What does Square charge per transaction?

How much does Square charge customer per transaction

When a customer taps or inserts their card in person, you pay 1.9% per transaction with the Square Reader. Sellers using Square Terminal or Square Register pay 1.6% per transaction. There is a lower risk of fraudulent activity when the cardholder is present.

How do I avoid Square fees

Afterpay Fees

Square sellers using Afterpay get paid the full amount at the time of purchase, minus a processing fee on the total order. Enabling Afterpay with Square is free — there are no monthly fees or startup costs.

CachedSimilar

Does Square invoicing charge a fee

When you process a payment in person, Square charges a fee of 1.6% per tap or insert on Square Terminal and Square Register and 1.9% per tap or insert on Square Reader or Square Stand.

Does Square take a percentage of tips

Square will charge merchants a 3.5 percent fee, plus 15 cents, on the total amount — including taxes and tips — for transactions that don't require a credit card and cardholder to be present when a payment is made.

Cached

How do I charge customers by card in Square

To charge a card via the Square DashboardConfirm the amount you'll be charging with your customer.Navigate to Invoices in your online Square Dashboard > click Create Invoice. For existing unpaid invoices, select Edit.Fill out your invoice.Under Payment, use the drop-down menu to select a payment card.Click Charge.

How much does Square cost per month

How much does Square cost per month Square does not charge a monthly or annual fee. Instead, the company makes money through a percentage of every credit card transaction it processes. Square charges 2.6% plus 10 cents for most in-person transactions.

Are there any hidden fees with Square

There are no monthly or hidden fees for credit card processing. All fees are deducted before funds are transferred to your linked bank account. Note: Processing fees are deducted before each transfer and cannot be charged on a monthly basis.

What is the cheapest way to use Square

If you're looking for the cheapest Square fees possible, you can use the Square mobile POS app on your smart device and process payments through the free magstripe card reader you receive with your account. In this case, you'll only pay the 2.6% + $0.10 processing fee per transaction.

Does Square always charge a fee

Square does not charge a monthly or annual fee. Instead, the company makes money through a percentage of every credit card transaction it processes. Square charges 2.6% plus 10 cents for most in-person transactions. However, if the card must be entered manually, it charges 3.5% plus 15 cents per transaction.

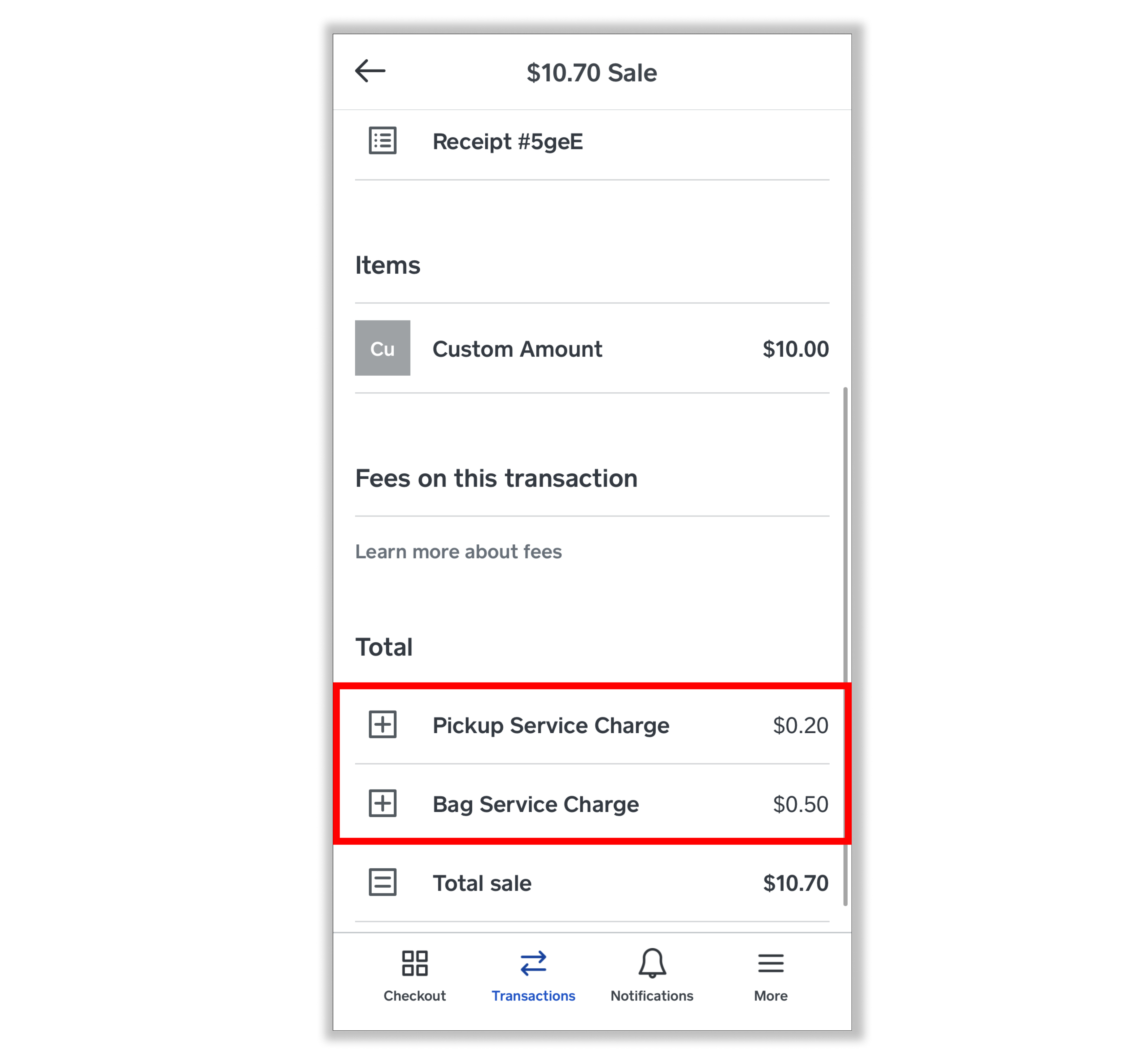

How do I find my Square merchant fees

View Fees for a Single PaymentGo to Transactions on your online Square Dashboard.Select a date range from the date selector tool in the upper-left corner.Select a transaction. The fee paid for the transaction will be listed below the transaction details.

What is the average tip on Square

The average tip on the Square platform in January 2023 was 20%, up from 16% before the pandemic. The company also reported that the average tip rose to 17% in 2023 and 2023.

What is smart tipping on Square

Square makes it easy to allow your customers to sign for their payments. And add gratuity on digital or printed receipts to collect tips from your customers go to the menu tap Settings then tap

Can I charge card fees to customers

However, in some cases, businesses have sought to cover or offset the cost of accepting certain payment methods by imposing surcharges on consumers who choose to use those payment methods. Businesses are not permitted to impose surcharges for paying by debit card, credit card or electronic payment services.

Can you charge a customer for paying by card

Businesses cannot impose any surcharge for using the following methods of payment: consumer credit cards, debit cards or charge cards. similar payment methods that are not card-based (for example, mobile phone-based payment methods) electronic payment services (for example, PayPal)

Is Square worth it for small business

Square is a standout point-of-sale system and often a good option for small businesses. Its wide range of features and hardware can be tailored to fit a variety of business types. The pricing is transparent, and the free plan is one of the most powerful no-cost POS systems we've seen.

Is Square not free anymore

$0 per month for a single location. $29 per month, per location. $69 per month, per location. Note: If you wish to use Appointments with Plus or Premium across multiple locations, you will be charged per location.

What is the most you can charge on Square

Large Transactions

All Square merchants have a per transaction limit of $50,000. If you'd like to accept individual transactions above $50,000 each, you'll need to split the payment into multiple installments. Make sure to record the receipt number and the total amount charged for each installment.

What percent does Square take

Square does not charge a monthly or annual fee. Instead, the company makes money through a percentage of every credit card transaction it processes. Square charges 2.6% plus 10 cents for most in-person transactions. However, if the card must be entered manually, it charges 3.5% plus 15 cents per transaction.

Does Square have a maximum fee

Square Online Fees

That fee is 2.9% + $0.30. The rate drops to 2.6% + $0.30 with the Premium plan, the highest pricing tier you can choose when setting up your Square Online store.

How do I get around merchant fees

7 Ways to Avoid Merchant FeesLearn How to Read Your Merchant Statements.Choose the Right Pricing Structure for Your Merchant Account.Reduce Fraud and Chargebacks.Avoid Equipment Leases.Monitor and Audit Your Statements Every Month.Negotiate Merchant Fees Directly With Your Processor.Don't Switch Processors.