What does judgment on credit mean?

How bad is a Judgement on your credit report

Judgments Don't Affect Your Credit Score, But Can Impact Your Application. Since judgments are not included in credit reports, they won't be factored into credit score calculations.

Cached

How do I fix a Judgement on my credit report

How to remove negative items from your credit report yourselfGet a free copy of your credit report.File a dispute with the credit reporting agency.File a dispute directly with the creditor.Review the claim results.Hire a credit repair service.

Can I get a Judgement removed from my credit

You may dispute a judgment on your credit report based on the following arguments: The Debt Was Paid. The credit agencies will remove the judgment from your credit report if you can show that you did, in fact, pay your debt on time.

How long does a Judgement last on your credit

seven years

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

Will a Judgement affect buying a house

Many mortgage companies will not lend to borrowers who have open or recently paid judgments. Judgments also keep credit scores low and can make them so low that you will not qualify for a mortgage even if it has been paid off. The effect a judgment has on your credit lessens over time.

How does a judgment affect you

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt.

How do you clear a judgment

There are only three ways in which a judgment can be made to go away: paying the debt, vacating the judgment or discharging the debt through bankruptcy.

How does a Judgement affect you

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt.

Does a Judgement ever expire

Money judgments automatically expire (run out) after 10 years. To prevent this from happening, you as the judgment creditor must file a request for renewal of the judgment with the court BEFORE the 10 years run out.

Can you negotiate after a Judgement

Negotiate With the Judgment Creditor

It's never too late to negotiate. The process of trying to grab property to pay a judgment can be quite time-consuming and burdensome for a judgment creditor.

Will a judgement affect buying a house

Many mortgage companies will not lend to borrowers who have open or recently paid judgments. Judgments also keep credit scores low and can make them so low that you will not qualify for a mortgage even if it has been paid off. The effect a judgment has on your credit lessens over time.

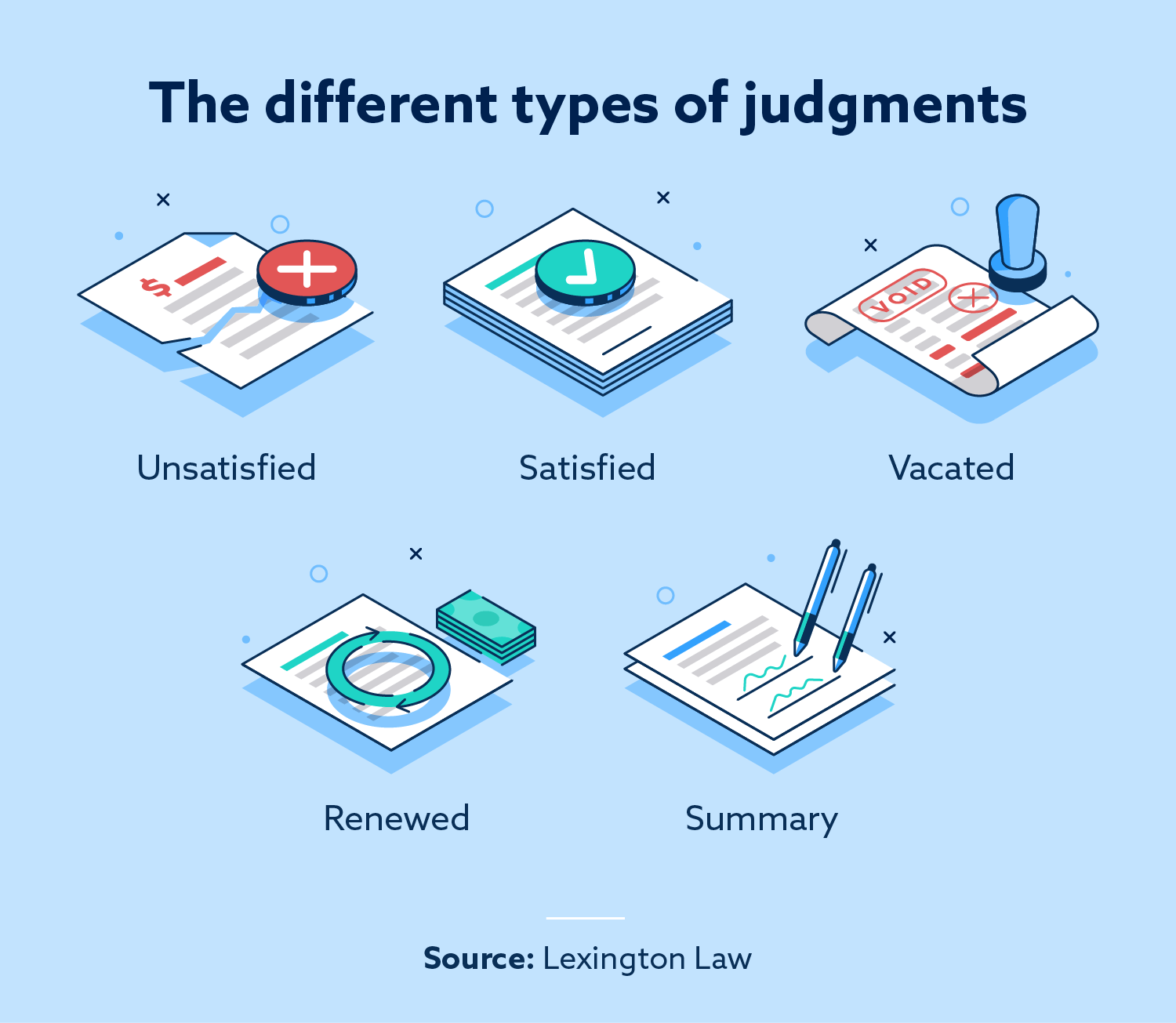

What are 3 types of judgement

There are several types of judgments that will suffice in this situation. The pretrial types of judgments are as follows: Confession of Judgment, Consent Judgment, Default Judgment.

How does a judgement affect you

You cannot be sent to jail for failing to pay a debt or for having a judgment against you; however, a judgment can greatly affect your financial position. A judgment allows a creditor to garnish wages, garnish bank accounts, or take a lien against property in your name.

Is judgment a good or bad thing

The negative feelings and actions that can result from unnecessary judgement can have a significant impact on our psychological well-being. In fact, studies have shown that unnecessary judgement increases levels of stress, anxiety, and feelings of depression.

What percentage should I ask a creditor to settle for after a Judgement

between 30%-50%

Most obligations settle between 30%-50% of the original value. If the debt collection agency is unwilling to accept any settlement, you may negotiate a payment plan with them. Payment plans can keep you out of court, and you won't need to fork over a large amount of cash at once.

What is a Judgement debt

A judgment is an official result of a lawsuit in court. In debt collection lawsuits, the judge may award the creditor or debt collector a judgment against you. You are likely to have a judgment entered against you for the amount claimed in the lawsuit if you: Ignore the lawsuit, or.

What is the purpose of the Judgement

Judgment is a court decision, spelled out in a court order, that adjudicates a dispute between two parties by determining the rights and obligations of each party.

What is an example of Judgement

We have to make a judgment about the value of their services. The judgment of the editors is final. Don't rush to judgment without examining the evidence. “Were his policies good or bad” “I'll have to reserve judgment on that.

What are the dangers of judgment

Judgement makes you Self-Critical

The more you judge others, the more you judge yourself. By constantly seeing the bad in others, we train our minds to find the bad. This can lead to increase in stress. Stress can weaken the immune system and cause high blood pressure, fatigue, depression, anxiety and even stroke.

Is a settlement better than a Judgement

A settlement is usually much easier to collect than a judgment, and the defendant will usually pay it more quickly and willingly. A settlement saves both sides the stress and expense of a trial and brings a quicker conclusion to the legal process.