What happens if you did not use your credit card?

What happens if I take a credit card and don’t use it

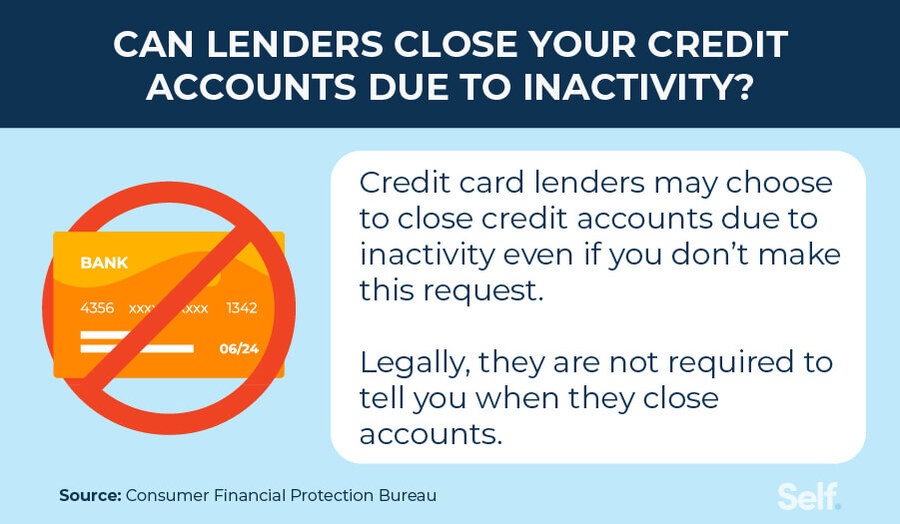

Your Card May Be Closed or Limited for Inactivity

Without notice, your credit card company can reduce your credit limit or shut down your account when you don't use your card for a period of time. What period of time, you ask There's no predefined time limit for inactivity that triggers an account closure.

Cached

Do unused credit cards hurt your score

Not using your credit card doesn't hurt your score. However, your issuer may eventually close the account due to inactivity, which could affect your score by lowering your overall available credit. For this reason, it's important to not sign up for accounts you don't really need.

Cached

How long can a credit card go without being used

Some credit card issuers will close your credit card account if it goes unused for a certain period of months. The specifics depend on the credit card issuer, but the range is generally between 12 and 24 months.

Will I be charged if I don’t use my credit card

Will I be charged if I don't use my credit card Credit card companies used to charge inactivity fees, but the Federal Reserve banned this practice in 2010. Even though you can no longer receive inactivity fees, you will still receive regular charges, primarily the annual fee and any interest that you accrue.

Cached

How often should I use my credit card to keep it active

once every 3 months

How often should I use my credit cards to keep them active There is no universal minimum, but experts recommend using your cards at least once every 6 months. If you want to play it safe, use them at least once every 3 months, especially if the cards are store credit cards. Every credit card issuer is different.

Is it better to close a credit card or leave it open with a zero balance

In general, it's better to leave your credit cards open with a zero balance instead of canceling them. This is true even if they aren't being used as open credit cards allow you to maintain a lower overall credit utilization ratio and will allow your credit history to stay on your report for longer.

Is it better to cancel a credit card or just not use it

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Is it better to close a credit card or let it go inactive

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

What happens if I haven’t used my credit card in months

Nothing much happens if you don't use your credit card for a month. You'll just need to keep up to date with your monthly payment if you have an existing balance. But your credit card issuer isn't going to close your account for less than three months of inactivity.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

How often should I use my $200 credit card

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

Is it better to cancel a credit card or keep it and not use it

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Is it bad to keep a credit card open with no balance

Closing a credit card with a zero balance may increase your credit utilization ratio and potentially drop your credit score. In certain scenarios, it may make sense to keep open a credit card with no balance. Other times, it may be better to close the credit card for your financial well-being.

Is a zero balance on a credit card bad

A zero balance on credit card accounts does not hurt, but it certainly does not help increase a credit score either. Ask first if you really need to borrow as lenders are out to make a profit on the funds they lend you.

How many credit cards are too many

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

Is it good to have empty credit cards

Closing unused credit cards makes it easier to keep your finances in check. If your credit card company charges an annual fee, it's worth cancelling so you can save that money. Another reason to cancel is that you may find it spurs your credit card provider into offering you a better deal.

Will my credit score drop if I don t use my credit card for a month

Not using a credit card has no direct effect on your credit score. However, credit card companies can close your account due to inactivity. If this happens, your credit utilization ratio might increase, and the average age of your credit accounts might reduce.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

What is the 15 3 rule

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

How much of my $500 credit card should I use

The less of your available credit you use, the better it is for your credit score (assuming you are also paying on time). Most experts recommend using no more than 30% of available credit on any card.