What FICO score does GMAC use?

How hard is it to get approved with GM Financial

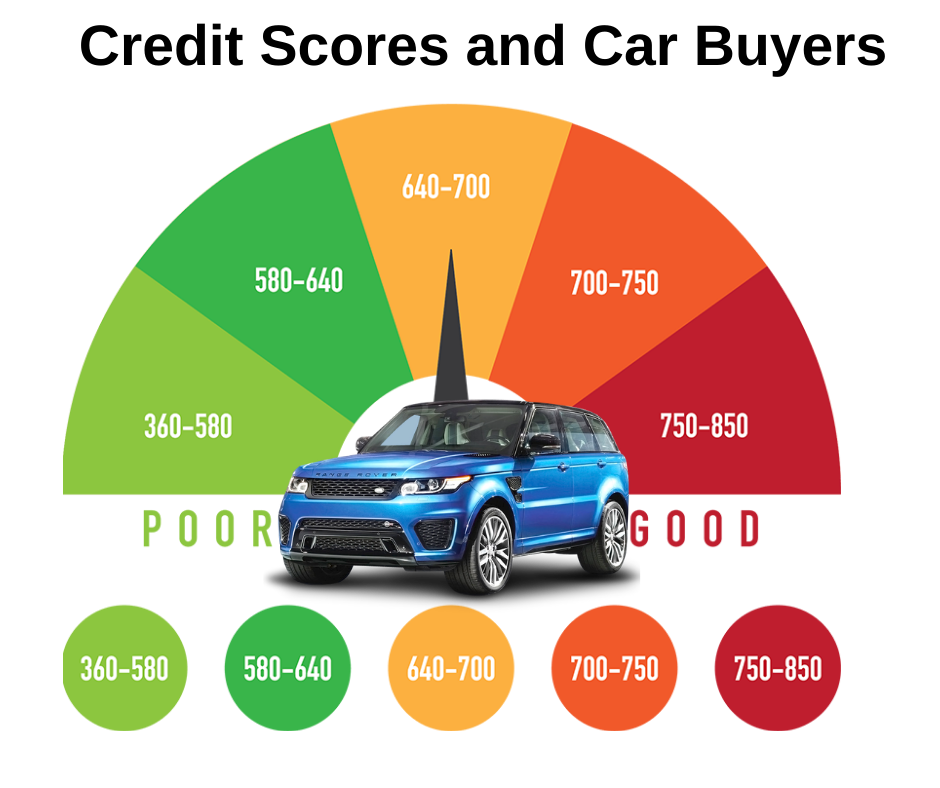

Any credit score below 620 is considered “Subprime.” Unfortunately, customers within this range will have a difficult time applying for GM financial support.

Cached

What credit score do you need for GMAC lease

What do you need to qualify for GM Financial Applicants with a credit score of at least 550 and up to 850 may be eligible for GM Financial. The minimum age to be eligible is 18 or the state minimum, whichever is higher. GM Financial does not have or does not disclose a minimum annual income eligibility requirement.

CachedSimilar

What FICO score is used by most lenders

While most lenders use the FICO Score 8, mortgage lenders use the following scores:Experian: FICO Score 2, or Fair Isaac Risk Model v2.Equifax: FICO Score 5, or Equifax Beacon 5.TransUnion: FICO Score 4, or TransUnion FICO Risk Score 04.

What is the lowest credit score GM will finance

620

You will need a credit score of at least 620 to qualify for a loan with GM Financial, though some dealerships may be willing to work with bad-credit borrowers.

What credit bureau does GM financing use

“GMAC, or GM Financial, uses TransUnion. They may also use Experian or Equifax if you're a borderline candidate for financing. before you apply.”

What is a Tier 1 credit score

Tier 1 credit is generally defined as a credit score of 750 or higher. The term is most commonly used among auto lenders, but other lenders use it as well. People with tier 1 credit have the highest level of creditworthiness and will usually receive the most favorable terms on loans and lines of credit.

Is Experian FICO score accurate

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Which FICO score is more accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

Can I finance a car with a 625 credit score

There's no standard minimum credit score required for a car loan, but those with lower credit scores might have to pay more interest than someone with better credit.

What is GMAC interest rate

3.44% APR for 36 months for well-qualified buyers when financed w/Cadillac Financial. Monthly payment is $29.28 for every $1000 you finance. Average down payment is 18%. Some customers will not qualify.

Is GM credit card Capital One

Cardholder Experience

The GM BuyPower card is serviced by Capital One, one of the top card issuers in the country.

What credit score is Tier 2

What is tier 1 credit

| Credit Score | |

|---|---|

| Tier 1 | 720-850 |

| Tier 2 | 660-720 |

| Tier 3 | 600-660 |

Nov 28, 2023

What does tier 2 credit score mean

What Is a Tier 2 Automotive Credit Rating Tier 2 credit is given to borrowers who fall into the acceptable range, meaning they can finance purchases but will not get as generous of terms as their Tier 1 counterparts, including higher interest rates. Credit scores for Tier 2 typically range from 640 to 690.

Which FICO score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

Why is my Experian score so much higher than FICO

Why is my Experian credit score different from FICO The credit scores you see when you check a service like Experian may differ from the FICO scores a lender sees when checking your credit. That's because the lender may be using a FICO score based on data from a different credit bureau.

Why is Experian score higher than FICO

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.

Why is my FICO score so low compared to Experian

Why is my Experian credit score different from FICO The credit scores you see when you check a service like Experian may differ from the FICO scores a lender sees when checking your credit. That's because the lender may be using a FICO score based on data from a different credit bureau.

Can I get a 40k car with 600 credit score

It's essential to be knowledgeable about how your auto loan process will be different than someone with a higher score. You might not have the same options, but you can still get an auto loan with a 600 credit score.

What credit score do I need for a 40 000 car loan

For favorable terms and a low interest rate, you need to reach at least 700 – 749, with a higher score ensuring even better terms.

What is the credit rating of GM Financial

Rating History

| Date : | 07-Sep-2023 | 05-May-2023 |

|---|---|---|

| Rating : | BBB- | BBB- |

| Action : | Review – No Action | Affirmed |