What does it mean when an account closed on your credit report?

Is it good when an account is closed on credit report

A closed account in good standing will remain on your credit report for up to 10 years. Remember, the presence of this type of account on your credit report is a positive. As TransUnion and Experian note, a closed account that shows a positive history of payments is likely to help your credit score.

Cached

Do I still owe money on a closed account

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor. In most situations, creditors will not reopen closed accounts.

Cached

What does it mean if an account is closed on your credit report

A creditor may close an account because you requested the closure, paid the account off or replaced it with a loan, or refinanced an existing loan. Your account may also be closed because of inactivity, late payments or because the credit bureau made a mistake.

Cached

Does a closed account look bad on your credit

Closed accounts that were never late can remain on your credit report for up to 10 years from the date they were closed. If the accounts you mentioned are showing as potentially negative, it's likely due to delinquencies noted in the history of the account.

Cached

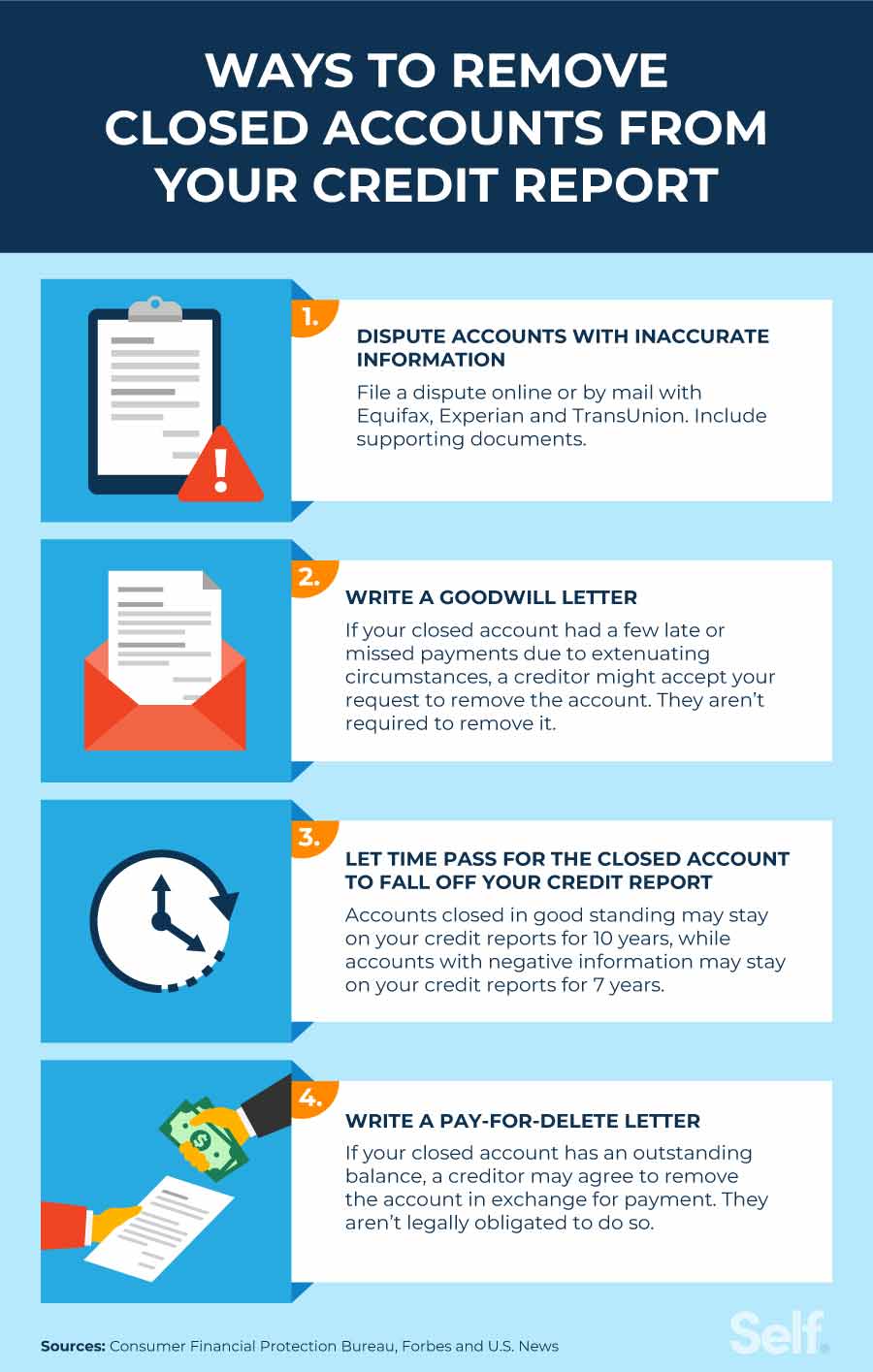

How do I fix a closed account on my credit report

You cannot remove a closed accounts from your credit report unless the information listed is incorrect. If the entry is an error, you can file a dispute with the three major credit bureaus to have it removed, but the information will remain on your report for 7-10 years if it is accurate.

Does a closed account go to collections

Closed accounts with remaining balances – like a canceled credit card account with an outstanding balance – can also affect your score negatively. If the account defaulted, it could be transferred to a collection agency.

How do I get closed accounts off my credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Do closed accounts get removed

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

How long after an account is closed does it stay on credit report

10 years

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

How much does credit score drop with closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

What is the difference between a charge off and a closed account

"Charge off" means that the credit grantor wrote your account off of their receivables as a loss, and it is closed to future charges. When an account displays a status of "charge off," it means the account is closed to future use, although the debt is still owed.

Do closed accounts affect buying a house

In closing, for most applicants, a collection account does not prevent you from getting approved for a mortgage but you need to find the right lender and program.

Should you pay closed accounts

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time.

Do I have to pay closed collections

It may be sold to a debt buyer or transferred to a collection agency. So does that mean I don't owe the debt any longer No. You're still legally obligated to pay the debt.

How long does it take a closed account to come off credit

How Long Do Closed Accounts Stay on Your Credit Report Generally speaking, if an account's payment history helps your credit score, it will stay on your credit reports for 10 years after it is closed.

What happens after the accounts have been closed

When an accountant closes an account, the account balance returns to zero.

Why would an account be closed

A bank can close your account without notice for any reason. But most of the time, banks close accounts when the account holder has violated terms in the account agreement. Account agreement violations could include inactivity for a prolonged period of time, repeated overdrafts or illegal activity.

Should you pay off open or closed accounts first

For this reason, leaving your credit card accounts open after you pay them off is usually better for credit scores as their credit limit will continue to factor into your utilization ratio.

How much does credit score drop for a closed account

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Should I pay a closed charged off account

Should I pay off charged-off accounts You should pay off charged-off accounts because you are still legally responsible for them. You will still be responsible for paying off charged-off accounts until you have paid them, settled them with the lender, or discharged them through bankruptcy.