What happens if I use my credit card before the closing date?

Can I use my credit card 2 days before closing

Yes, you can use your credit card before your closing date, but do your best to keep your purchases small and pay off your balance swiftly.

Can I use my credit card on closing day

Yes, you can use your credit card on the day of your closing date, or any time between the closing date and due date. Any purchase made after the closing date will simply carry over to the balance of your next month's billing statement.

Cached

What happens if I don t pay my credit card before the closing date

Depending on your issuer and your account terms, the lender may apply a penalty annual percentage rate (APR) to your account if it's been 60 days without a payment. In general, card issuers report late payments every 30 days. Late payments are only one of several factors that impact credit scores.

How soon after closing date can I use my credit card

How soon after closing can I use my credit card If you already have a credit card (or opened a new card shortly after closing on a home mortgage loan) there's no need to wait before using the account.

Cached

Can I spend money before closing

Lenders will check the borrower's credit report to verify any critical financial details. If the lender spots any big purchases that significantly impact your financial picture, it's possible they won't finalize the mortgage. With that, it is important to wait until after closing day before making any big purchases.

What should you not do during underwriting

Tip #1: Don't Apply For Any New Credit Lines During Underwriting. Any major financial changes and spending can cause problems during the underwriting process. New lines of credit or loans could interrupt this process. Also, avoid making any purchases that could decrease your assets.

What happens if you open and close a credit card the same day

Multiple Hard Inquiries – When you open a credit card, it triggers a hard inquiry on your credit report. Closing a card immediately after opening it and reopening another card leads to two hard inquiries on your report within a short time. This can lead to your credit score dropping further.

What days should you not use your credit card

What are the worst times to use a credit cardWhen you haven't paid off the balance.When you don't know your available credit.When you're just doing it for the rewards (but you haven't done the math)When you're afraid you have no other choice.When you're in a heightened emotional state.When you're suspicious of fraud.

Should I pay before closing date

To avoid paying interest and late fees, you'll need to pay your bill by the due date. But if you want to improve your credit score, the best time to make a payment is probably before your statement closing date, whenever your debt-to-credit ratio begins to climb too high.

Can I pay my credit card the same day I use it

Yes, if you pay your credit card early, you can use it again. You can use a credit card whenever there's enough credit available to complete a purchase.

Why no big purchases before closing

Lenders will check the borrower's credit report to verify any critical financial details. If the lender spots any big purchases that significantly impact your financial picture, it's possible they won't finalize the mortgage. With that, it is important to wait until after closing day before making any big purchases.

Is it better to pay credit card before or after closing date

To avoid paying interest and late fees, you'll need to pay your bill by the due date. But if you want to improve your credit score, the best time to make a payment is probably before your statement closing date, whenever your debt-to-credit ratio begins to climb too high.

Can your loan be denied at closing

Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.

Can I spend money during underwriting

Any major financial changes and spending can cause problems during the underwriting process. New lines of credit or loans could interrupt this process. Also, avoid making any purchases that could decrease your assets. Once the underwriting decision has been made, you can go forward with any planned purchases.

Do they run your credit during underwriting

Credit. One of the most important factors in the mortgage approval process is your credit history. The underwriter will review your credit report to see how well you made payments on, or paid off car loans, student loans and other lines of credit.

Can I use a credit card I just got approved for

Choose a Card That Offers Instant Access to Credit

You can use some credit cards immediately upon approval, even without the card in hand. For instance, you can apply for many store credit cards in-store and, if approved, use the account to pay on the spot.

Is it better to leave a credit card open and not use it or close it

If you pay off all your credit card accounts (not just the one you're canceling) to $0 before canceling your card, you can avoid a decrease in your credit score. Typically, leaving your credit card accounts open is the best option, even if you're not using them.

What is the best date for credit card billing cycle

28th of every month is a sweet spot. Reason is as some banks report credit utilisation to CIBIL on 30/31 and some on Billing date. So if the date is kept on 28th no need to remember the credit utilisation reporting date for each card.

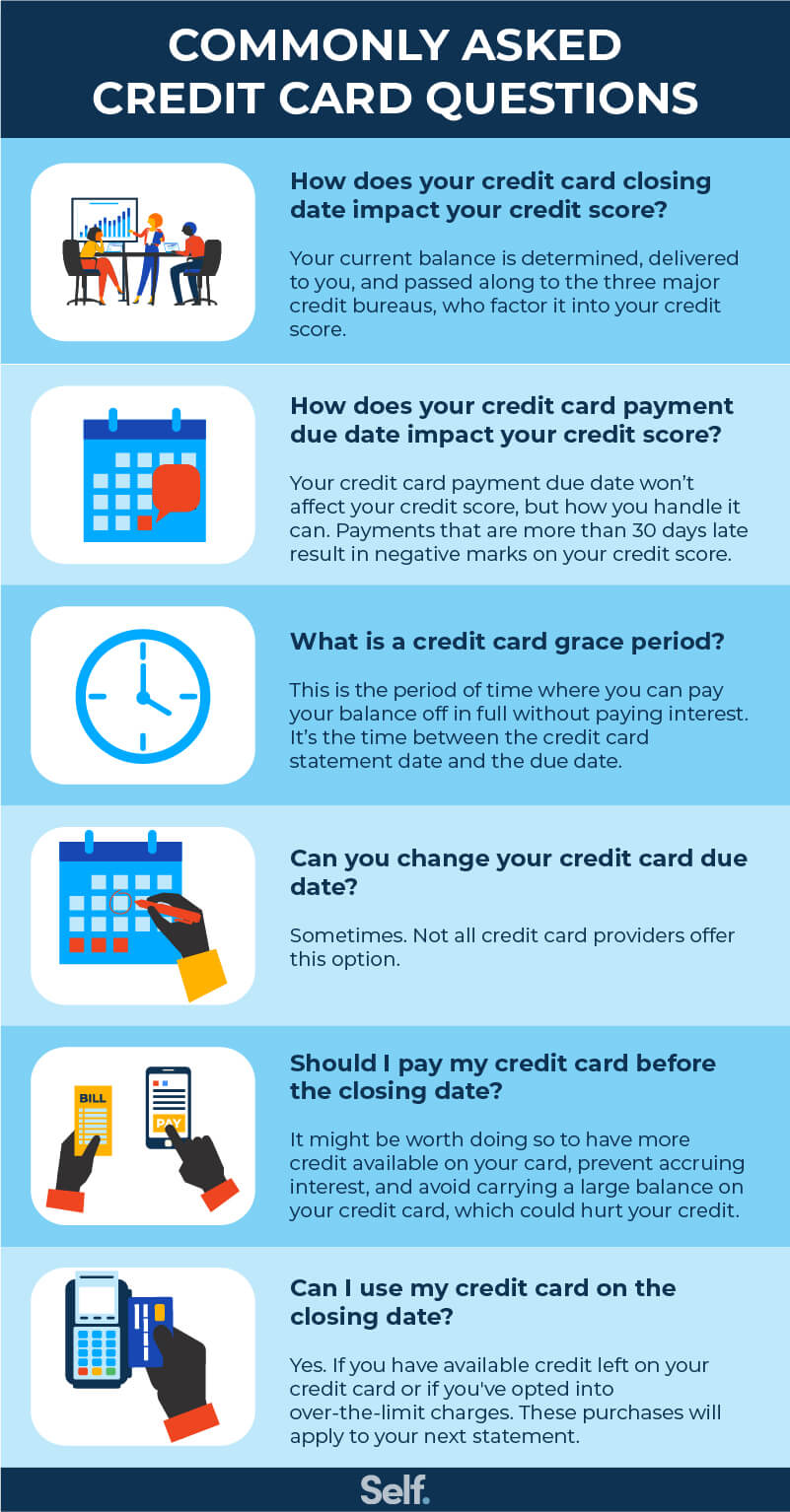

What is the difference between payment due date and closing date

What is the difference between a closing date and a due date The closing date is the last day in a billing cycle, and the due date is when a payment is due on your credit card, usually about one month after the closing date.

What happens if I pay my credit card before statement

Paying your credit card balance before your billing cycle ends can have a positive impact on your finances. It'll prevent you from missing a payment, help you avoid expensive interest charges, increase your credit limit and improve your credit score faster.