What happens if I file form 8919?

Why is Turbotax making me fill out form 8919

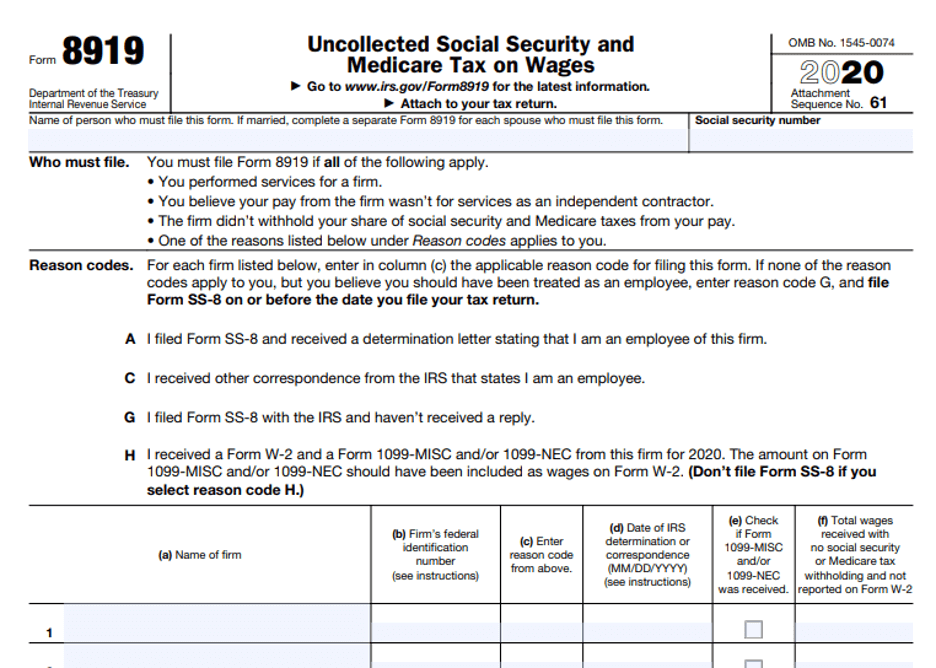

You may need to file Form 8919 if you: Perform services for a company as an independent contractor but the IRS considers you an employee and Social Security and Medicare taxes were not withheld from your pay.

Cached

How does being a 1099 employee affect Social Security

If you're self-employed, you pay the combined employee and employer amount. This amount is a 12.4% Social Security tax on up to $160,200 of your net earnings and a 2.9% Medicare tax on your entire net earnings.

How do I file a 8919 on Turbotax

Where do I enter Form 8919Search for "8919" and then click the jump to "8919" link (if you are just logging into your account, make sure you click the Take Me to My Return button before performing the search).You will get sent to the Other Wages Received Page.

Do 1099 workers get Social Security

Independent contractors contribute to Social Security and Medicare through the self-employment tax (SET). Since ICs have no employer, they pay both the employer and the employee shares of the Social Security and Medicare contributions.

Should I file form 8919

Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. By filing this form, your social security earnings will be credited to your social security record.

How do I remove 8919 from TurboTax

To delete form 8919 for TurboTax online follow these instructions:At the top of your page hover over "My Account"Click on "Tools"Click on "Delete A Form"Scroll down and find "Form 8919" and click on delete next to it.

What are the disadvantages of being a 1099 employee

What are the disadvantages of being a 1099 employee Some of the disadvantages of being a 1099 employee include you must fund 100% of your Medicare and Social Security taxes, health insurance, retirement savings, as well as any tools and equipment needed for your profession.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

Will I get a tax refund if my business loses money

A business loss occurs when your business has more expenses than earnings during an accounting period. The loss means that you spent more than the amount of revenue you made. But, a business loss isn't all bad—you can use the net operating loss to claim tax refunds for past or future tax years.

What if my employer gives me a 1099 instead of a W-2

If you've received a 1099 Form instead of an employee W-2, your company is treating you as a self-employed worker. This is also known as an independent contractor. When there is an amount shown on your Form 1099-MISC in Box 7, you're typically considered self-employed.

Do you pay taxes on 1099 employees

Because payroll taxes are taxes paid on the wages and salaries of employees, employers only pay payroll tax on their W-2 employees — not on their 1099 workers, freelancers, or independent contractors.

Will the IRS know if I don’t file a 1099-NEC

IRS reporting

Since the 1099 form you receive is also reported to the IRS, the government knows about your income even if you forget to include it on your tax return.

Can I ignore 1099 B

If you receive a Form 1099-B and do not report the transaction on your tax return, the IRS will likely send you a CP2000, Underreported Income notice. This IRS notice will propose additional tax, penalties and interest on this transaction and any other unreported income.

Is it worth it to get audit defense from TurboTax

Is Turbo Tax Audit Defense Worth It In general, the TurboTax Audit Defense addition is not necessarily worth it for several different reasons. The first reason why adding this to your tax return is not worth it is because the IRS is unlikely to audit your return. On average, one in every 333 taxpayers gets audited.

How do I remove pay with refund from TurboTax

To remove refund processing fees and change your payment method in the mobile app before you e-file:Sign in if you're not already signed in.Select Finish and File, then select Start next to Review your order.Swipe down and select View payment options.Choose a payment option other than paying with your federal refund.

How much can a 1099 employee make without paying taxes

$400

These individuals are also interchangeably referred to as independent contractors or freelancers. The IRS taxes 1099 contractors as self-employed. And, if you made more than $400, you need to pay self-employment tax.

How much does a 1099 affect my taxes

When you work on a 1099 contract basis, the IRS considers you to be self-employed. That means that in addition to income tax, you'll need to pay self-employment tax. As of 2023, the self-employment tax is 15.3% of the first $147,000 in net profits, plus 2.9% of anything earned over that amount.

What is the Social Security bonus trick

Wait as Long as You Can

Claiming “early,” at age 62, will result in the permanent reduction of your Social Security checks by up to 30%. Waiting until age 70, however, has the opposite effect. For every year that you delay claiming past full retirement age, your monthly benefits will get an 8% “bonus.”

How do I get $144 added back to my Social Security check

To qualify for a Medicare giveback benefit, you must be enrolled in Medicare Part A and B. You must be responsible for paying the Part B Premiums; you should not rely on state government or other local assistance for your Part B premiums.

How many years can you claim a business loss on your taxes

Period of Limitations that apply to income tax returns

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.