What happens if I don’t fill out 1098-T?

What happens if I don’t report my 1098-T

If you file within 30 days of the deadline the penalty is $30 per 1098 form with a maximum of $250,000 per year or $75,000 for small businesses. If you file after 30 days of the deadline but before August 1, the penalty is $60 per 1098 form with a maximum of $500,000 per year or $200,000 for small businesses.

Cached

Is there a penalty for not filing a 1098-T

1098-T Rules & Regs. School must file a 1098-T form for any enrolled student where a reportable transaction was made (ex: Tuition and Fees). Penalties of $250 for each tax document sent to the IRS with a missing or incorrect TIN. The Maximum penalty can reach $3M per year.

Cached

How does a 1098-T affect my taxes

The IRS Form 1098-T is an information form filed with the Internal Revenue Service. You, or the person who may claim you as a dependent, may be able to claim an education tax credit on IRS Form 1040 for the qualified tuition and related expenses that were actually paid during the calendar year.

Is a 1098-T form good or bad

If you or your parents paid qualified tuition and college-related expenses during the tax year, you'll likely receive a Form 1098-T from your school. This form is important, because it may help you claim valuable education credits come tax time.

Cached

Do college students need to file 1098-T

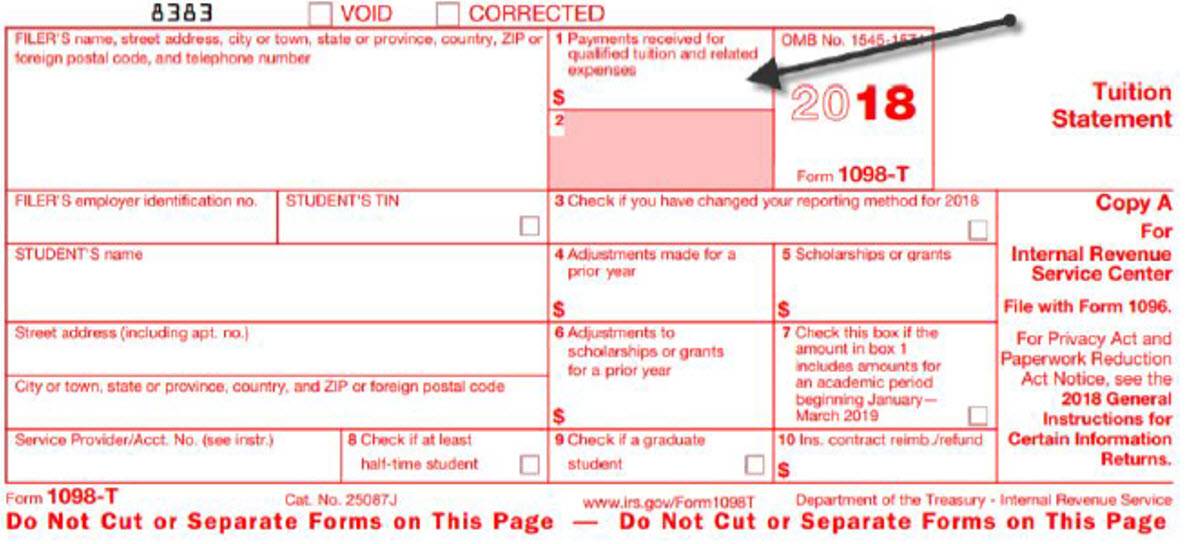

Eligible post-secondary institutions are required to send Form 1098-T to tuition-paying students by January 31 and file a copy with the IRS by February 28. Schools use Box 1 of the form to report the payments received.

How far back can you file 1098-T

You can file form1098-T for more than four years. However, after the first four years the most beneficial education credit (the American Opportunity Credit) will be used up. After that, you'll be able claim the Lifetime Learning Credit or the Tuition and Fees Deduction.

Does filing a 1098-T increase refund

Form 1098-T allows up to $4,000 in deductions.

As with any tax deduction, that can lower your AGI and potentially increase your tax refund. It's important to remember that you can only claim one educational tax benefit per student in a tax year.

How much money do you get back from 1098-T

You can get a maximum annual credit of $2,500 per eligible student. If the credit brings the amount of tax you owe to zero, you can have 40 percent of any remaining amount of the credit (up to $1,000) refunded to you.

Why does a 1098-T decrease my refund

When you entered the 1098-T with scholarships but no tuition TurboTax will treat the scholarship as taxable income. After you have entered the 1098-T you will have the opportunity to enter your education expenses. Once these expenses are more than the scholarship amount your refund should return to normal.

Do colleges report 1098-T to IRS

The 1098-T form is used by eligible educational institutions to report information about their students to the IRS as required by the Taxpayer Relief Act of 1997. Eligible educational institutions are required to submit the student's name, address, taxpayer identification number (TIN), enrollment and academic status.

Is there a minimum amount for 1098-T

The $600 threshold applies to each borrower regardless of the number of student loans obtained by that borrower. However, you may file a separate Form 1098-E for each student loan of the borrower, or you may file one Form 1098-E for the interest from all student loans of the borrower. Who must file.

Do students always claim their 1098-T even if their parents are claiming them

Once your parents claim you as a dependent on their tax return, your parents will also claim all scholarships, grants, tuition payments, and your 1098-T on their tax return. In addition, your parents will also be able to claim all eligible educational tax credits.

Whose tax return does a 1098-T go on

Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

Does a 1098-T form give you money back

Education Credits and Deduction

And, because the credit is partially refundable (up to 40%), you (or your parents) could get a refund even if you don't owe any taxes. That's right, the government could send you a check, up to $1,000 to help with your education expenses.

How much do you usually get back from 1098-T

A form 1098-T, Tuition Statement, is used to help figure education credits (and potentially, the tuition and fees deduction) for qualified tuition and related expenses paid during the tax year. The Lifetime Learning Credit offers up to $2,000 for qualified education expenses paid for all eligible students per return.

Does 1098-T affect fafsa

Yes, if you receive a Form 1098-T, any financial aid received during the tax year will be displayed in Box 5.

Are colleges required to send 1098-T

Who gets the 1098-T form Schools are required to send Form 1098-T to any student who paid "qualified educational expenses" in the preceding tax year.

Does 1098-T go to IRS

Eligible post-secondary institutions are required to send Form 1098-T to tuition-paying students by January 31 and file a copy with the IRS by February 28. Schools use Box 1 of the form to report the payments received.

What is the income limit for 1098-T

You can get the full education tax credit if your modified adjusted gross income, or MAGI, was $80,000 or less in 2023 ($160,000 or less if you file your taxes jointly with a spouse). If your MAGI was between $80,000 and $90,000 ($160,000 and $180,000 for joint filers), you'll receive a reduced credit.

Should the student or the parent claim 1098-T

You must report the excess as taxable income on the federal return for the person issued the 1098-T (this may be the student and not the parent).