cards have the Chip-and-Signature verification mode, but not all have Chip-and-PIN. See our listing of issuers that offer Chip-and-PIN cards if you're going to be traveling outside the U.S.

Why are banks switching to EMV cards

Security benefits: EMV cards are more secure than cards that only have a magnetic stripe, which is one of several reasons why the U.S. – and much of the world – has made the switch.

What will ruin an EMV credit card chip

Instead of a magnetic strip that you swipe, most credit cards now have an EMV chip that you insert into a card reader or even use to pay contactlessly. Luckily EMV chips aren't affected by magnets. However, scratches or prolonged exposure to water can cause damage or make them stop working altogether.

What is the disadvantage of EMV

The Cons of Credit Cards with a Chip

EMV was designed to prevent fraudulent transactions, but it does nothing for the data once you lose control of your card. Hackers can easily get this information from unencrypted transaction info stored on company devices.

What are the disadvantages of EMV chip cards

The Cons of Credit Cards with a Chip

The chips may not be as secure as we think they are. EMV was designed to prevent fraudulent transactions, but it does nothing for the data once you lose control of your card. Hackers can easily get this information from unencrypted transaction info stored on company devices.

Is it safer to tap your credit card rather than insert the chip

More Secure. Tapping to pay isn't all about making your life simpler, but it also creates a more secure way to shop. By using a mix of chip technology, Near Field Communication (NFC), and Radio Frequency Identification (RFID), tapping to pay is safer than your classic swipe or insertion of a credit or debit card.

Can I swipe my card instead of using chip

If you are unable to insert your chip card into a chip terminal, you can always swipe your card to complete the transaction. Most often, merchants that haven't activated their terminals will block the chip slot.

Can a card with EMV chip be cloned

EMV chips themselves cannot be cloned. However, fraudsters can create a workable card clone by copying data from the card's chip and transferring it to a magnetic stripe card.

Do skimmers work on tap to pay

More videos on YouTube

The tap-to-pay method of payment used in contactless card transactions does not put the card in contact with card skimmers, which are typically hidden inside of card readers.

Why can’t you swipe a chip card

You see, if you swipe a chip card instead of inserting it into slot, the merchant is responsible for covering any fraudulent charges — not the bank. And some retailers aren't in a financial position to cover major security breaches, like that corner store you picked up a gallon of milk from in a pinch.

Is tapping credit card safer than chip

More Secure. Tapping to pay isn't all about making your life simpler, but it also creates a more secure way to shop. By using a mix of chip technology, Near Field Communication (NFC), and Radio Frequency Identification (RFID), tapping to pay is safer than your classic swipe or insertion of a credit or debit card.

Is chip safer than swipe

Chip cards are more secure than cards that solely use a magnetic stripe. Cards that use the EMV chip technology are harder for fraudsters to copy from in-person transactions. Magnetic stripe cards carry static data directly in the magnetic stripe.

Can ATMs detect cloned cards

But new research suggests retailers and ATM operators could reliably detect counterfeit cards using a simple technology that flags cards which appear to have been altered by such tools. A gift card purchased at retail with an unmasked PIN hidden behind a paper sleeve.

Can EMV chips be tracked

The smart chip is not a locator system, so the physical location of a credit or debit card cannot be tracked. Also known as an EMV chip, this smart chip embedded on your card creates dynamic data for every transaction, which makes it nearly impossible for criminals to steal or clone your information.

Can you tell if an ATM has a skimmer

Look for hidden cameras

At the gas pump or ATM, inspect what's around the card reader. Look closely above it to see if there are any holes looking down on where you would insert your card. There might be a hidden camera capturing you entering your PIN. Keep in mind that ATMs often have security cameras built into them.

How do you tell if your card has been skimmed

Know the Signs of Card SkimmingUnusual damage to the card reader.Glue or adhesive marks on or around the card reader.Unusual brochure holders or plastic panels added above/near the card reader or PIN pad that could contain a camera.Unusual feeling keyboard or a keyboard that sits higher than usual.

Is tapping a credit card safer than swiping

Tapping to pay isn't all about making your life simpler, but it also creates a more secure way to shop. By using a mix of chip technology, Near Field Communication (NFC), and Radio Frequency Identification (RFID), tapping to pay is safer than your classic swipe or insertion of a credit or debit card.