What does PMI stand for?

What does the PMI stand for

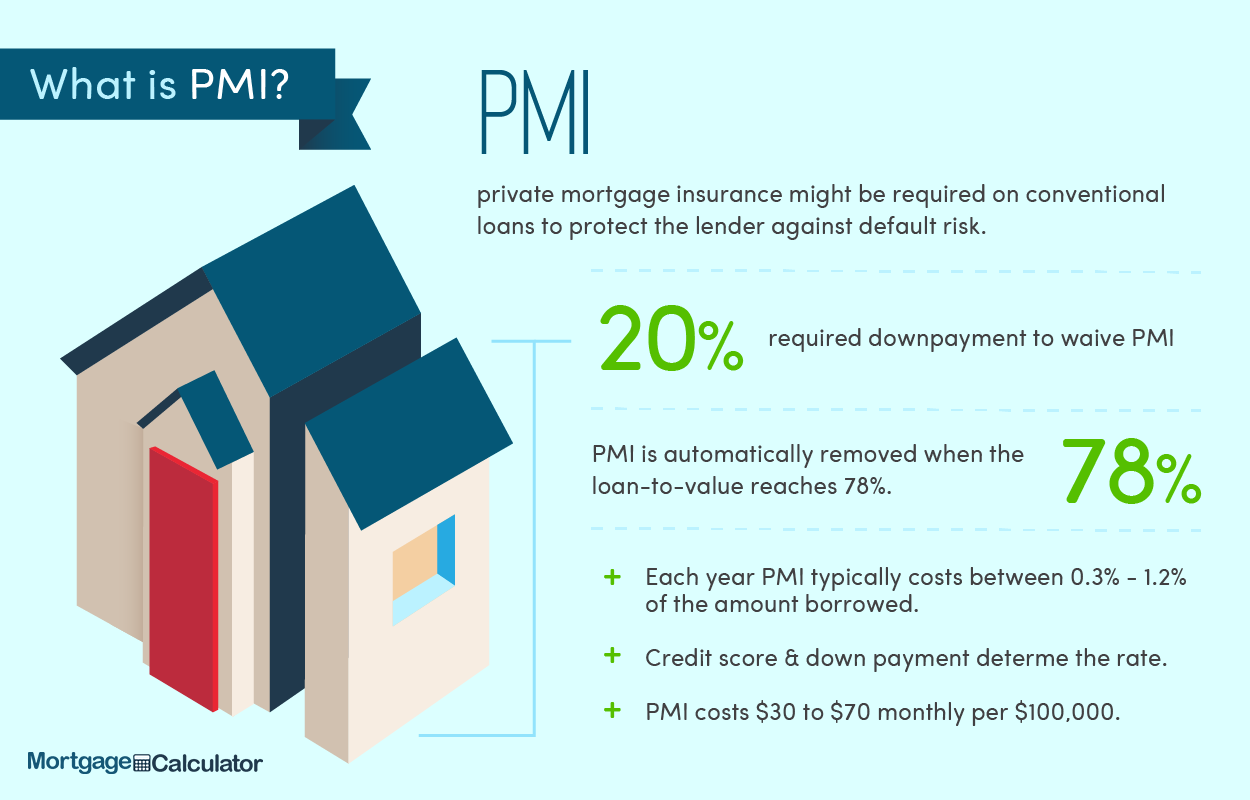

Private mortgage insurance, also called PMI, is a type of mortgage insurance you might be required to pay for if you have a conventional loan. Like other kinds of mortgage insurance, PMI protects the lender—not you—if you stop making payments on your loan.

Cached

What is PMI and how does it work

What is private mortgage insurance PMI is insurance for the mortgage lender's benefit, not yours. You pay a monthly premium to the insurer, and the coverage will pay a portion of the balance due to the mortgage lender in the event you default on the home loan.

Cached

How much is PMI on a $300 000 loan

But in general, the cost of private mortgage insurance, or PMI, is about 0.5 to 1.5% of the loan amount per year. This annual premium is broken into monthly installments, which are added to your monthly mortgage payment. So a $300,000 loan would cost around $1,500 to $4,500 annually — or $125 to $375 per month.

Cached

Is PMI good or bad

PMI is an avoidable extra cost associated with buying a home. That said, sometimes paying PMI is the right move; it can help you get into a home that would otherwise be out of reach.

Cached

How long do you pay PMI insurance

How long do you pay for PMI Homeowners typically pay PMI until they have reached 20 percent equity in their home, or an 80 percent or smaller loan-to-value (LTV) ratio on their mortgage. Loan servicers must terminate PMI once you reach a 78 percent LTV ratio, based on the home's original assessed value.

What is the difference between PMI and mortgage insurance

Mortgage insurance, also known as private mortgage insurance or PMI, is insurance that some lenders may require to protect their interests should you default on your loan. Mortgage insurance doesn't cover the home or protect you as the homebuyer. Instead, PMI protects the lender in case you are unable to make payments.

Is it better to put 20 down or pay PMI

Putting down 20% on a home purchase can reduce your monthly payment, eliminate private mortgage insurance and possibly give you a lower interest rate.

Does PMI go away after 20 percent

You can remove PMI from your monthly payment after your home reaches 20% in equity, either by requesting its cancellation or refinancing the loan.

At what point does PMI go away

When your loan balance reaches 78% of the home's original purchase price, your lender must automatically terminate your PMI. You can also request that your PMI be removed when you have 20% equity in your home.

How long does PMI last for

Final PMI termination

(This final termination applies even if you have not reached 78 percent of the original value of your home.) The midpoint of your loan's amortization schedule is halfway through the full term of your loan. For 30-year loans, the midpoint would be after 15 years have passed.

Can I avoid PMI with 7% down

How to avoid paying PMI To avoid PMI for most loans, you'll need at least 20 percent of the home's purchase price set aside for a down payment.

How do I avoid PMI with 15% down

To sum up, when it comes to PMI, if you have less than 20% of the sales price or value of a home to use as a down payment, you have two basic options: Use a "stand-alone" first mortgage and pay PMI until the LTV of the mortgage reaches 78%, at which point the PMI can be eliminated. 2. Use a second mortgage.

Can I drop my PMI after 2 years

If you've owned the home for at least five years, and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI to be canceled. If you've owned the home for at least two years, your remaining mortgage balance must be no greater than 75 percent.

Can you avoid PMI with 10%

How can I avoid PMI with 10 percent down If you can make a 10 percent down payment, you could avoid PMI if you use a second loan to finance another 10 percent of the home's purchase price. Combining these will satisfy your first mortgage lender's 20 percent down payment requirement, avoiding PMI.

Can I get rid of PMI without refinancing

The only way to cancel PMI is to refinance your mortgage. If you refinance your current loan's interest rate or refinance into a different loan type, you may be able to cancel your mortgage insurance.

Can you remove PMI without 20% down

You can avoid PMI without 20 percent down if you opt for lender-paid PMI. However, you'll end up with a higher mortgage rate for the life of the loan. That's why some borrowers prefer the piggyback method: Using a second mortgage loan to finance part of the 20 percent down payment needed to avoid PMI.

Does PMI automatically go away after 20 percent

When your loan balance reaches 78% of the home's original purchase price, your lender must automatically terminate your PMI. You can also request that your PMI be removed when you have 20% equity in your home.

How can I get rid of PMI without 20% down

To sum up, when it comes to PMI, if you have less than 20% of the sales price or value of a home to use as a down payment, you have two basic options: Use a "stand-alone" first mortgage and pay PMI until the LTV of the mortgage reaches 78%, at which point the PMI can be eliminated. 2. Use a second mortgage.

How many years before you can remove PMI

If you've owned the home for at least five years, and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI to be canceled. If you've owned the home for at least two years, your remaining mortgage balance must be no greater than 75 percent.

How do I get my PMI waived

The only way to cancel PMI is to refinance your mortgage. If you refinance your current loan's interest rate or refinance into a different loan type, you may be able to cancel your mortgage insurance.