What does having a creditor mean?

What does it mean when someone is a creditor

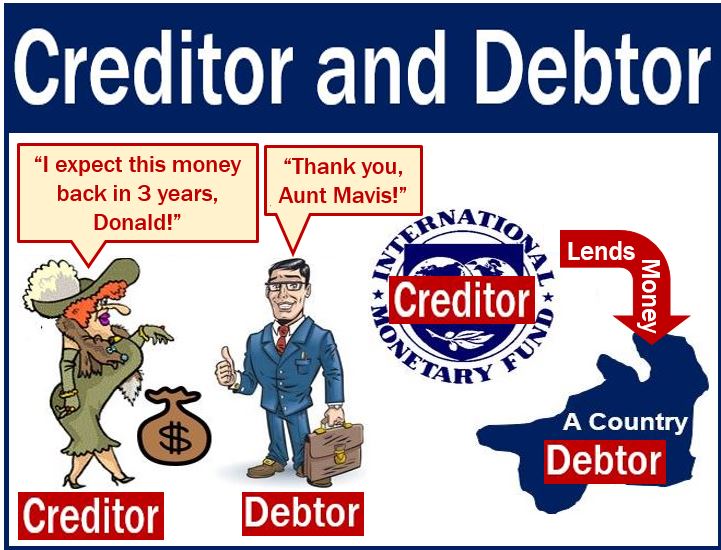

Creditors are individuals, people, or other entities (i.e., organisation, government body, etc.) that are owed money because they have provided goods or services or loaned money to another entity. Generally speaking, you can expect to deal with two types of creditors: loan creditors and trade creditors.

Is a creditor someone you owe

Simply put, a creditor is an individual, business or any other entity that is owed money because they have provided a service or good, or loaned money to another entity.

What is an example of a creditor

What is an example of a creditor Here are some common creditors you may encounter: Friend or family member you owe money to. Financial institution, like a bank or credit union, that extends you a personal loan, installment loan, or student loan.

Cached

What is the difference between a debt holder and a creditor

The difference between a debtor and a creditor is that the creditor is the one who lends money in a credit relationship, and the debtor is the one who borrows it.

Cached

What power does a creditor have

The most important power that a creditor has is to have a company liquidated (legally shut down). A liquidator is someone who is appointed to wind up a company. A creditor can ask a court to appoint a liquidator if the company is unable to pay its debts.

Can anyone be a creditor

There are several types of creditors, such as real creditors, personal creditors, secured creditors and unsecured creditors. Real creditors: A real creditor is a financial institution, such as a bank or credit card issuer, that has a right to be repaid. Personal creditors: These are friends or family you owe money.

Do creditors ever forgive debt

Debt forgiveness happens when a lender forgives either all or some of a borrower's outstanding balance on their loan or credit account. For a creditor to erase a portion of the debt or the entirety of debt owed, typically the borrower must qualify for a special program.

What happens if you owe creditors

If You Owe Money

The creditor will sell your debt to a collection agency for less than face value, and the collection agency will then try to collect the full debt from you. If you owe a debt, act quickly — preferably before it's sent to a collection agency.

What are the three types of creditors

Personal creditors: These are friends or family you owe money. Secured creditors: These lenders have a legal right — often through a lien — to property you used as collateral to secure the loan. Unsecured creditors: A credit card issuer is a good example of this type of creditor.

How do creditors make money

The Business Definition of Creditor

Creditors make money by charging interest on the money they loan out to other people or institutions. For example, a creditor could lend a borrower $10,000 with a five percent interest rate.

Can I pay the creditor instead of the debt collector

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

Who does a creditor belong to

Creditors are the parties to whom debtors should pay back. Debtors are mentioned under the category known as accounts receivable as a current asset, while creditors come under accounts payable as a current liability.

What action can creditors take

A judgement can be granted only after your creditors take certain steps including writing to you advising that you are in default and offering solutions, issuing a summons if you cannot find a solution or don't respond, and approaching the court for a judgement that will allow them to enforce the debt.

What can creditors do or not do

They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you. Debt collectors cannot make false or misleading statements.

What debts Cannot be forgiven

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

What happens if you ignore creditors

Ignoring or avoiding the debt collector may cause the debt collector to use other methods to try to collect the debt, including a lawsuit against you. If you are unable to come to an agreement with a debt collector, you may want to contact an attorney who can provide you with legal advice about your situation.

What are the most common creditors

Examples of common creditorsReal creditors: A real creditor is a financial institution, such as a bank or credit card issuer, that has a right to be repaid.Personal creditors: These are friends or family you owe money.

Why are creditors important

Creditors play an important role in international trade through the supply of goods and services to international traders. Credit is a key driver of international trade growth and innovation as it allows business success goods and services which they can trade with and pay for later.

What happens if you never pay collections

If you ignore a debt in collections, you can be sued and have your bank account or wages garnished or may even lose property like your home. You'll also hurt your credit score. If you aren't paying because you don't have the money, remember that you still have options!

Is it better to pay creditor or collection agency

It's important to try and pay the original creditor before a debt gets sent to collections. In some cases, the original creditor may be able to reclaim the debt from collections and work out a payment plan with you. A collection account on your credit report harms your credit score considerably.