What happens if a bank closes your credit card?

Is it bad if a bank closes your credit card account

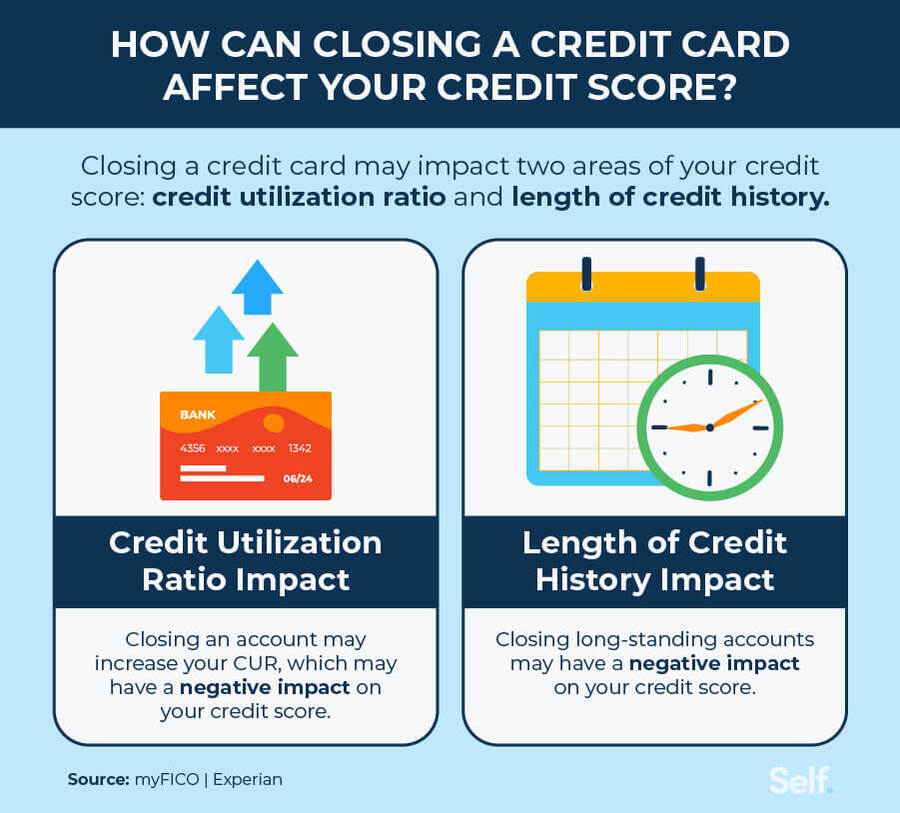

Having a card account closed by the issuer can hurt your credit scores. Use your cards regularly to avoid it.

Cached

What does it mean when a bank closes your credit card account

It may be because your credit score dropped significantly, and the issuer now considers you too risky a borrower. Or it may not have anything to do with you at all. During the COVID-19 pandemic, issuers looking to reduce their risk amid uncertain times closed accounts and slashed credit limits across the board.

Cached

Can you reopen a credit card that the bank closed

It may be possible to reopen a closed credit card account, depending on the credit card issuer, as well as why and how long ago your account was closed. But there's no guarantee that the credit card issuer will reopen your account. For example, Discover says it won't reopen closed accounts at all.

Cached

Should I pay off a closed credit card

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

How long does a closed credit card stay on your credit report

10 years

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

How do I recover from a closed credit card

Once you know the reason for account closure, call customer service and ask them to reopen the account. You'll likely need to provide the reasons you'd like to reopen the account and address any issues that led the issuer to close the account, if that was the case.

How long after a credit card is closed can you reopen it

In the cases where an issuer is willing to reopen an account, it typically can't have been closed for more than three to six months. Here's how to reopen a closed credit card: Call customer service. If you still have your card, the number is on the back.

Will paying off a closed credit card fix your credit

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

How long does a closed credit card stay on your report

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Should I pay off a closed credit card account

While closing an account may seem like a good idea, it could negatively affect your credit score. You can limit the damage of a closed account by paying off the balance. This can help even if you have to do so over time. Any account in good standing is better than one which isn't.

Do I still have to pay a closed credit card

What happens to your balance after you close a credit card When you close a credit card that has a balance, that balance doesn't just go away — you still have to pay it off. Keep in mind that interest will keep accruing, so it's a good idea to pay more than the minimum each billing period.

Do you have to pay back a closed credit card

What happens to your balance after you close a credit card When you close a credit card that has a balance, that balance doesn't just go away — you still have to pay it off. Keep in mind that interest will keep accruing, so it's a good idea to pay more than the minimum each billing period.

Should I still pay a closed credit card

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor.

Should I still pay off a closed credit card

What happens to your balance after you close a credit card When you close a credit card that has a balance, that balance doesn't just go away — you still have to pay it off. Keep in mind that interest will keep accruing, so it's a good idea to pay more than the minimum each billing period.

Do you still need to pay off a closed account

You can still make payments on a closed credit card account, you just cannot make purchases with it. To pay off a balance, continue making payments the same way you did before it was closed. You can usually do this online or, if you get a paper bill, via check.

Is it better to close a credit card you don t use or leave it open

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Do closed credit cards go away

An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Should I pay a closed credit card account

You can minimize the impact to your credit score by paying off the balance on the closed credit card, even if you have to pay it off over a period of time.

How many points will my credit score drop if I close a credit card

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.

Do I still owe on a closed credit card

Once your credit card is closed, you can no longer use that credit card, but you are still responsible for paying any balance you still owe to the creditor.