What happens if I use my credit card the day payment is due?

Can I use my credit card the day the payment is due

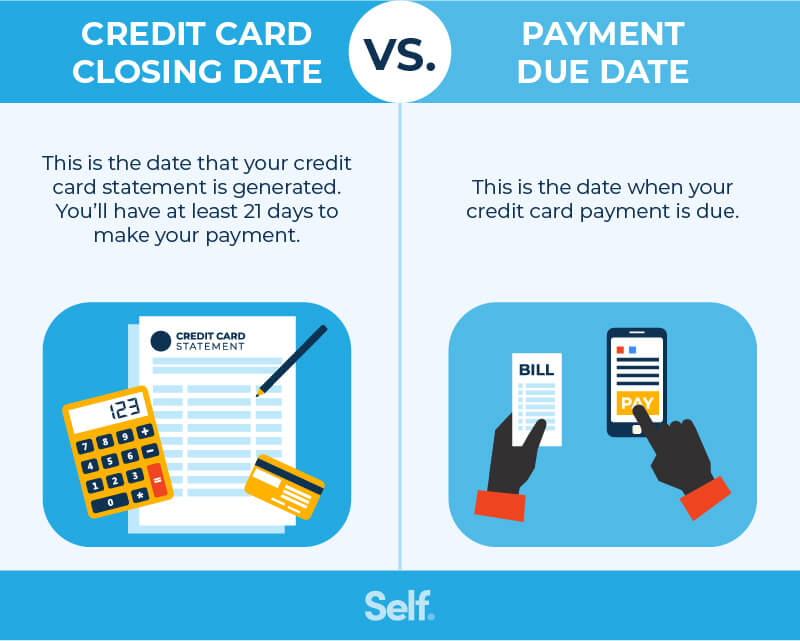

Yes, you can use your credit card between the due date and the credit card statement closing date. Purchases made after your credit card due date are simply included in the next billing statement.

How long after my payment due date can I use my credit card

If you pay your credit card statement balance in full by the due date every month, your grace period continually renews, and you will never pay interest on purchases. A credit card grace period, when you have one, is a minimum of 21 days.

Cached

Can I still use my credit card if I miss a payment

If you don't pay on time, you might not be able to use your card for new purchases until your account is current. When a credit card account goes 180 days—a full six months—past due, the credit card issuer must close and charge off the account.

What happens if we pay credit card bill on due date

In reality, you will pay interest on the outstanding amount starting from the payment due date. The rate of interest cost can be as high as 45% annualized. So, it is always better to clear your entire dues by the payment due date.

What is the 15 3 rule

The 15/3 credit card payment rule is a strategy that involves making two payments each month to your credit card company. You make one payment 15 days before your statement is due and another payment three days before the due date.

Is it better to pay your credit card the day its due or before

Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date. If you can afford to do it, paying your credit card bills early helps establish good financial habits and may even improve your credit score.

Will one day late payment affect my credit

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Is it better to pay credit card before due date or on due date

Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date. If you can afford to do it, paying your credit card bills early helps establish good financial habits and may even improve your credit score.

Does a 1 day late credit card payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

How many days before due date should I pay my credit card

Paying credit card bills any day before the payment due date is always the best way to avoid penalties. Paying credit card bills any day before the payment due date is always the best. You'll avoid late fees and penalties. However, making payments even earlier can have even more benefits.

Should I wait until the due date to pay my credit card bill

The best time to pay your credit card bill is before it's late. You can avoid late payment fees when you make at least your minimum payment by the due date. And if you can pay your full balance before the due date, you can avoid accruing interest charges.

Why does the 15 3 credit hack work

The 15/3 hack can help struggling cardholders improve their credit because paying down part of a monthly balance—in a smaller increment—before the statement date reduces the reported amount owed. This means that credit utilization rate will be lower which can help boost the cardholder's credit score.

How do you avoid the 5 24 rule

How to bypass the Chase 5/24 rule If you've been approved for five cards in the past 24 months, you will not be approved for another Chase card thanks to the 5/24 rule. There have been reports of “Selected for you” and “Just for you” offers being exempt from the 5/24 rule.

Does it hurt credit to pay before due date

By making an early payment before your billing cycle ends, you can reduce the balance amount the card issuer reports to the credit bureaus. And that means your credit utilization will be lower, as well. This can mean a boost to your credit scores.

Is paying on the due date late

Credit card companies generally can't treat a payment as late if it's received by 5 p.m. on the day it's due (in the time zone stated on the billing statement), or the next business day if the due date is a Sunday or holiday.

How much does a 2 day late payment affect credit score

By federal law, a late payment cannot be reported to the credit reporting bureaus until it is at least 30 days past due. An overlooked bill won't hurt your credit as long as you pay before the 30-day mark, although you may have to pay a late fee.

Can I use my credit card if I pay before due date

You're completely allowed to use your credit card during the grace period. Any purchases you make after your closing date are part of the next billing cycle, not the current one. But if you don't pay the full balance listed on your statement, you'll lose the grace period.

How much is a one day late payment credit one

The Credit One credit card late fee is up to $29 for the first late payment and up to $39 for any subsequent late payments in the following 6 months. This fee applies to all Credit One credit cards.

What three moves can sabotage your credit score

3 Ways People Destroy Their Credit ScoreMaking Late Payments That Show For Years On Your Credit Report.Maxing Out Your Credit Cards.Not Paying Your Debts or Declaring Bankruptcy.

Does Capital One use the 5 24 rule

Capital One business cards also count toward your 5/24 limit. Technically you become eligible on the first day of the month following the expiration of the 24 month timer on your 5th oldest card (we know, it's kind of 5/25)