What does it mean to be pre-approved for an upgrade on your credit card?

What does preapproved mean with upgrade

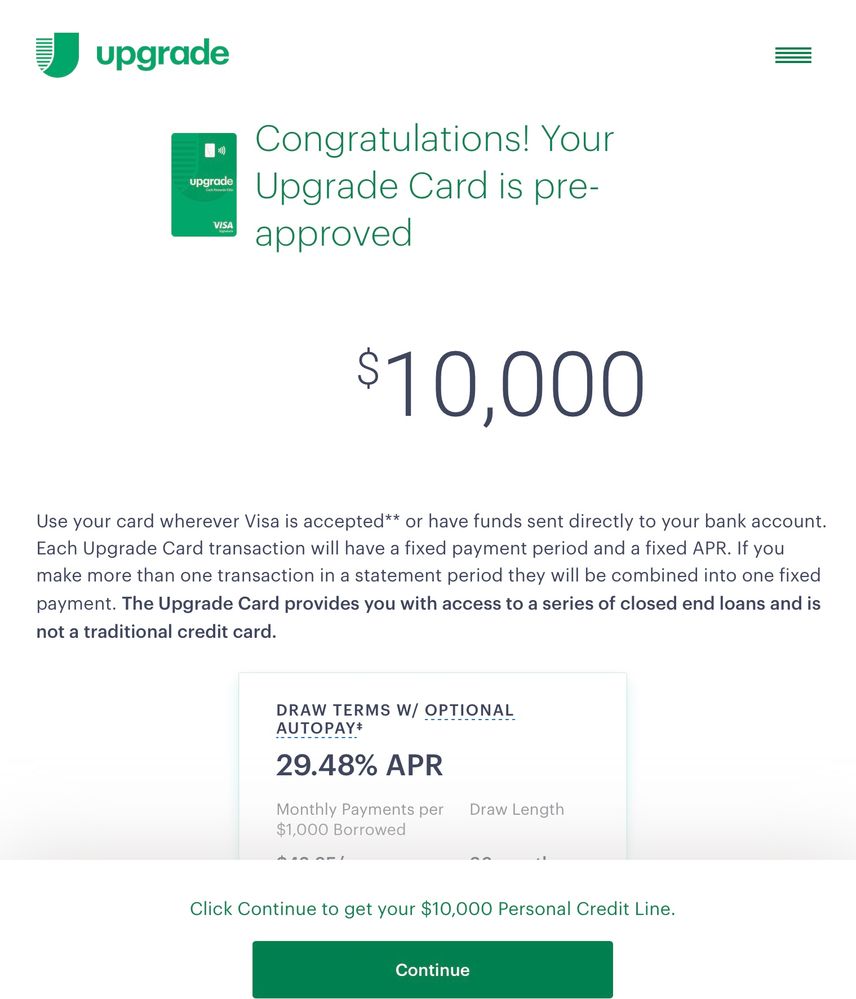

Receiving a pre-approved letter means that you have met the minimum borrowing requirements based on information obtained from your credit report. Please keep in mind that this does not yet take into account other factors that we'll verify should you submit an application, such as employment and income.

Cached

How do you qualify for an upgrade card

Upgrade Credit Card RequirementsAt least 18 years old.Physical U.S. address (no P.O. boxes)Proof of enough income to make the monthly minimum payment.Social Security number.Fair credit or better.Checking or savings account.

Cached

Should I accept a pre-approved credit card

The bottom line

Credit card preapprovals are usually a good sign since they show you have met basic criteria like having good credit or a history of employment. That said, you may not want to go after the first prequalified credit card offer you receive.

What is the credit score limit for upgrade

560

Borrower Requirements

Borrowers with fair or lower credit can apply for a loan through Upgrade, which sets this company apart from competitors with higher minimum credit score requirements. Upgrade requires that borrowers have a credit score of just 560 and a maximum debt-to-income ratio of 75%.

Does pre-approved mean you will get it

When a credit card offer mentions that someone is pre-qualified or pre-approved, it typically means they've met the initial criteria required to become a cardholder. But they still need to apply and get approved. Think of these offers as invitations to start the actual application process.

Does pre-approval mean you are approved

Both pre-qualified and pre-approved mean that a lender has reviewed your financial situation and determined that you meet at least some of their requirements to be approved for a loan. Getting a pre-qualification or pre-approval letter is generally not a guarantee that you will receive a loan from the lender.

Is it easy to get approved by upgrade

The loans are also fairly easy to get, requiring a credit score of only 620 for approval. Plus, Upgrade loans are available to U.S. citizens as well as permanent residents of the U.S. and immigration-visa holders.

What are the disadvantages of upgrade card

The Upgrade card will hold you to paying a higher monthly payment each month so your interest charges over time won't run rampant, however it doesn't offer the flexibility to pay a lower amount in a cash-strapped month like a traditional credit card does.

Can you get denied after pre-approval

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval. If this happens, do not despair.

How fast does upgrade approve loans

within 1 to 4 business days

Upgrade may approve you within 1 to 4 business days, but it can take longer if the company needs extra documentation to verify your information. After your application is approved and you accept the offer, it may take a few more days to receive your funds, which Upgrade will send by electronic bank transfer.

What happens if I get pre-approved

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. They'll also perform a credit check.

Can you be denied after pre-approval

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval. If this happens, do not despair.

Is pre-approved a good thing

Getting a pre-qualification or pre-approval letter is generally not a guarantee that you will secure a loan from the lender. However, it may help you prove to a seller that you are able to receive financing for your purchase.

Does Upgrade card verify income

Upgrade does not publicize their income requirements, but they will ask for documents to verify an applicant's income. Upgrade's personal loans range from $1,000 to $50,000. Borrowers can repay their Upgrade personal loans within 36 to 60 months.

Does the Upgrade card build your credit

Is the Upgrade Card for You The Upgrade Visa® Card* can be a solid option for improving credit for those who don't want a secured card and don't need rewards.

What credit score do you need for the upgrade one card

The Upgrade card delivers an impressive cash back rate for such a low-fee card available for cardholders with “average” credit or higher (580+ FICO score). Cardholders get an unlimited 1.5 percent cash back on all purchases when they are paid back on time.

Does upgrade always verify income

Upgrade does not publicize their income requirements, but they will ask for documents to verify an applicant's income. Upgrade's personal loans range from $1,000 to $50,000. Borrowers can repay their Upgrade personal loans within 36 to 60 months.

Does pre-approval mean anything

Both pre-qualified and pre-approved mean that a lender has reviewed your financial situation and determined that you meet at least some of their requirements to be approved for a loan. Getting a pre-qualification or pre-approval letter is generally not a guarantee that you will receive a loan from the lender.

Is a pre-approval a guarantee

A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount. This document is based on certain assumptions and it is not a guaranteed loan offer.

Is it easy to get approved by Upgrade

The loans are also fairly easy to get, requiring a credit score of only 620 for approval. Plus, Upgrade loans are available to U.S. citizens as well as permanent residents of the U.S. and immigration-visa holders.