What effect did the overuse of credit have on the economy in the late 1920s?

What effect did the use of credit have on economy in the 1920s

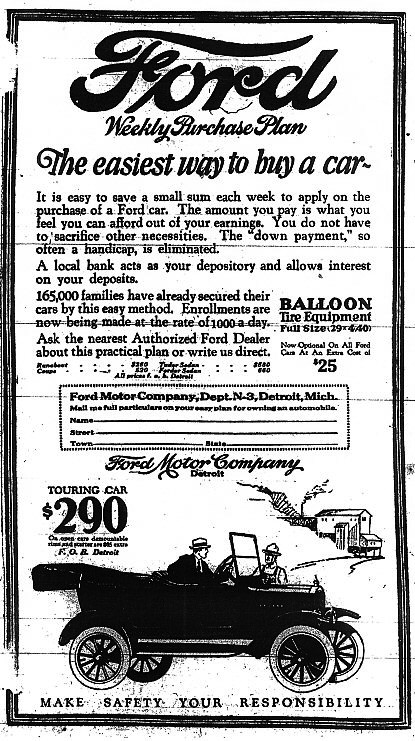

The expansion of credit in the 1920s allowed for the sale of more consumer goods and put automobiles within reach of average Americans.

What was the effect of buying on credit during the 1920s quizlet

During the 1920's, many Americans were living beyond their means, buying things on credit that they could not afford. Businesses were mass-producing goods to keep up with demand, but when consumers' credit began running out, businesses had an over-production problem. This led to mass lay-offs of workers.

How did the use of credit in the 1920s impact the Great Depression

Millions of Americans used credit to buy all sorts of things, like radios, refrigerators, washing machines, and cars. The banks even used credit to buy stocks in the stock market. This meant that everyone used credit, and no one had enough money to pay back all their loans, not even the banks.

Cached

Why was credit bad in the 1920s

Americans became infatuated with credit. Most people were spending money they knew they couldn 't pay off, this caused many Americans in the 1920's to go into debt. Credit in the 1920's vs the credit today has evolved , but the same selfishness overuse of it still remains.

Cached

How did credit affect the economy

When consumers and businesses can borrow money, economic transactions can take place efficiently and the economy can grow. Credit allows companies access to tools they need to produce the items we buy.

What are the impacts of credit on the economy

It is not difficult to comprehend the concrete way in which the growth of credit influences economic growth. When credit grows, consumers can borrow and spend more, and enterprises can borrow and invest more. A rise of consumption and investments creates jobs and leads to a growth of both income and profit.

How does buying on credit affect the economy

When consumers and businesses can borrow money, economic transactions can take place efficiently and the economy can grow. Credit allows companies access to tools they need to produce the items we buy.

How did buying on credit affect the Great Depression

Buying on credit or using installment plans had been normalized in the 1920s, but the market crash in October 1929 resulted in a sharp drop in the number of consumers purchasing on credit by 1930, while households focused on paying off their existing debts.

What effects did the Great Depression have on the credit industry

FDR's credit policies during the Great Depression had a lasting and positive effect on the credit industry, making banks and investments much safer and less risky. Under FDR, Congress created the Federal Deposit Insurance Corporation (FDIC), which guaranteed that deposits over $2,500 were secure and could not be lost.

How did credit debt lead to the Great Depression

Economist Irving Fisher explained in 1933 that to keep up with their house, auto, and other debt payments, people cut back on their spending. This, he said, was the major reason consumer demand dropped, which caused more price and wage deflation, less investment, falling output by companies, and layoffs.

How did buying things on credit lead to problems in the 1920s

Consumerism was a culture that dominated the 1920s. It resulted in people buying things they didn't need and taking on debt they couldn't afford, which ultimately led to the stock market crash.

Why did the economy begin to weaken in the late 1920s

In the late 1920s, demand for American goods began to decline as some European nations experienced growing financial difficulties. Those difficulties were connected to international debts dating back to World War I.

What effect did the use of credit have on the economy in the 1920s it made the economy stronger it made the economy weaker

Answer and Explanation: The correct answer is Option D) it made the economy weaker. In the year of 1920s, the economy took a large amount of credit to fulfill its needs. The use of more credit will lead to a weaker form of economy.

What is the impact of credit

Credit scores play a huge role in your financial life. They help lenders decide whether you're a good risk. Your score can mean approval or denial of a loan. It can also factor into how much you're charged in interest, which can make debt more or less expensive for you.

What is the negative impact of credit

A poor credit history can have wider-ranging consequences than you might think. Not only will a spotty credit report lead to higher interest rates and fewer loan options; it can also make it harder to find housing and acquire certain services.

What are the disadvantages of credit in economy

Using credit also has some disadvantages. Credit almost always costs money. You have to decide if the item is worth the extra expense of interest paid, the rate of interest and possible fees. It can become a habit and encourages overspending.

How did credit work in the 1920s

Installment credit soared during the 1920s. Banks offered the country's first home mortgages. Manufacturers of everything–from cars to irons–allowed consumers to pay "on time." About 60 percent of all furniture and 75 percent of all radios were purchased on installment plans.

What happened to consumer debt between 1920 and 1929

America's consumers could indeed have it all, if they had an iron stomach for debt. Consumer debt more than doubled between 1920 and 1930.

How did too much debt cause the Great Depression

Economist Irving Fisher explained in 1933 that to keep up with their house, auto, and other debt payments, people cut back on their spending. This, he said, was the major reason consumer demand dropped, which caused more price and wage deflation, less investment, falling output by companies, and layoffs.

How did consumer credit affect the Great Depression

Buying on credit or using installment plans had been normalized in the 1920s, but the market crash in October 1929 resulted in a sharp drop in the number of consumers purchasing on credit by 1930, while households focused on paying off their existing debts.